Daily Market Newsletter

May 13, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

May Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

China fires back and the trade war is fully on now with no light at the end of the tunnel. The S&P has dropped about a buck-fifty which is about 5%, half-way to correction territory. Is this the beginning of the end or just a dip that should be bought?

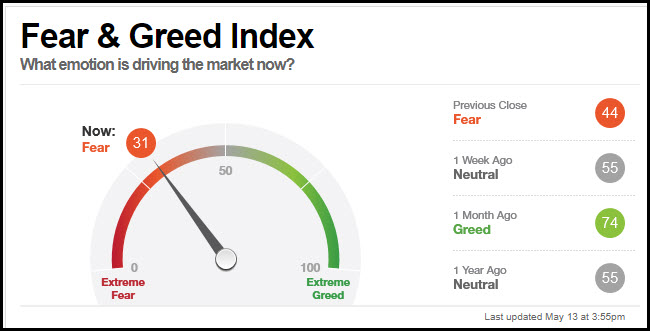

Investor “fear” is moderate right now, not off the charts just yet. But we might get a trade-able capitulation move in the near future if more bad news comes stumbling into the front door. What I think is fascinating is that this is the *only* bipartisan praise that Trump has received from his political foes, because I believe that they are doubling down on this trade war crashing the economy and the Market with it.

But how many times has this guy taken an idea to the brink, and then pivoted? Every. Single. Time. I would not be surprised to see markets higher a week or two from now, based on some comment or turn of phrase that provides certainty.

And if not, then the long drop has begun. In today’s video I’ll talk about the route that price has to take to reverse one way or another.

Strategies to play? This might be a time for caution to let this drop play out. This is doing a perfect job of recharging the weekly chart. Let’s not be in a rush to buy the dip just yet.

Subscriber Update: I will be out of the country and not producing the report from Monday May 20th until Thursday June 6th; in my stead will be Alex who has started to do some guest videos (below) so that you get used to his voice and style. I will also NOT be setting up any positions that require any attention, they will be more of the “fire & forget” version.

Please sign up for our free daily crypto report here.

Here is Alex’s weekend video discussing “volatility” trading strategies.

Offensive Actions

Offensive Actions for the next trading day:

- I will set up the next series of short calls on SLV by selling the 19JUL $15 calls; see “stocks” section below. I will keep this as an open order.

- No new orders for tomorrow.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was above-average today and breadth ended the day really weak with -407 advancers minus decliners. The low-water mark that day was -465 advancers minus decliners, near panic levels.

SPX Market Timer : The Intermediate line fell from the Upper Reversal Zone, now showing a bearish bias. No leading signals at this time..

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term downtrend. The RUT is in a long-term uptrend, an intermediate uptrend, and a short-term downtrend. The Dow is in an intermediate uptrend and short-term downtrend.

VIX: The VIX rose to 20.55, back outside the bollinger bands. The RVX rose to 23.74 and is back outside the bollinger bands.

Fibonacci Retracements: The price has pulled down to the 50% retracement of the March/April swing.

Support/Resistance: For the SPX, support is at 2791 … with overhead resistance at 2954. The RUT has support at RUT 1500 with overhead resistance at 1617 and 1742. All indices that we track recently showed a Death Cross with the 50ma crossing below the 200ma; this can be a leading signal for a true Bearish move. It can also signal “false” and create a massive swing higher. We might be seeing the latter scenario as the Dow ,S&P500, RUT, and /NQ have now printed a Golden Cross.

Fractal Energies: The major timeframe (Monthly) is charged again, with a reading of 54, yet is starting to reflect the reversion to the larger uptrend again. The Weekly chart has an energy reading of 46, gaining energy on this pullback. The Daily chart is showing a level of 46 which is charged again but starting to reflect the energy draw from the move down. These readings say that we should expect maybe one more week of choppy price behavior but will see sharp moves during this chop.

Other Technicals: The SPX Stochastics indicator fell to 53, mid-scale. The RUT Stochastics indicator fell to 57, mid-scale. SPX MACD histogram fell below the signal line, showing a loss of upside momentum after negative divergence. The SPX is outside the Bollinger Bands with Bollinger Band support at 2846 and resistance at the upper band at 2973 with price is below the lower band. The RUT is outside the Bollinger Bands with its boundaries at 1542 to 1618 and price is below the lower band.

Position Management – NonDirectional Trades

I have the following position in play:

- SPY 17MAY 282.5/283.5*297/298 Long Iron Condor (4/22) entered for $.16 on the put side and $.17 on the calls. The puts were closed (5/13) for a $.48 credit. This gave us a net $140 profit from the puts alone. When we set up this trade on 4/22 we had expected an 8 point EM, and that came to realization today plus some. Now we’ll see if we can harvest any value from the calls to increase our profits.

If we see a little further pull to the downside, we might want to consider setting up a HP put credit spread on the SPY.

I have no positions in play at this time.

No additional trades at this time; the timing is absolutely crucial on these trades so we have to find absolutely exhausted conditions prior to taking these entries.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I will go out to the 19JUL series and sell the $15 calls for at least $.15 credit.

I like AMD right now but per my weekend directive, ” I will enter these on Monday morning barring a big crash in equities,” I decided not to enter with markets very weak this morning. There is always another day and we should let this pullback play out.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking for the next signal.

- RSI(2) CounterTrend – None at this time.

- Daily S&P Advancers – Looking for the next signal to go long when we have single-digit advancers on the ADSPD.

- Swing – I set up a long swing trade on the Russell 2000 via the IWM (4/24), with a 24MAY IWM 163/164 debit call spread (4/24) for $.20 debit. I will look for 100% return on this trade.

Crypto has come down to a one-coin market (Bitcoin) which is absolutely ripping higher from a complex bottom. Not a great place to accumulate until the price fades lower first.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Thursday’s close at SPY 288.10, there is a +/-5.539 EM into this coming Friday; this is about 50% larger than last week’s 3.477 EM. The EM targets for this Friday’s close are 293.64 to the upside, and 282.56 to the downside.

At this point we can fade either EM depending on how the price tests it. Very good possibility that we’ll be range-bound. Those that are more aggressive might want to consider a front-week Iron Condor, which I’ll discuss in today’s video.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- TGT 17MAY 80/82.5 debit call spread (4/9) entered for $1.25 debit. We will look for a 50% return on this trade. Earnings have already passed for TGT, but this one took it on the chin the other day as AMZN announced one-day delivery.

- SBUX 31MAY 77/78 debit call spread (4/29) entered for $.48 debit. I will look for a 50% return.

- MCD 7JUN 197.5/200 debit call spread (5/6) entered for $1.14 debit. I will look for a 50% return.

We are also keeping an eye on the Momentum stocks in this section. Most of those are a little extended at this point and this pullback might do the rest of the market a lot of good. I would like to let the market settle first before going heavily long.

No other entries at this point.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time.