Daily Market Newsletter

March 21, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

April Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

I had written yesterday: “Ultimately rates going a lot lower will somewhat buoy the equity market, because of the eternal search for yield.” Today turned into one of those runaway freight train trend days, ones that leave everyone behind. I still believe that “long” is the right direction with a dovish Fed, and ultimately it’s for us to align ourselves with the market and not fight it.

We might have a pause in the assault tomorrow, which would set up an almost-perfect upper EM fade with 22MAR SPY puts.

Markets are not pricing in any future rate hikes this year…there is a 23% chance of a rate CUT this September, and that increases to 32% by December.

As long as we have a dovish Fed, we should continue to expect money to be plowed into equities. Be careful of the “lower high” in some indices, however.

Please sign up for our free daily crypto report here.

An embedded flash video is available here.

Offensive Actions

Offensive Actions for the next trading day:

- The upper EM fade play might be on tomorrow with 22MAR SPY puts; I will discuss in today’s video.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

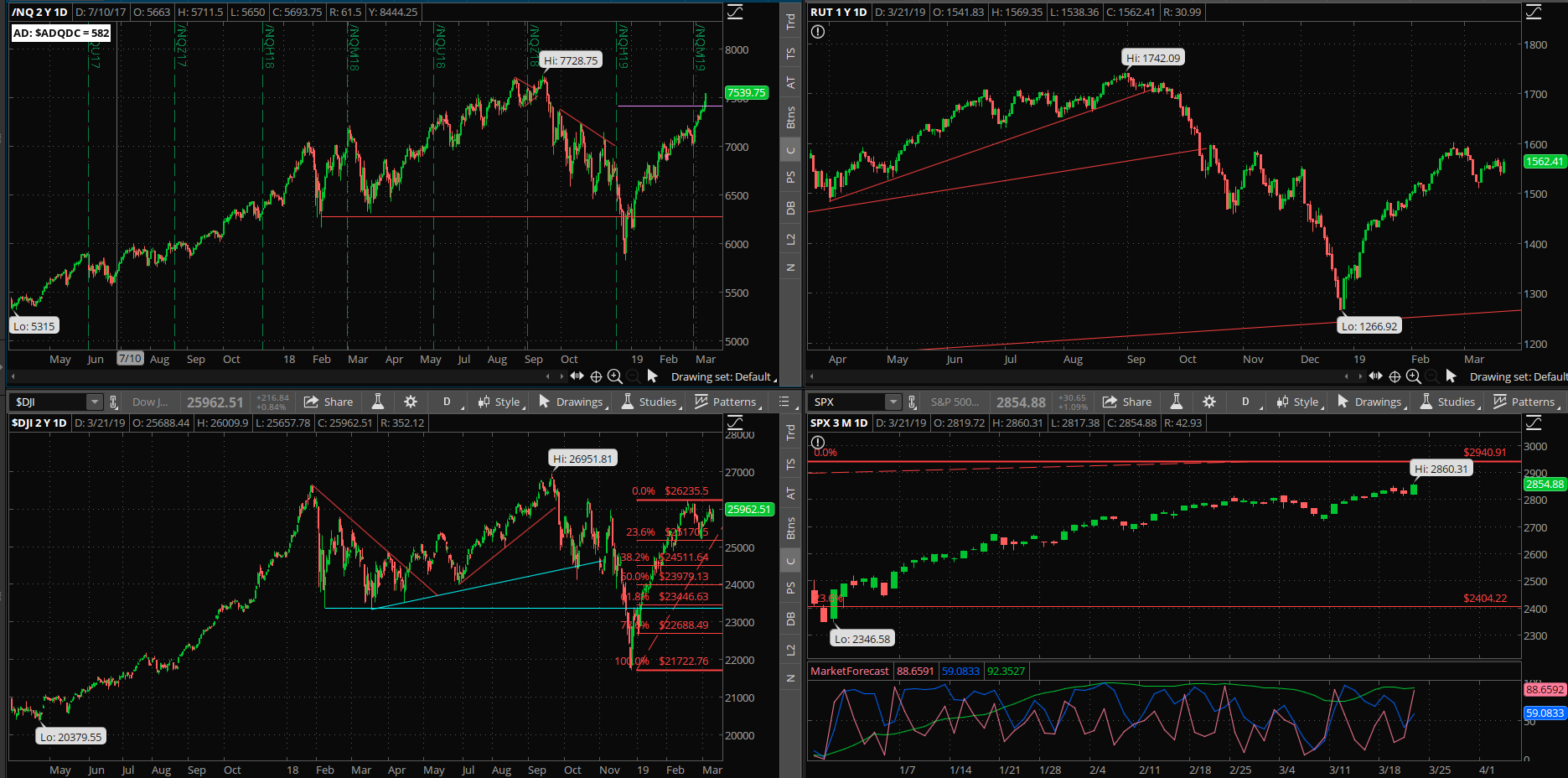

Market Internals: Volume was above-average today and breadth ended the day very strong at +390 advancers minus decliners.

SPX Market Timer : The Intermediate line flattened into the Upper Reversal Zone, now showing a bullish bias. No leading signals at this time, but once again close to a full bearish cluster.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate uptrend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX fell to 13.63 after peaking at 50.3 a year ago, inside the bollinger bands. The RVX fell to 17.02 and is inside the bollinger bands.

Fibonacci Retracements: The price has moved through several important Fib levels and is not caring about any confluence levels that these present. The recent retracement did not even get to the 23.6% fib retracement.

Support/Resistance: For the SPX, support is at 2700 … with overhead resistance at 2941. The RUT has support at RUT 1500 with overhead resistance at 1600 and 1742. The S&P500, Russell 2000, Dow, and Nasdaq 100 have all printed a Death Cross with the 50ma crossing below the 200ma; this can be a leading signal for a true Bearish move. It can also signal “false” and create a massive swing higher. We might be seeing the latter scenario.

Fractal Energies: The major timeframe (Monthly) is charged again, with a reading of 58. The Weekly chart has an energy reading of 33, in exhaustion from the uptrend. The Daily chart is showing a level of 38 which is in exhaustion again from today’s move.

Other Technicals: The SPX Stochastics indicator rose to 71, mid-scale. The RUT Stochastics indicator rose to 48, mid-scale. SPX MACD histogram rose above the signal line, showing a return of upside momentum. The SPX is outside the Bollinger Bands with Bollinger Band support at 2746 and resistance at the upper band at 2851 with price is above the upper band. The RUT is inside the Bollinger Bands with its boundaries at 1521 to 1600 and price is above the lower band. The Bollinger Bands are starting to squeeze again.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPY 27MAR 271/272*287/288 Long Iron Condor (2/25) entered for $.18 debit on the call spreads and $.16 debit on the put spreads. I will look for a 200% return on each side individually and may the best side win.

No additional trades for now.

I have no positions in play.

Waiting for the next condition to sell options again; realized vol is out-pacing implied vol again. The rebound off of the bottom has been violent and traders are chasing after the move.

I have the following positions:

- SPY 29MAR/26APR 282 Put Calendar Spread (3/18) filled for $1.69 debit. I closed out this position (3/20) for a $1.90 credit. This gave us a $17/contract profit or a 10% return on capital for the trade.

Calendar spreads are good for markets in quiet/trending character, so we’ll look to see if we can continue to prosecute this market with Time Spreads if things stay stable.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I currently have the SLV 18APR $15.5 calls (2/11) for a $.17 credit.

- EBAY 26APR $34 puts (3/11) sold for $.73 credit. I will look to remove this trade for a $.10 debit.

- PFE 17MAY $39 puts (3/18) sold for $.39 credit.

No additional trades at this time.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking for the next signal.

- RSI(2) CounterTrend – None at this time.

- Daily S&P Advancers – Looking for the next signal to go long when we have single-digit advancers on the ADSPD.

- Swing – I have no positions at this time.

Crypto has had relative strength over the last few weeks and no one believes this rally.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 281.31, there is a +/- 3.382 EM into this coming Friday. The EM targets for this Friday’s close are 284.69 to the upside, and 277.93 to the downside.

The price broke the upper weekly EM again today; the upper level fade might be on tomorrow if the price ducks down below the 284.69 level again.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play:

- UPS 29MAR 112/113 Debit Call Spread (3/4) entered for $.50 debit. This one got run through by FDX’s outlook.

- SBUX 29MAR 71/72 Debit Call Spread (3/4) entered for $.50 debit. I closed this position for a $.74 credit (3/21) which gave us a $20/contract profit after commissions, or a 40% return on capital.

- CSCO 26APR 52/53 Debit Call Spread (3/13) entered for $.50 debit. I sold this position into strength (3/20) for a $.74 credit. That gave me a $20/contract profit after commissions, or a 40% return on capital.

- PYPL 26APR 101/102 Debit Call Spread (3/18) entered for $.50 debit.

The Weekly exhaustion on the S&P is going to give markets a headwind for a couple of weeks, but it might not affect the “Momentum” stocks.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time. I cleared out the most recent set of puts on the drop to the 200ma back in October. I will “reload” again soon, if/when the weekly chart goes into upside exhaustion. The three-month puts are coming down in price closer to what I’d prefer to pay. (3 months out/90% of current value)