Daily Newsletter

October 19, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

November Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

The Market is starting to throw off some warning signals.

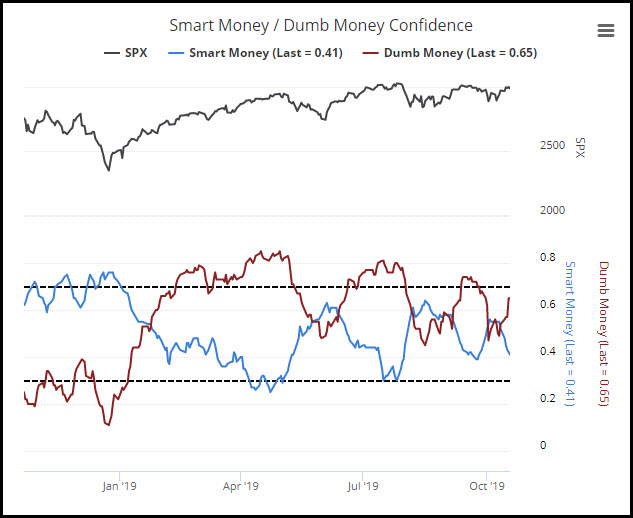

First, Sentimentrader.com tracks the “smart money” vs. the “dumb money.” Smart money typically enters near the bottom of a sell-off and sneaks out the back door near important turning points. Here is their latest graph from Friday:

Notice that “Smart Money” has been selling into this rally and “Dumb Money” piling on. It has not peaked yet, so we don’t know where the exact turning point will be, however this is not a great sign and explains why markets have been unable to break into new highs.

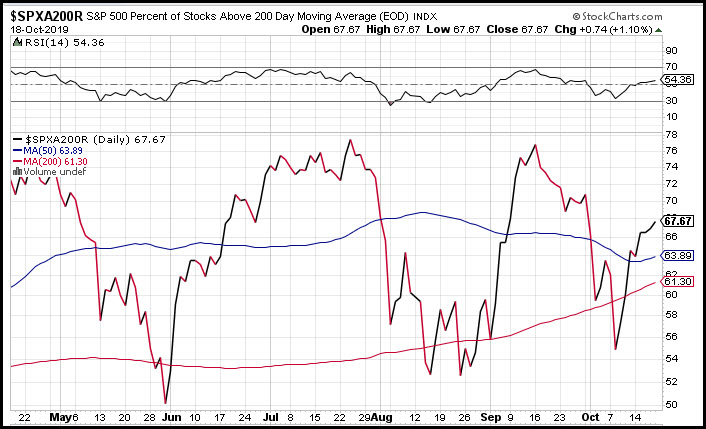

We are also seeing technical divergence in the S&P; this stockcharts.com chart tracks the percentage of S&P500 stocks above their 200 day moving average; note how the percentage is much lower today vs. the September highs with nearly identical high prices. That’s a negative divergence and worth noting.

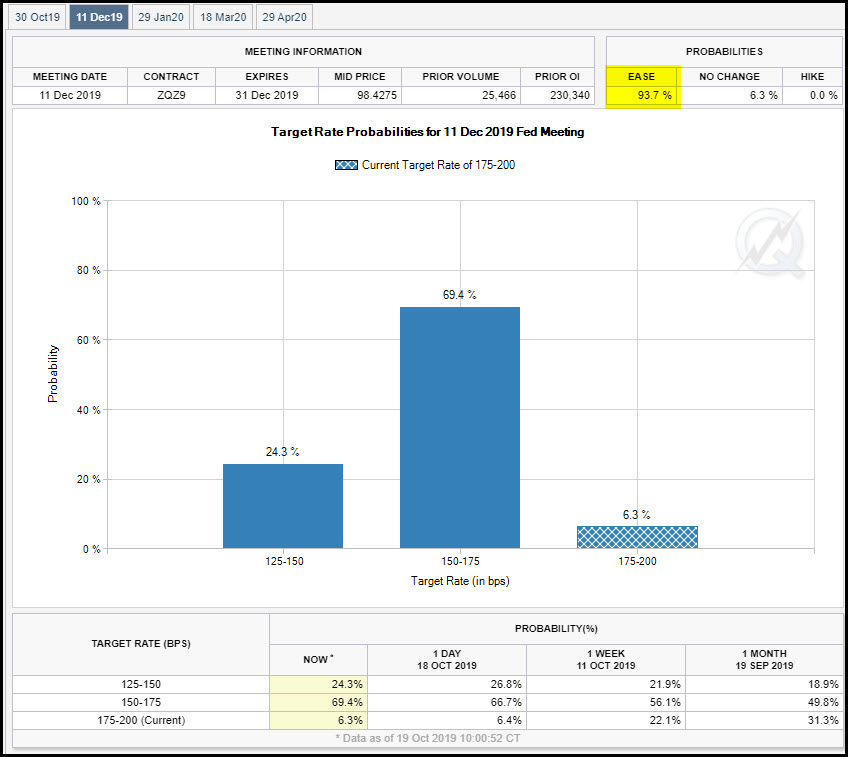

The Fed has seen something in the domestic and/or global economy and is already messaging future cuts, however we will likely only get one prior to year-end, and it’s probably going to happen in two weeks:

That’s a 94% chance of a rate cut by year-end, with a 24% chance of a half-point cut over the next ten weeks.

Normally I hear all of the negative news and think “go long” as markets love to climb the wall of worry…but now we have some serious technical erosion to the foundation of this market.

We have a big move in the works, and it’s high stakes at this point because it could mean at least 500 SPX handles. Intuition says that when this many people are negative on the markets, then price will find a way to go higher, even if it’s the short-term. The data is starting to weigh on that opinion, however. October is an equal-opportunity dream crusher and we have nine trading days to go.

The following companies report earnings over the next few days::

- Monday: HAL

- Tuesday: CMG, LMT, PG, SNAP, UPS, UTX

- Wednesday: AMD, BA, CAT, EBAY, F, LVS, MSFT, TSLA

- Thursday: AAL, AMZN, GILD, PBR, V, VLO

- Friday: VZ

- Future FB, AAPL 10/30, GOOGL 10/28

Short-Term Outlook: We’ve been in a massive consolidation pattern since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, but we’ll know which price levels to respect to warn us if that energy’s going lower instead.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- I have a new call debit spread on NKE outlined in the “Whale” section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average Friday with advancers minus decliners showing a mixed number of +1 at the closing bell.

SPX Market Timer : The Intermediate line has turned up below the Upper Reversal Zone and is now “Bullish.” No leading signals at this time.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX rose to 14.25, inside the Bollinger bands. The RVX rose to 17.83 and is inside the Bollinger bands.

Fibonacci Retracements: The price is back near the highs and fibs are not in play.

Support/Resistance: For the SPX, support is at 2825 and overhead resistance at 3028. The DOW has support at 25500 and overhead resistance at 28399. The RUT has support at 1450 and resistance at 1600.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 52. The Weekly chart has an energy reading of 66, now fully-charged. The Daily chart is showing 46, showing some fatigue from the rally . Larger timeframe energies are waiting on a very big move, which will start with the smallest timeframes.

Other Technicals: SPX Stochastics rose to 68, mid-scale. RUT Stochastics rose to 53, mid-scale. The SPX MACD fell above the signal line, showing a decrease in positive momentum. The SPX is below the upper bollinger band with the range 2891 to 3023. The RUT is inside the bollinger bands with the range 1463 and 1562.

Position Management – NonDirectional Trades

I have the following positions in play at this time:

- SPY 18OCT 289/290*308/309 Long Iron Condor (9/16) was entered for a $.16 debit on the put spreads and an $.18 debit on the call spreads. The put spreads fired at our target (10/2) of $.48 which means that we made a net profit after commissions of $28/contract on the put spreads, and a full net profit on the entire trade of $8/contract after commissions, or a 23.5% aggregate return on capital..

- SPY 15NOV 281/282*310/311 Long Iron Condor (9/30) was entered for a $.16 debit on the puts and $.18 debit on the calls. I will look for a 200% return on either side. Not enough gamma to get the put side to fire on the recent downdraft.

No additional orders at this point.

I have no positions in play:

This is not the right character of market for this strategy at this point.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold the SEP $17.50 calls (8/13) for $.18 credit and closed down this position (9/5) for a $.44 debit. I will let this price chart trend as much as it wants to in the near future before writing against it again.

- CSCO – My cost basis is now $48.80/share prior to the latest trade. I sold the JAN20 $50 calls for $1.94/contract so our cost basis could be as low as $46.86 depending on the outcome of those JAN calls. Our shares also went ex-dividend on Thursday so that’s another $35/contract so our cost basis could now be as low as $46.51. I don’t want to see this trade below $46/share on a closing basis.

No other trades at this time.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – The long cross has fired again. I would look for the first pullback between the 8ema and 21ema.

- RSI(2) CounterTrend – I’ll look for the next setup.

- Daily S&P Advancers – Looking for the next signal to go long with single-digit advancers to close the day.

- Swing – None at this time..

Crypto has been in a consolidation after last month’s downdraft. We might need to see one final capitulation before it can release.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 297.97, there is a +/-3.794EM into this coming Friday; this is much smaller than last week’s 5.223 EM. The EM targets for this Friday’s close are 301.76 to the upside, and 294.18 to the downside.

The price stayed within the range last week, and we might see the same this week as well with a smaller EM range yet.

I have the following positions in play:

- SPY NOV 299/300 Debit Put Vertical (10/17) entered for a $.37 debit. I will seek a 50% return on this trade.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have no positions in play at this time:

On Monday I will set up a NKE 22NOV ATM debit call spread, $1-wide spreads, for about $.50 debit. I will seek a 50% return on the trade.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no open positions at this time. Skew is making OTM puts really expensive now.

If we see a decent bounce back up I might consider reloading.