Daily Market Newsletter

April 1, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

April Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

This weekend I had written: “This means that we need to force ourselves to stick with the trend until we see evidence to the contrary.” And once again, seemingly for the umpteenth time since 2009 investors have underestimated the economy’s performance. Rates did rise a little today on the good economic news as well as the improved outlook for 1Q. Or maybe it’s a well-orchestrated game played by those that can, who wind up the skepticism only to punish the short-sellers later.

The 1Q earnings season really gets started next week with the large banks mid-week.

Once more I am reminded that we cannot wait for Monday morning to place trades. Everything must be in place by Friday morning at the latest.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- No new orders for tomorrow.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average today and breadth ended the day modestly stronger with +274 advancers minus decliners.

SPX Market Timer : The Intermediate line rose below the Upper Reversal Zone, now showing a bullish bias. This chart is once again one big rally day from a full bearish cluster.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate downtrend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX fell to 13.49 after peaking at 50.3 a year ago, inside the bollinger bands. The RVX fell to 17.77 and is inside the bollinger bands.

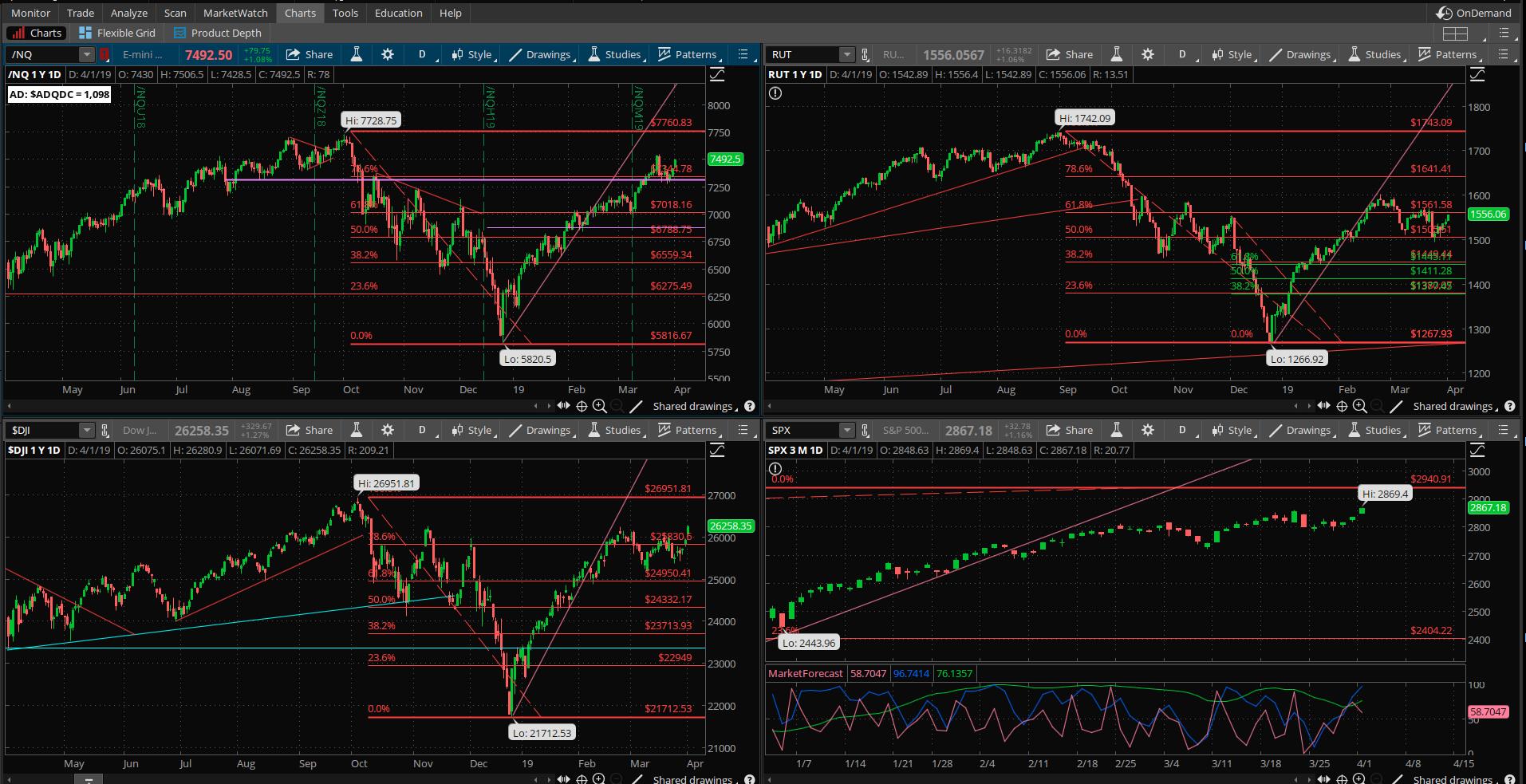

Fibonacci Retracements: The price has moved through several important Fib levels and is not caring about any confluence levels that these present. The recent retracement did not even get to the 23.6% fib retracement. We’ll see if fibs start to matter again.

Support/Resistance: For the SPX, support is at 2700 … with overhead resistance at 2941. The RUT has support at RUT 1500 with overhead resistance at 1600 and 1742. The S&P500, Russell 2000, and Nasdaq 100 have all printed a Death Cross with the 50ma crossing below the 200ma; this can be a leading signal for a true Bearish move. It can also signal “false” and create a massive swing higher. We might be seeing the latter scenario as the Dow has now printed a Golden Cross, to be followed by the SPX any day.

Fractal Energies: The major timeframe (Monthly) is charged again, with a reading of 55, yet is starting to reflect the reversion to the larger uptrend again. The Weekly chart has an energy reading of 30, in exhaustion from the uptrend. The Daily chart is showing a level of 59 which is now heavily recharged. These readings say that we should expect at least a couple of weeks of choppy price behavior but will see sharp moves during this chop due to the charged nature of the daily chart.

Other Technicals: The SPX Stochastics indicator fell to 61, mid-scale. The RUT Stochastics indicator rose to 51, mid-scale. SPX MACD histogram rose below the signal line, showing a return of upside momentum. The SPX is inside the Bollinger Bands with Bollinger Band support at 2747 and resistance at the upper band at 2869 with price is at the upper band. The RUT is back inside the Bollinger Bands with its boundaries at 1507 to 1576 and price is below the upper band. The price is starting to release after the recent Bollinger Band squeeze.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPY 12APR Long Straddle entered (4/1) for $4.68 debit.I will immediately look for a 40% return on the entire position and will not look to leg in nor leg out. This trade really favors a downside move as it’s a long-vega trade. Max risk on this trade is limited to what we pay for it but we want to avoid letting this one circle the drain.

No additional positions to add at this time.

I have the following positions in play:

- SPX 2725/2730*2860/2865 Iron Condor (3/25) entered for $2.60 credit per this weekend’s advisory. My goal is to remove this trade for a 25% return on risk. This would be a closing debit of $2.00 or less.

No additional trades at this time.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character, but not sideways/volatile which might be coming next. If the market reverts back to quiet/trending, then I’ll look to continue this method.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I currently have the SLV 18APR $15.5 calls (2/11) for a $.17 credit. I will let these expire.

- EBAY 26APR $34 puts (3/11) sold for $.73 credit. I will look to remove this trade for a $.10 debit.

- PFE 17MAY $39 puts (3/18) sold for $.39 credit. I will look for a $.10 debit to remove.

No additional trades at this time.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking for the next signal.

- RSI(2) CounterTrend – None at this time.

- Daily S&P Advancers – Looking for the next signal to go long when we have single-digit advancers on the ADSPD.

- Swing – I placed a SPY 17APR 282/283 debit put spread (3/29) for $.42 debit, and will look for a 50% return from this trade. This is counter-trend but looking for a quick move lower.

Crypto has had relative strength over the last few weeks and no one believes this rally.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 282.48, there is a +/-3.79 EM into this coming Friday; this is significantly smaller than last week’s 5.268 EM and is more in-line with the norms. The EM targets for this Friday’s close are 286.27 to the upside, and 278.69 to the downside.

The price has just about tested the upper EM after one day so this looks like a poor upper marker fade for the week.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have no positions in play at this time.

We are getting close to earnings season and this will be a series of land mines that we’ll have to avoid if we’re to get back into longs again.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time. I cleared out the most recent set of puts on the drop to the 200ma back in October. I will “reload” again soon, if/when the weekly chart goes into upside exhaustion. The three-month puts are coming down in price closer to what I’d prefer to pay. (3 months out/90% of current value)