Daily Newsletter

February 29, 2020Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

March Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

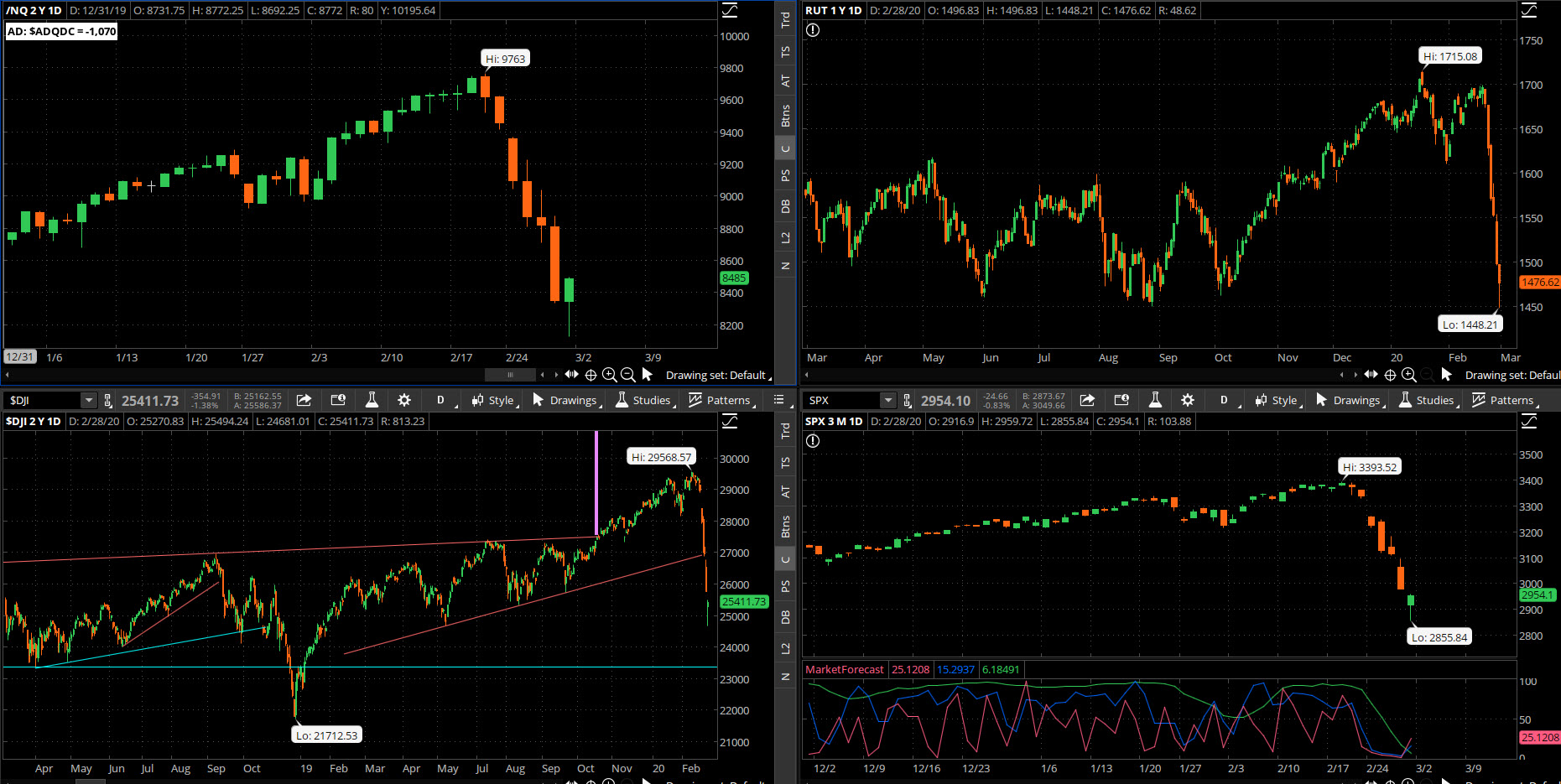

Well that was a hell of a week. What started off Monday as being an “interesting” move quickly turned into a horror show by Friday. Here are some data points for this move so far:

- Correction: The SPX has dropped 538 points in only 7 days to create a 15.85% haircut.

- Fear/Greed: The CNN Fear/Greed study is showing a value of 10; we saw a value of “7” in late 2018.

- VIX; The VIX topped out at 49.48 Friday, almost equaling the value seen in the early 2018 correction.

- Volume: The volume on Friday finally approached capitulation proportions not seen since the 2015 correction.

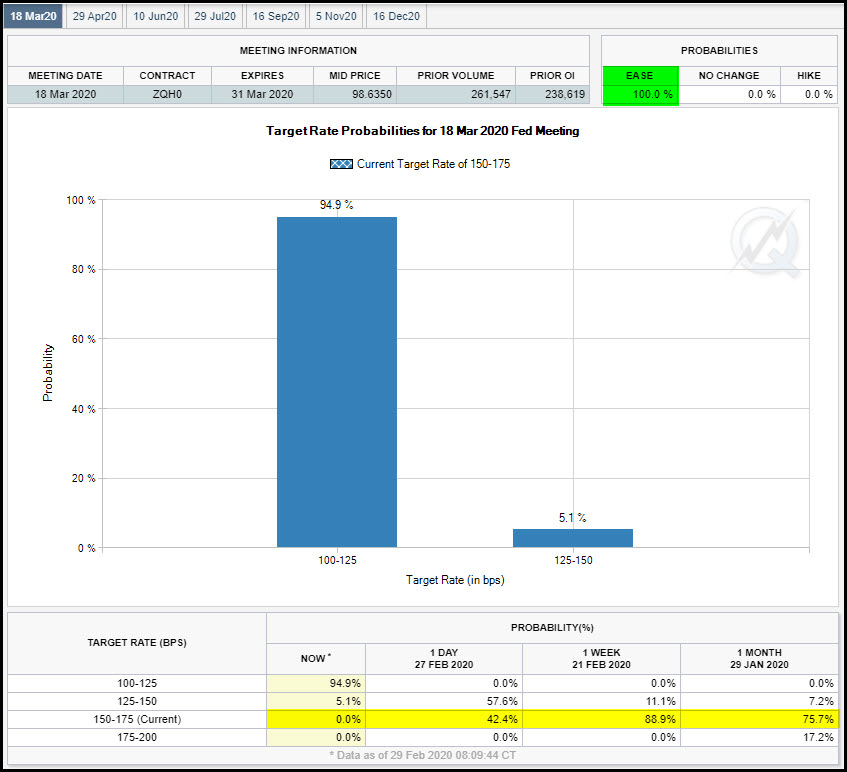

I wrote on Thursday” “Something that we’ll all want to see is early weakness and late strength.” We finally got that “late strength” with 15 minutes left in the session as Jerome Powell issued a brief statement that the FOMC was “open to rate cuts if necessary.” This has now changed the market dynamic in an instant to price in a 100% chance of a rate cut in 2.5 weeks:

Notice that just one month ago, there was a 76% chance of NO CUT and everything was just perfect.I have been talking for weeks about the “Musical Chairs” market that would keep going as long as the music was playing, but stick a broom handle into the spokes of the market’s wheels and no one will be able to find a seat when the music stops.

So is THIS the bottom, or do we have further to go? As I’ve said several times this week, too much damage has been done technically to encourage a V-bottom recovery. I think the fun’s just getting started for 2020. The odds are good that this is at the very least an intermediate low that we can trade against, plus we can use the enormously inflated risk premium to sell against.

I’m going to nibble on some downside premium-selling options trades starting Monday. See today’s video for more detail.

Watch these levels for the S&P “circuit breakers.”

My New Book is Available! – Fractal Energy Trading is now available on amazon.com for paperback or kindle!

Subscriber Update: I will be “grandfathering” OptionsLinebacker and DocsTradingTools customers over to a new advisory service, targeting <soon>. I intend to make this service more “actionable” with more trade alerts, and plan to include guest contributors who are experts in their specific strategies. If there are any elements of the OLD (existing) service that you want to make sure are carried into the new service, please let me know by dropping me at line at doc@docstradingtools.com

Short-Term Outlook: We’ll be in a corrective pattern for several months as markets transition to sideways/volatile.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- I will sell SPY 17APR put credit spreads; see the “HP Nondirectional” section below.

- I will sell puts against the SSO for the 17APR cycle; see “stocks” section below.

- I will sell a LP Iron Condor on the SPX on Monday; see “LP Condors” section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- I now have an SSO long position based on my A/D swing signal that I discussed on Monday. I will look to clear this position on the next bounce up.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was huge again Friday, the highest of the week, with the advancers minus decliners showing a closing value of -246 by the closing bell, which was up dramatically from the -494 low value of the day.

SPX Market Timer : The Intermediate line has fallen into the Lower Reversal Zone and is now “bearish.” After four days in a row with the rare Full Bullish Cluster with all three timeframes oversold, we finally saw this signal release and now it’s only a “Strong Bullish Cluster” with the two strongest timeframes oversold. This can be a leading signal for a bounce.

DOW Theory: The SPX is in a long term uptrend, an intermediate downtrend, and a short-term downtrend. The RUT is in a long-term uptrend, an intermediate downtrend, and a short-term downtrend. The Dow is in an intermediate downtrend and short-term downtrend.

VIX: The VIX moved higher to close at 40.11, well outside of the Bollinger bands. The intraday high on Friday was 49.48 The RVX rose to 47.06 and is outside the Bollinger bands.

Fibonacci Retracements: The price has come down to undercut the 50% fib retracement of the entire 2018-2020 swing, and amazingly, the entire October-February swing has been wiped out.

Support/Resistance: All of the previous support lines have failed; once the capitulation occurs we’ll re-draw.

Fractal Energies: The major timeframe (Monthly) is above exhaustion now with a value of 39, and is starting to gain energy from the counter-trend move. The Weekly chart has an energy reading of 34, now into exhaustion from the move down. The Daily chart is showing 17, severely exhausted to the downside AND THE LOWEST VALUE THAT I CAN FIND, equal to the 1987 crash.

Other Technicals: SPX Stochastics fell to 49, mid-scale. RUT Stochastics fell to 51, mid-scale. The SPX MACD fell below the signal line, showing a decrease in positive momentum. The SPX is below the lower bollinger band with the range 3016 to 3533. The RUT is below the lower bollinger band with the range 1512 and 1769.

Position Management – NonDirectional Trades

I have no positions in play at this time.

I would like to sell SPY put credit spreads into the 17APR cycle. This is going to be somewhat tricky as no doubt there will be a gap up or gap down by Monday morning. If we gap up and continue higher on the day then I will step to the side on this trade. I would like to sell the SPY 17APR 278/280 put credit spread (sell the 280/buy the 278) for a minimum $.30 credit.

I have no positions in play.

I’m going to set up a SPX 20MAR (PM) Iron Condor using $5-wide spreads on Monday morning. I will talk about strike prices in today’s video. The entire trade should receive a credit of $2.50 per contract.

I have no open positions at this time.

This is the wrong type of price character to play Time Spreads; we’re seeing vol crush and a huge buying panic.The previous fear about Corona has disappeared overnight.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. Looking for the next rally to sell calls against.

- BAC 03APR $32.5 Puts (2/18) were sold for $.33 credit.

On Monday I will sell puts against the SSO. I would be a buyer of the SSO at $100/share. I will seek the highest credit that I can receive on Monday morning by selling the SSO 17APR $100 puts, currently going for $4.45 x $6.70. These are somewhat illiquid but there’s enough OI to make a market.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Awaiting the next signal.

- RSI(2) CounterTrend – I’ll look for the next setup.

- Daily S&P Advancers – Looking for the next signal to go long with single-digit advancers; I entered the SSO long (2/25) at a price of 142.18/share. I added a second half of the position on Friday at $120.46/share for a blended cost basis of $131.32. I will look for the RSI(2) to hit a value of 70 to close this position.

- Swing – I have no positions in play:

BTC and other top-ten coins have been breaking higher in 2020, but pulling back short-term due to what I believe are margin calls from the larger markets.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 296.26 there is a +/-17.97EM into this coming Friday; this is enormous. The EM targets for this Friday’s close are 314.23 to the upside, and 278.29 to the downside.

Energy that hit the market last week will cause ripples of volatility for weeks to come, perhaps even months. Fading the EM markers is unlikely to work.

I have the following positions in play:

- SPY 13MAR 328/323 debit put spread (2/12) entered for $.66 debit, and closed (2/24) for a $2.07 credit. This gave me a gross profit before commissions of $141/contract, or a 214% return on capital.

No additional trades at this time. We’ll look for the next recovery rally and establish a position into euphoria.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- XLF 6MAR 31/32 debit call spread (2/6) was added for a $.45 debit. I will look for a 50% return.

- FB 13MAR 212.5/215 debit call spread (2/10) was added for a $1.18 debit. I will look for a 50% return.

- INTC 20MAR 65/67.5 debit call spread (2.18) was added for a $1.25 debit. I will look for a 50% return.

- GDX 20MAR 29/31 debit call spread (2/20) was added for an $.86 debit and was closed (2/24) for a $1.29 credit. This gave us a gross profit of $43/contract or a 50% return on capital.

No additional trades at this time. Unless we see a V-bottom recovery these trades will have a difficult time reaching profitability, thus the whole purpose for limited-risk trading.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads. The timing on these credit spreads has been nearly impossible to determine with today’s declining-rate environment, and we might be in the process of one final mighty blow-off.

I will continue to buy long puts into extreme upside strength. Puts won’t be cheap any time soon now, I’ll have to wait on the next bounce up and over-pay for protection until we get a VIX in the low teens again.

I have no open positions at this time.