Daily Newsletter

November 23, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

December Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Once again we come into a weekend report with mixed signals and a confusing backdrop. What do we know as facts right now?

- Trend – we have an upside breakout that is supported by longer-term Monthly and Weekly trends.

- Risk – there is a greater-than-usual amount of downside risk due to the usual factors of politics, economy, and trade.

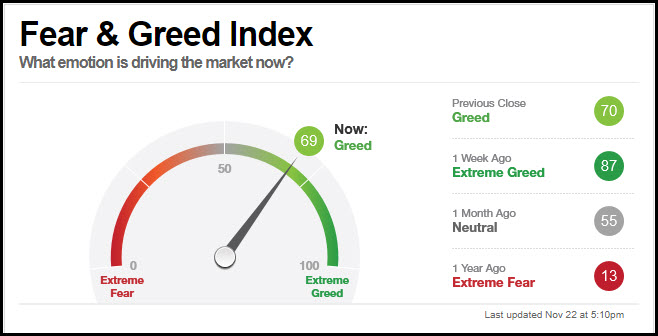

- Sentiment – the dumb money/smart money spread is much larger than normal, which is a risk

The “X” factor will be interest rates; the Ten-Year Note chart is consolidating in a bear flag between 1.4 to 1.9%, and if it breaks we’ll see rates dive again and we’ll need to watch that 1.4% level as a threshold that we don’t want to see break. The TLT Bond ETF is showing a massive broadening pattern and the next upside breakout (which would coincide with rates dropping) might be the tipping point.

Sentiment took a break this week, which is the recipe for longer-term trends:

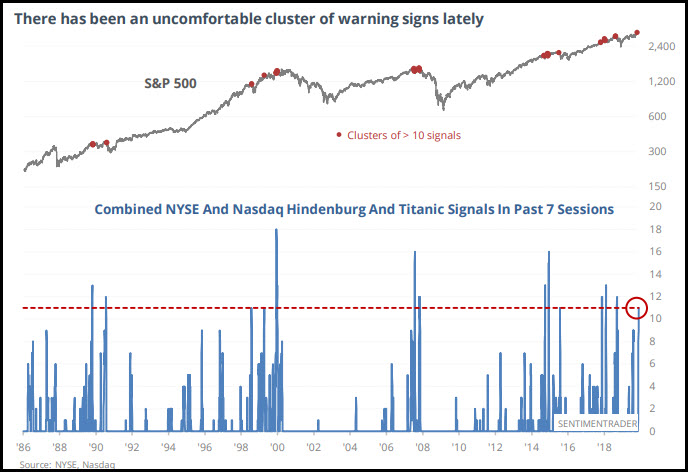

But with the trend and the ebullient nature of the dumb money has come yet another cluster of warning signals (Hindenburg Omens, etc) and you can see the significance of these on the chart from Sentimentrader.com below. To be sure, we’ve see higher numbers of clusters and thereby “more dangerous” conditions in the past, with full bear markets as a result. This means that we might be up for yet another correction, as unlikely as that seems having just come from a cluster of them, and a full vertical Bear just a year ago.

What does this mean for us? Continue to go with the trend but don’t get overly long. Look for super-strong conditions on lighter volume to set up potential short deltas.

This will be a fairly light week of holiday tape; most of the time we see positive price action during holiday week while we’re in a primary Bull.

Short-Term Outlook: We’ve been in a massive consolidation pattern since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, but we’ll know which price levels to respect to warn us if that energy’s going lower instead.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- I will look to enter a BAC Debit Call Spread position described in the “Whale” section below..

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- We will look for a bounce to sell our CSCO shares into strength

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

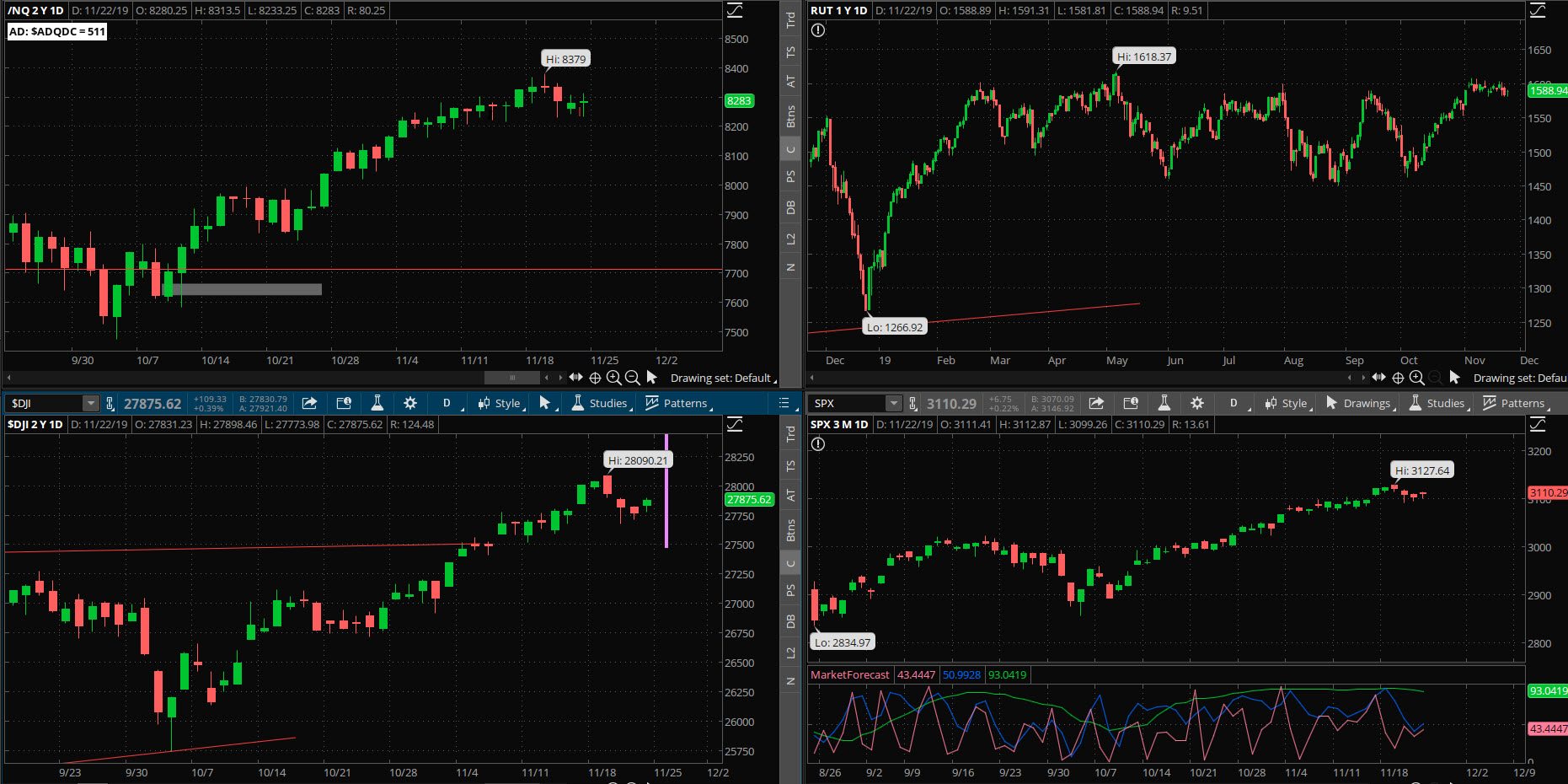

Market Internals: Volume was average Friday, with advancers minus decliners showing a modestly supportive value of +136 at the closing bell.

SPX Market Timer : The Intermediate line has flattened in the Upper Reversal Zone and is still “Bullish.” No leading signals.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term downtrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term downtrend.

VIX: The VIX fell to 12.34, inside the Bollinger bands. The RVX fell to 15.39 and is outside the Bollinger bands. There is a pretty extreme bollinger squeeze happening on the VIX and RVX.

Fibonacci Retracements: The price is back to the highs and fibs are not in play.

Support/Resistance: For the SPX, support is at 2825 with no overhead resistance. The DOW has support at 25500 and no overhead resistance. The RUT has support at 1450 and resistance around 1608.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 48. The Weekly chart has an energy reading of 44, starting to reflect the recent breakout. The Daily chart is showing 52, quickly recovering from exhaustion. Larger timeframe energies are waiting on a very big move, which will start with the smallest timeframes.

Other Technicals: SPX Stochastics flattened at 85, overbought. RUT Stochastics fell to 57, mid-scale. The SPX MACD fell below the signal line, showing a decrease in positive momentum. The SPX is below the upper bollinger band with the range 3031 to 3138. The RUT is inside the bollinger bands with the range 1569 and 1608. The RUT Bollingers are starting to squeeze.

Position Management – NonDirectional Trades

I have the following positions in play at this time:

- SPY 20DEC 296/297*319/320 Long Iron Condor (11/4) was entered for a $.17 debit on the puts and a $.16 debit on the calls. I will look for a 200% return on either side.

No additional positions now.

I have no positions in play:

- SPX 15NOV 3040/3045*3095/3100 Iron Condor (11/6) entered for $2.50 credit and closed (11/13) for $1.85 debit. This gave us a gross per-contract profit of $65, or a 26% return on risk.

No other entries at this time. We’ll need to see the SPX go into severe daily exhaustion again. This trend is too strong to fade for more than a couple of days.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

I’m tracking a 29NOV/27DEC Put Calendar, set up for a $24.55 debit and looking for a 10% return.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold the SEP $17.50 calls (8/13) for $.18 credit and closed down this position (9/5) for a $.44 debit. I will let this price chart trend as much as it wants to in the near future before writing against it again.

- CSCO – My cost basis is now $46.18/share after the latest short call trade and dividend payment. I sold the JAN20 $50 calls for $1.94/contract and closed them out for $.15, (11/15) giving me a $177/contract profit. I will look for any kind of a dead cat bounce in the near future to unload CSCO shares into strength.

No other trades at this time.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – The long cross has fired and is gone. The next entry would be off of the 21ema.

- RSI(2) CounterTrend – I’ll look for the next setup.

- Daily S&P Advancers – Looking for the next signal to go long with single-digit advancers to close the day.

- Swing – None at this time..

BTC and other top-ten coins are once again in consolidation.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 310.96 there is a +/-2.847 EM into this coming Friday; this is smaller than last week’s 3.385 EM, and that’s mostly because we only have 3.5 trading days this upcoming week. The EM targets for this Friday’s close are 313.81 to the upside, and 308.11 to the downside.

The price got close to, but did not test the lower EM last week.

In this market we will continue to seek tests against the lower EM marker and not necessarily stand in front of the upper marker, since the trend has appeared to unfurl to the upside again.

I have no positions in play:

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- NKE 22NOV 96.5/97.5 debit call spread (10/21) entered for $.50 and expired on Friday.

- V 29 NOV 180/182.5 debit call spread (10/29) entered for $1.15 debit and closed for a $1.64 credit. (11/20). This gave me a net profit after commissions of $46.40, or a 40.3% return on capital .

- SLV 20DEC 15.5/16.5 debit call spread (11/18) entered for $.42 debit. I will seek a 50% return.

I will enter the BAC 27DEC $1-wide debit call spread on Monday for around $.50 debit.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have the following open positions at this time:

- SPY 21FEB 279 long puts (11/15) entered for $2.21 debit. I will look to clear half of the position on any test of the 200 sma, and the other half upon a 10% haircut in price.