Daily Newsletter

January 15, 2020Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

January Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Banks did not fare well with today’s round of earnings, but was overshadowed by the signing of the Trade Deal. There was some profit-taking after that announcement, however markets recovered over the last hour to finish marginally positive. So far we’ve seen a relatively tame news cycle compared to last week’s excitement, with most of the news already priced in. Markets desperately need a week or two of consolidation, or better yet, a pullback. Markets have to go lower to ultimately go higher.

Most of our “Momentum” players look really tired and in need of a rest. I think the best course of action is to set up “long gamma” trades for the short term.

The following stocks are reporting earnings over the next few days: (Monday is a market holiday)

- Thursday: CSX, MS, SCHW

- Friday: SLB

- Tuesday: AMTD, HAL, IBM, NFLX, UAL, UBS

- Wednesday: JNJ, LVS

- Upcoming earnings of interest: GOOGL 2/3, AMZN 1/30, FB, MSFT 1/29, AAPL 1/28, FOMC 1/29

Subscriber Update: I will be “grandfathering” OptionsLinebacker and DocsTradingTools customers over to a new advisory service, targeting the February timeframe. I intend to make this service more “actionable” with more trade alerts, and plan to include guest contributors who are experts in their specific strategies. If there are any elements of the OLD (existing) service that you want to make sure are carried into the new service, please let me know by dropping me at line at doc@docstradingtools.com

Short-Term Outlook: Prices are breaking from a massive consolidation pattern in play since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. The first weekly trend from that consolidation is already into exhaustion and looks to be ready to consolidate.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- No new orders tomorrow.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- I will look to close any remaining long “whale” trades.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average today, with the advancers minus decliners showing a mixed value of +65 near the close.

SPX Market Timer : The Intermediate line has flattened in the Upper Reversal Zone and is still “Bullish.” After four days in a row of Strong Bearish Cluster, this study took a pause today.

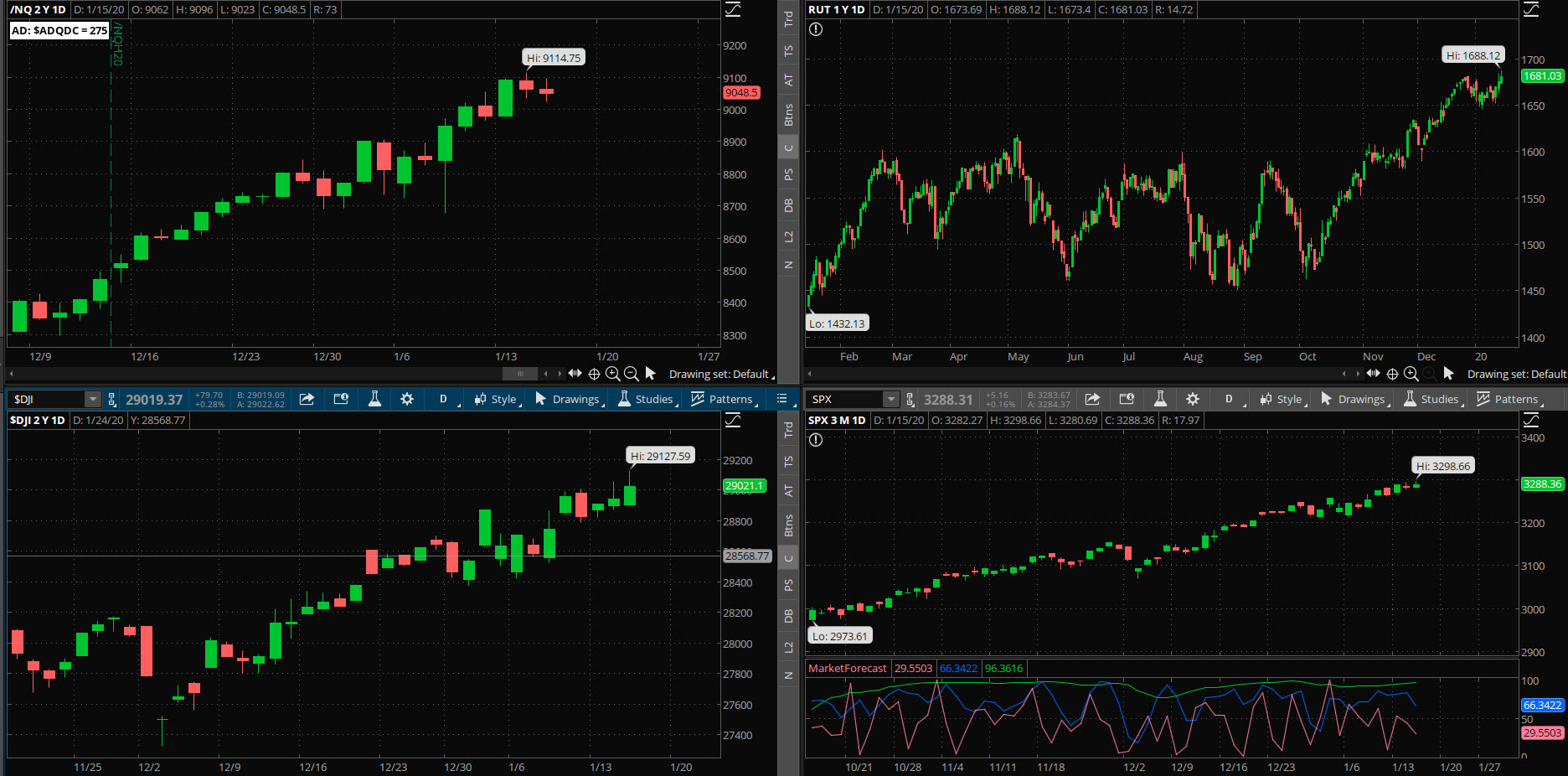

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate uptrend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX fell to 12.47, inside the Bollinger bands. The RVX rose to 14.15 and is inside the Bollinger bands.

Fibonacci Retracements: The price is near new highs again and no point in looking at retracements yet.

Support/Resistance: For the SPX, support is at 2825 with no overhead resistance. The DOW has support at 25500 and no overhead resistance. The RUT has support at 1450 and resistance around 1742.

Fractal Energies: The major timeframe (Monthly) is into exhaustion now at a value of 37, and is starting to reflect energy bleed from the very linear trend from late 2018. The Weekly chart has an energy reading of 25, deep into exhaustion. The Daily chart is showing 49, recovering from exhaustion again. We’re seeing a runaway bull once again but now both parent charts into exhaustion. Very few daily trends continue when the energy level is at 25 or lower.

Other Technicals: SPX Stochastics rose to 79, below overbought. RUT Stochastics rose to 52, mid-scale. The SPX MACD rose above the signal line, showing an increase in positive momentum. The SPX is below the upper bollinger band with the range 3184 to 3298. The RUT is above the upper bollinger band with the range 1654 and 1682. The RUT Bollingers are starting to squeeze really tight.

Position Management – NonDirectional Trades

I have the following positions in play at this time:

- SPY 27JAN 320/321*330/331 long condor (12/27) entered for $.25 debit on the put spreads and $.23 debit on the call spreads, for a total $.48 debit. I will seek a total 25% return on the entire trade, or a $.60 credit with a GTC limit order. At the time of entry, the price was about SPY 323.4 with a +/-9.25 EM.

- SPY 14FEB 319/320*333/334 long condor (1/13) entered for $.50 overall debit. I will seek a total 25% return on the trade. At the time of entry, the price was about SPY 327.5 with a +/- 9.58 EM.

- IWM 165 31JAN Straddle (1/13) entered for $3.91 debit. EM is about +/-4.0 points and IWM price was 164.6. Looking for 30% return on capital.

No other trades at this time.

We are not in a good mode for the traditional “High Probability” short iron condors since the price movement has been incredibly directional, and the Implied Vol is reflective of this with a very low/complacent value. Not good odds to sell options right now, better odds to buy them and go “long gamma.”

I have no positions in play.

No further trades with this strategy until this parabolic runaway move terminates and volatility gets out of the gutter. This is a great strategy while the price is in quiet/trending character with “stair-stepping” price movement, but a poor strategy when price is in a runaway “tail” move.

I have no current positions:

Calendar spreads would be good trades in expected chop, however we’re still suffering from a lack of short-term vol.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. Looking for the next rally to sell calls against.

We’ll look for the next pullback to potentially sell puts against our next candidate.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Awaiting the next signal.

- RSI(2) CounterTrend – I’ll look for the next setup.

- Daily S&P Advancers – Looking for the next signal to go long with single-digit advancers to close the day.

- Swing – I have the following positions in play:

- XLV 17JAN 101/102 debit call spread (1/6) Connors Powerzone setup entered for $.50 debit, and closed (1/8) for $.65 credit. This gave us a $12.40/contract gain after commissions, or a net 24.8% return on capital.

- XLP 17JAN 62/63 debit call spread (1/6) Connors Powerzone setup entered for $.52 debit and closed (1/10) for a $.61 credit. I chased this one lower at Friday’s open all the way down from $.68. (!) This gave me a net $6.40/contract profit after commissions, or a 12.3% return on capital.

BTC and other top-ten coins are once again in a downtrend; could this be the final capitulation after slipping into a Bear almost two years ago?

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 325.71 there is a +/-3.836 EM into this coming Friday; this is smaller than the 4.491 EM from last week. The EM targets for this Friday’s close are 329.55 to the upside, and 321.87 to the downside.

Volatility is increasing; the price hit the upper weekly EM of the SPY on Friday.

I have the following positions in play:

- SPY 31JAN 312/313 debit put spread (12/30) entered for $.14 debit. I am looking for a 100% return from this trade. This should be an inexpensive speculative “flier” for capturing profits should we see a sharp downdraft in prices during the month.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- WMT 24JAN 121/122 debit call spread (12/16) was entered for $.50 debit. I will seek 50%.

No further trades at this time. My job at this point is to harvest some kind of profit on as many of these trades as possible in the short term, prior to what we believe will be a higher level of volatility coming soon.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

If we see a continued rally into January, I will double up on my puts to add another position, at 10% OTM using APR puts.

I have the following open positions at this time:

- SPY 21FEB 279 long puts (11/15) entered for $2.21 debit. I will look to clear half of the position on any test of the 200 sma, and the other half upon a 10% haircut in price.