Daily Market Newsletter

January 22, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

February Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Over the weekend I had written, “I do believe that there will be a short-term pause in the near future. This assault has been relentless and is nearing a level of unsustainability, mostly driven by the over-bearishness and skepticism that has put so many on the wrong side of the tape. There should be some type of consolidation and/or pullback in the near future. It is after THAT point that we will know the true intentions of this market into 2019.”

I think that consolidation began today with a combination of a big “miss” in existing home sales, as well as the US cancelling a Trade meeting with China. Events normally conspire to provide what the market “wants,” which was to pause. We might expect this to continue for at least a week.

In the short-to-medium term, we have three possible outcomes:

- Bottom Re-Test: Still very much in play if the next shoe drops, we would see a second bout of panic selling that would re-test or potentially undercut the December 24 low. Take your pick from the potential list of doom/gloom factors that might cause this. This outcome would likely show by late January to mid-February. The higher up that this rebound rally goes, the less likely that this scenario is to playing out, and more likely to see a significant “higher low.”

- Grinding Rally to Monthly Lower High: It’s possible for the bottom re-test to be bypassed through the use of a “scary higher low” that creates the same slingshot effect. In this case, we’d see about a three-month rally to recapture as much as 61.8% of the drop from the September highs.

- A 1998 LTCM Repeat: This one featured a bottom re-test (like above) and then a blistering “melt-your-face-off” rally higher. This was a very different rally from a “grind higher to a monthly lower high” so we’ll recognize that if it occurs. We also have to consider that this move might show WITHOUT a bottom re-test a la 1998.

I think that the next couple of months will be particularly hard to secure a “direction” on price. Just when the siren blows for “all clear” is when the next down-leg will materialize. And just when everyone gives up hope (see LAST THURSDAY!) a rip-yo-face-off rally like last Friday’s will show up. This type of market is not typically one where the newer trader will flourish.

If you’re not sure where you fit in this continuum, use this period to experiment trading AGAINST your emotions. When all looks bleak and hopeless, place very small long positions. When all looks clear and the world is bullish, close those long positions and set up very small bearish trades. Continuing to read/watch the same news as everyone else and trade based on that news will almost certainly guarantee poor performance.

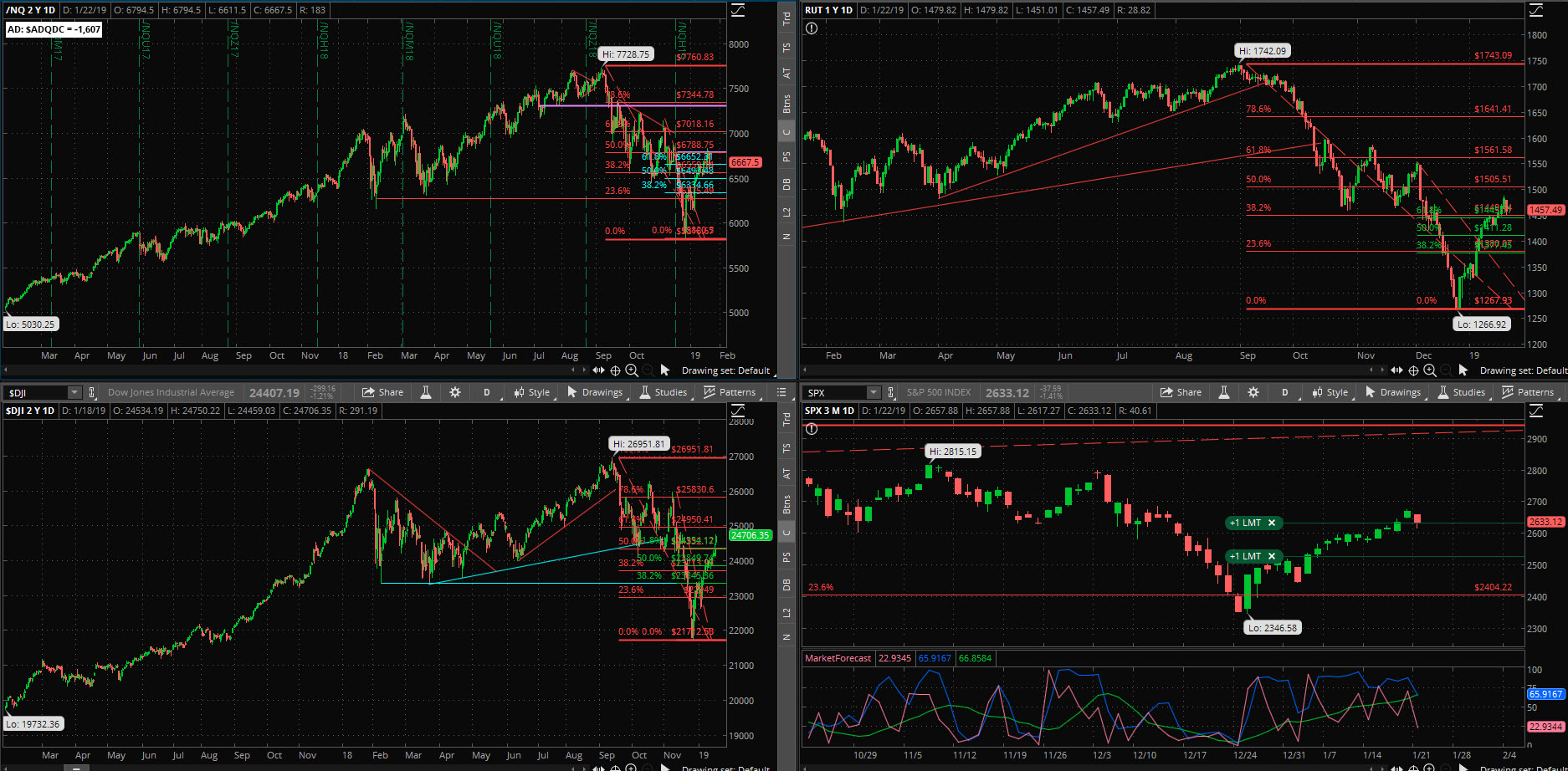

Here is the current scorecard for the correction from the September 2018 highs:

- S&P is down ~594 points or 20.20%

- Dow is down 5239 points or 19.44%

- /NQ is down 1908 points or 24.69%

- RUT is down 475 points or 27.27%

What is our approach to trading this market, which has now moved into a “Volatile/Trending” character?

- Sell credit spreads/create iron condors on the SPX into relative extremes, beyond the current range of movement.

- Establish long iron condors when the price shows potential of moving a great distance in the near future.

- Exercise caution with long stocks/short puts since the 50/200 death cross has hit each index

- Look to establish debit spread-based swing trades against sentiment extremes, and/or EM boundaries

- Use short-term long options to play within the intraday volatility

Please sign up for our free daily crypto report here.

An embedded flash video is available here.

Offensive Actions

Offensive Actions for the next trading day:

- No new trade entries for tomorrow.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

0

Technical Analysis Section

Market Internals: Volume was average today and breadth ended the day fairly weak at -346 advancers minus decliners, from the low water mark of -466 earlier in the day.

SPX Market Timer : The Intermediate line rose to below the Upper Reversal Zone, still showing a bullish bias. No leading signals at this time but this chart is very close to showing a bearish cluster short-term.

DOW Theory: The SPX is in a long term uptrend, an intermediate downtrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate downtrend, and a short-term uptrend. The Dow is in an intermediate downtrend and short-term uptrend.

VIX: The VIX rose to 20.46 after peaking at 50.3 eleven months ago, inside the bollinger bands. The RVX rose to 23.25 and is inside the bollinger bands.

Fibonacci Retracements: The price has moved through several important Fib levels and is not caring about any confluence levels that these present.

Support/Resistance: For the SPX, support is at 2350 … with overhead resistance at 2700, 2800 and 2941. The RUT has support at RUT 950 with overhead resistance at 1500 and 1553. The S&P500, Russell 2000, Dow, and Nasdaq 100 have all printed a Death Cross with the 50ma crossing below the 200ma; this can be a leading signal for a true Bearish move.

Fractal Energies: The major timeframe (Monthly) is charged again, with a reading of 58. The Weekly chart has an energy reading of 49, recharging quickly again. The Daily chart is showing a level of 34 which is now in full exhaustion on the move from the recent bottom. A couple more weeks of non-linear movement and we’ll be ready for the next major swing.

Other Technicals: The SPX Stochastics indicator rose to 95, overbought. The RUT Stochastics indicator rose to 96, overbought. SPX MACD histogram fell above the signal line, showing a loss of upside momentum. The SPX is inside the Bollinger Bands with Bollinger Band support at 2382 and resistance at the upper band at 2704 with price is below the upper band. The RUT is inside the Bollinger Bands with its boundaries at 1268 to 1520 and price is below the upper band.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPY 25JAN 231/232*266/267 Long Iron Condor (12/28) entered for $.18 debits on the puts and calls. I closed the call spreads for a $.54 credit (1/18); this locks in a minimum $12/contract profit on the entire trade, or 33% return on capital. .

- SPX 15FEB 2150/2140 put credit spread (12/20) entered for $.80 credit. I closed this position (1/17) for $.10 debit, so my profit on this position was $66/contract.

- SPX 15MAR 2820/2830 call credit spread (1/17) entered for $.80 credit. I will look for the next retracement to remove this position for a profit.

The volatility appears to be coming in over the last couple of weeks; this is very normal after the panic low. Our edge might be over on this trade in the near term, as long as we see a grinding upside move. I believe I have enough inventory for now. I will start to add more as the energies increase/recharge and the price approaches my upside targets.

If we see a very sharp move lower in the near future, then we’ll start to scope out a downside put spread entry for MAR. In a perfect world we’d be filled at the bottom re-test but there might be a “higher low” that shows up first.

I have the following position in play:

- SPX 4FEB 2515/2520*2640/2645 Iron Condor (1/14) was entered for a $2.50 credit based on this weekend’s advisory. I will look for a $1.80 debit exit.

- SPX 15FEB 2590/2595*2710/2715 Iron Condor (1/22) was entered for a $2.50 credit based on Saturday’s advisory. I will look for a $1.80 debit exit.

I think I have enough inventory for now.

I have no remaining positions. Calendar spreads are good for markets in quiet/trending character, so we’ll want to wait for that type of price action to show again. The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

With all of the four major indices in a death cross, I am suspending additional short put selling until those signals clear. I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I opened up new short calls for the 15FEB cycle at SLV $15 calls, securing a $.23 fill (12/28).

- SSO – I sold the SSO 15FEB $65 puts (12/21) for a $1.15 credit. I will look to close these positions for a $.05 debit.

- HPE – I was assigned 500 shares in the DEC2018 cycle and my initial cost basis on this position is $13.78/share. I sold the 15FEB $14 calls (12/24) for a $.23 credit.

No additional entries at this time due to the death cross.

The only remaining long positions that I need to clear yet are the HPE covered call position, as well as the SSO short puts.

The recent trades were relatively small positions that would create a discount entry should I be assigned. Our priority at this point is to close our open positions and ride out the storm until conditions improve. With that said, if I see truly epic selling that allows me to secure puts at levels where I would be an enthusiastic buyer, I will take those trades. At the very least we would need to wait on Daily/Weekly exhaustion levels.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking for the next signal, which occurred last week and the first signal has passed. I will consider taking the next pullback to the space between the 8 & 21 ema with a debit call spread.

- RSI(2) CounterTrend – Looking for the next setup.

- Daily S&P Advancers – Looking for the next signal to go long when we have single-digit advancers on the ADSPD.

- Swing – I have the following positions:

- SPY 30JAN 247/248 debit put spread (1/3) for a $.42 debit. I will look for a 50% return.

- SPY 8FEB 260/261 debit put spread (1/17) for $.40 debit. I will look for a 50% return exit

Crypto markets have been strong when equities are weak; it appears like they might be negatively correlated and could create some important opportunities for us in 2019 if the equities market takes a dump.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Viewing the SPY from the Friday closing price at 266.46, there is a +/-4.151 EM into this coming Friday. This is yet again lower than last week’s 4.653 EM, for the third week in a row. The EM targets for this Friday’s close are 270.61 to the upside, and 262.31 to the downside.

That did not take long; the weekly Lower EM got bulldozed today, however a quick burst of short-covering allowed the price to close above the weekly EM marker. The upper EM would still be a good fade but only three days to go a long way.

My conclusion after recent experience is that this strategy is best reserved for stocks experiencing a snap-back rally in a primary bear trend, which we magically now have. I would like to remain patient for this snap-back rally as it could be intense.

We will look for the next bounce back up on the indices (to about SPX 2574 or higher) to start playing directional bear spreads

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play:

- MSFT 1FEB 106/107 debit call spread (1/16) entered for $.50 debit. I will look for a 50% return from this trade and need to close it prior to 30JAN earnings.

I was not able to find any candidates for Whales this weekend; everything worthy was blown out to the upside. A week or two of consolidation will help.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time. I cleared out the most recent set of puts on the drop to the 200ma back in October. I will “reload” again soon. The three-month puts are still somewhat expensive. (3 months out/90% of current price).