Daily Market Newsletter

May 29, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

June Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Hello all. It is Alex here covering for Doc who is on vacation for the next couple of weeks.

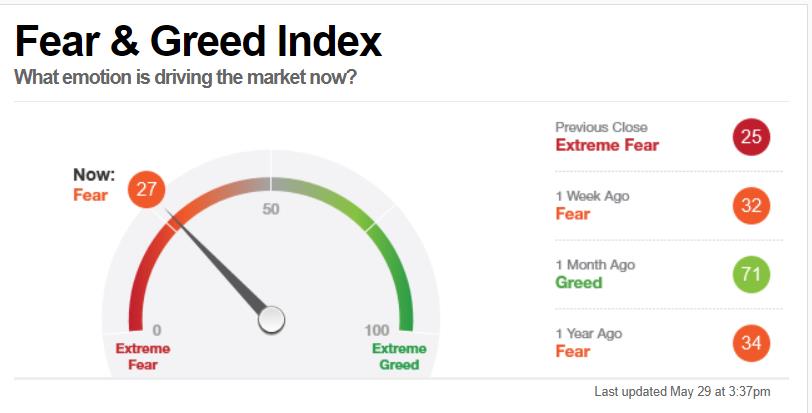

The Fear and Greed index tells it all. The markets are spooked. Yesterday the Fear and Greed Index closed at 25 – in the Extreme Fear zone. Today’s downside action only propelled it further into the extreme fear zone before recovering late in the day – a mirror of the S&P’s

Concerns over bond yields kicked the day off on a negative note. The 10 Year Treasury Notes quickly shed another couple of percent shortly after the open with renewed trade war and global recession concerns. Likewise, oil, another leading indicator for global growth continued it’s slide downward once again today. All the indices breached through key support levels early in the day, with the S&P’s and Russel failing to close back above their support levels at the end of the day. The S&P’s were down some 36 points today before getting a bit of a boost at the end of the day regaining close to half of it’s losses.

On the Fractal Energy front, we finally saw the daily energy drop significantly as a result of today’s sell off. That being said, the daily energy level is still up at 55 meaning we are nowhere near exhausted and still have plenty of capacity for continuation of this move. We breached the expected move on the downside today in the S&P’s in a resounding manner and closed only 5 points above it with 2 full trading days left to go. Options pricing is showing a 35 point expected move for the balance of the week and these types of weeks often play out in one of two ways – they either flatten out and stick to the edge of the expected move, or they touch 2X the weekly expected move, meaning we could see the S&P’s touch the 2730. As I mentioned yesterday, keep your position sizes in check and watch your allocation carefully.

Cheers

Alex

If you have any questions, please feel free to reach out to me at alex_docs_trading@outlook.com

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- I will set up the next series of short calls on SLV by selling the 19JUL $15 calls; see “stocks” section below. I will keep this as an open order.

- No new orders for Monday.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was roughly 30% above the 50 day average. The advancers versus decliners closed down -232 after hitting lows down to the -437 level in broad based selling early on in the session.

SPX Market Timer : The Intermediate, momentum and near-term lines are divergent and working their way lower in the bottom of the range. No leading signals at this time.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term downtrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term downtrend. The Dow is in an intermediate uptrend and short-term downtrend. All indices breached their support levels today with the SPX and RUT closing below support

VIX: The VIX edged its way higher by 2.25% closing at 17.90, inside the bollinger bands. The RVX stayed relatively flat closing at 20.95, and is inside the bollinger bands.

Fibonacci Retracements: Price passed through the 23.6% retracement of the rally that kicked off on Boxing day. The 23.6% level was very close to the 2800 support level and now that it has lost support may well continue down to the 38.2% retracement level sitting at 2719.

Support/Resistance: For the SPX, having breached it’s previous support level opens the 2650 level which is also the 50% Fibonacci level with overhead resistance at 2954. The RUT breached it’s 1500 support level again with the next nearest support at the 1460 level with overhead resistance at 1617 and 1742.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 54. The Weekly chart has an energy reading of 51 and is starting to charge up further. The Daily chart released a significant amount of energy with today’s sell off but it is still at a very respectable level of 55. There is still more than enough energy for significant moves to still take place.

Other Technicals: The SPX Stochastics indicator dropped to 15, having triggered a cross-over last Friday. The RUT Stochastics similarly dropped to 16, breaching into the lower boundary but with no crossover. The SPX MACD histogram is below the signal line, showing re-affirmed and even increased downside momentum. The SPX closed right at the lower Bollinger Band with support at 2794 and resistance at the upper band at 2948. The RUT closed slightly above the lower Bollinger Bands with its boundaries at 1490 to 1620.

Position Management – NonDirectional Trades

I have no remaining positions in play:

- SPY 17MAY 282.5/283.5*297/298 Long Iron Condor (4/22) entered for $.16 on the put side and $.17 on the calls. The puts were closed (5/13) for a $.48 credit. This gave us a net $140 profit from the puts alone. The calls expired for a net $95 loss so our return on this trade was a net 27.2% after commissions.

With the S&P500 charts nearly at full energy again across the board, it might be time soon for another long condor.

I have no positions in play at this time.

No additional trades at this time; the timing is absolutely crucial on these trades so we have to find absolutely exhausted conditions prior to taking these entries.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I will go out to the 19JUL series and sell the $15 calls for at least $.15 credit.

No additional stock plays until I return from travel 2nd week June; I’d like to see if the current pullback plays out a little deeper.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking for the next signal. I don’t like these signals to the short side.

- RSI(2) CounterTrend – None at this time.

- Daily S&P Advancers – Looking for the next signal to go long when we have single-digit advancers on the ADSPD.

- Swing – I set up a long swing trade on the Russell 2000 via the IWM (4/24), with a 24MAY IWM 163/164 debit call spread (4/24) for $.20 debit. At this point any kind of positive return on this trade would be welcome as I’m running out of time, a shame as this trade was within a penny of firing at my target.

Crypto had a big rally this week, and Bitcoin had a monstrous dump on Friday, effectively shaking off all of the late-to-the-party longs. So far the price action is positive.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Thursday’s close at SPY 285.84, there is a +/-5.309 EM into this coming Friday; this is about the same as last week’s 5.539 EM. The EM targets for this Friday’s close are 291.15 to the upside, and 280.53 to the downside.

The lower EM for this week lines up with the low test of last week, so this might be a good level to fade with an ITM call option should it be tested and offer support.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have no remaining positions in play at this time:

- TGT 17MAY 80/82.5 debit call spread (4/9) entered for $1.25 debit and expired OTM for a net $254 loss on two contracts.

- SBUX 31MAY 77/78 debit call spread (4/29) entered for $.48 debit and closed (5/16) for $.72 credit. This gave me a net profit of $20/contract or 42% net return on capital after commissions. .

- MCD 7JUN 197.5/200 debit call spread (5/6) entered for $1.14 debit and closed (5/17) for $1.57 credit, giving us a net $39/contract profit or a 34.2% return on capital after commissions.

We are also keeping an eye on the Momentum stocks in this section. Most of those are a little extended at this point and this pullback might do the rest of the market a lot of good. I would like to let the market settle first before going heavily long.

No other entries at this point.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time.