Daily Newsletter

August 31, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

September Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

To understand what we’re seeing, August’s monthly candle on the S&P500 had a 238 point range, which featured a 7.9% drop from the highs. Was that enough to create a full “correction” effect and reboot the market? Or is this just an early read on a transition to a “sideways/Volatile” market character that always precedes a full Bear?

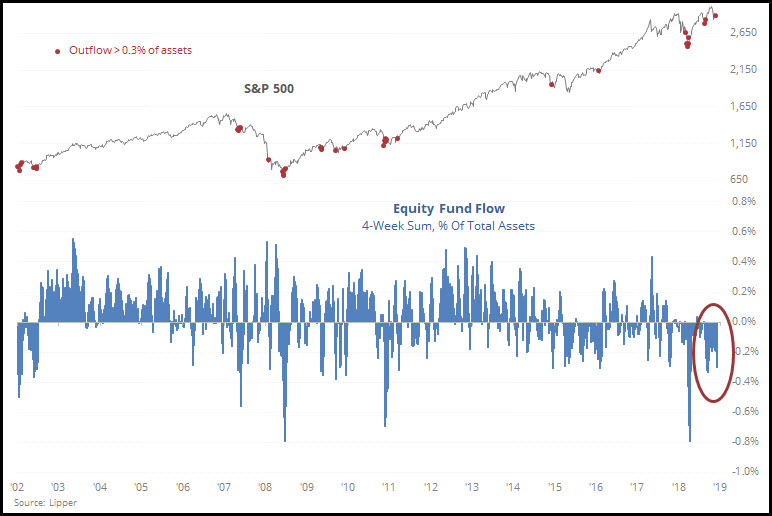

One of the reports that I read is SentimenTrader.com who published this graph on Friday:

The red dots indicate whenever investors have pulled out more than .3% of assets out of the market, which has just recently occurred in the month of August. Even in the most oppressive market conditions, this led to a consistent bounce in the intermediate term, and quite frequently the long term as well. This supports the recent hypothesis that I have that we might indeed see a bounce in the near future as the hunt for yield will drive investors to stocks again. I would love to see one more dive lower in price to undercut the recent lows, which should lead to a violent rally into September.

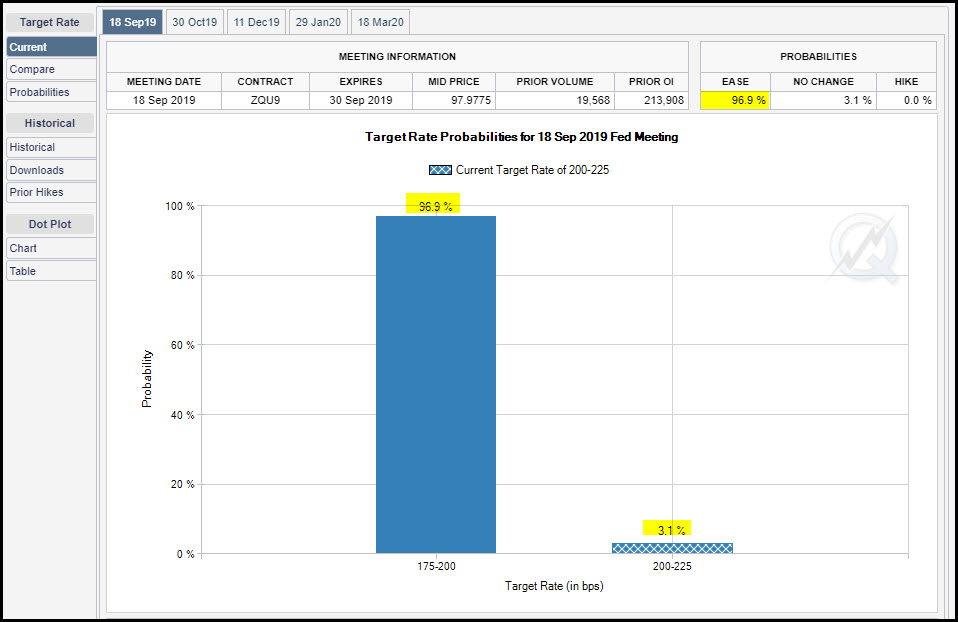

The Fed is screwed; they are backed into the corner for September’s meeting with an implied rate cut, with only a 3% chance of a “hold.” If the Fed is serious about holding we’ll see more messaging in the near future to avert a disaster come the 18th.

Subscriber Update: Due to the Monday Labor Day Market holiday, the next report will be on Tuesday. Have a great long weekend, folks. I believe that Alex will be picking up the Tuesday newsletter duties as I will be traveling the 30 hours that it takes to get to a conference in Bali. See you on Wednesday from south of the Equator!

Short-Term Outlook: We’ve been in a massive consolidation pattern since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, but we’ll know which price levels to respect to warn us if that energy’s going lower instead.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- I will not be adding any positions this week due to overseas travel.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average Friday with advancers minus decliners showing mediocre strength at +127, closing well below the highs of the day.

SPX Market Timer : The Intermediate line has turned up above the Lower Reversal Zone and is now bullish. No leading signals at this time.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX rose to 18.98, inside the Bollinger bands. The RVX rose to 22.02, and is inside the Bollinger bands.

Fibonacci Retracements: The SPX is caught in a very large consolidation pattern and fibs are useless in this area.

Support/Resistance: For the SPX, support is at 2730 and overhead resistance at 3028. The DOW has support at 24800 and overhead resistance at 28399. The RUT has support at 1450 and resistance at 1618.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 52. The Weekly chart has an energy reading of 51, just below fully-charged. The Daily chart is showing 63, now MASSIVELY charged up and ready to pop . Larger timeframe energies are waiting on a very big move, which will start with the smallest timeframes.

Other Technicals: The SPX Stochastics indicator rose to 60, mid-scale. The RUT Stochastics rose to 43, mid-scale. The SPX MACD histogram rose above the signal line showing an increase in momentum. The SPX is below the upper Bollinger Band with support at 2831 and resistance at the upper band at 2955. The RUT is above the lower Bollinger Band with its boundaries at 1452 to 1532. The Bollinger Bands are starting to squeeze together again.

Position Management – NonDirectional Trades

I have the following positions in play at this time:

- SPY 9SEP 276/277*301/302 Long Iron Condor (8/12) was entered for $.17 debits on both the put and call side. I will look for a 200% return on either side of the trade.The 9SEP SPY cycle had about an 11.8 point EM when we spec’ed this out, it’s well within the potential of this chart to hit it.

- SPY 30SEP 271/272*299/300 Long Iron Condor (8/26) was entered for $.18 debits on both the put and call side. I will look for a 200% return on either side of the trade. There is about a 14 handle EM to this cycle.

No other trade entries at this time. If the Bear Flag releases I will look to enter put credit spreads.

I have no positions in play:

This is not the right character of market for this strategy at this point.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold the SEP $17.50 calls (8/13) for $.18 credit. If SLV rises up and above the $17.50 level I will just buy back the calls and look for this rally to slow down first before writing any more premium.

- CSCO – I sold the 16AUG $50 puts (6/10) for a $.64 credit and this will help drop my cost basis to $49.36/share after the AUG19 assignment. I sold the 27SEP $50 calls (8/19) for $.62 credit.

Even though this has been a decent pullback, I’d like to stay conservative in the near term and look for something a little deeper before we go back to the well.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking at the next signal;

- RSI(2) CounterTrend – None at this time.

- Daily S&P Advancers – Looking for the next signal to go long with single-digit advancers to close the day.

- Swing – None at this time..

The Bear appears to be over. In the near term I expect to see large consolidation swings, which might provide “value” entries for these coins on a dip.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 292.45, there is a +/-6.159 EM into this coming Friday; this is smaller than last week’s 7.075 EM. The EM targets for this Friday’s close are 298.61 to the upside, and 286.29 to the downside.

The upper weekly EM was taken out last week, and that happened on a larger-than-normal EM, showing how big this move was. I will be traveling this upcoming week and not looking to fade levels.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- MSFT 30AUG 141/142 Debit Call Spread (7/28) entered for a $.50 debit and expired OTM. This one hit a small profit early on and was consumed by the overall market downturn in August.

- V 27SEP 182.5/185 Debit Call Spread (8/30) entered for $1.23 debit and will look for a 50% return.

.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no open positions at this time.

If we see a decent bounce back up I might consider reloading. I do think that we might see another wave of selling to come yet.