Daily Newsletter

December 30, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

January Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Profit-taking pretty much across the board (and maybe some tax-loss selling) as markets dipped broadly…buy mildly today.

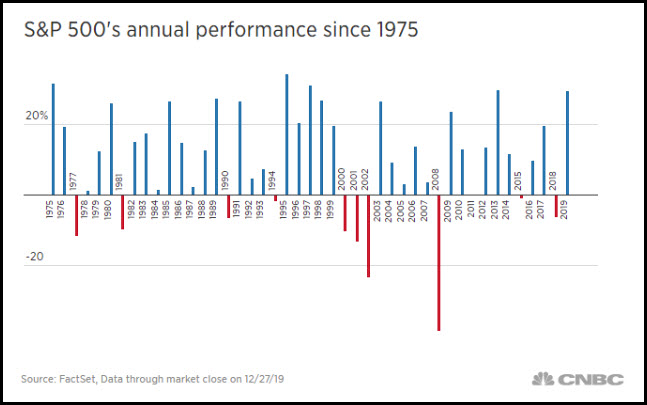

This graphic from CNBC shows the histogram of returns from the S&P over the last 45 years:

Notice that an exceptional year (which we’re ending tomorrow) does not necessarily lead to a negative year. Quite the opposite, in fact. A very strong year usually leads to a subsequent above-average year. But our recent experience with these “above average” years is that they can be very volatile. Certainly 2014 and 2018 bear this out after very strong preceding years.

And it’s not like this year was all that simple, either. A strong early reversal to flush out the excess bearishness was followed by six straight months of large-scale chop.

I expect 2020 overall to display much more vol than we’ve seen since the October bottom.

In the short run, I’d like to see if we can manage our current “long” spreads to completion, and we’ve started to lay in some “long gamma” trades to anticipate volatility. I’m not really in a hurry to add any more long inventory until we can determine which way the January vol will break.

Short-Term Outlook: Prices are breaking from a massive consolidation pattern in play since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, and the first weekly trend is playing out in that direction yet might be nearing completion..

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- No additional trades tomorrow.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

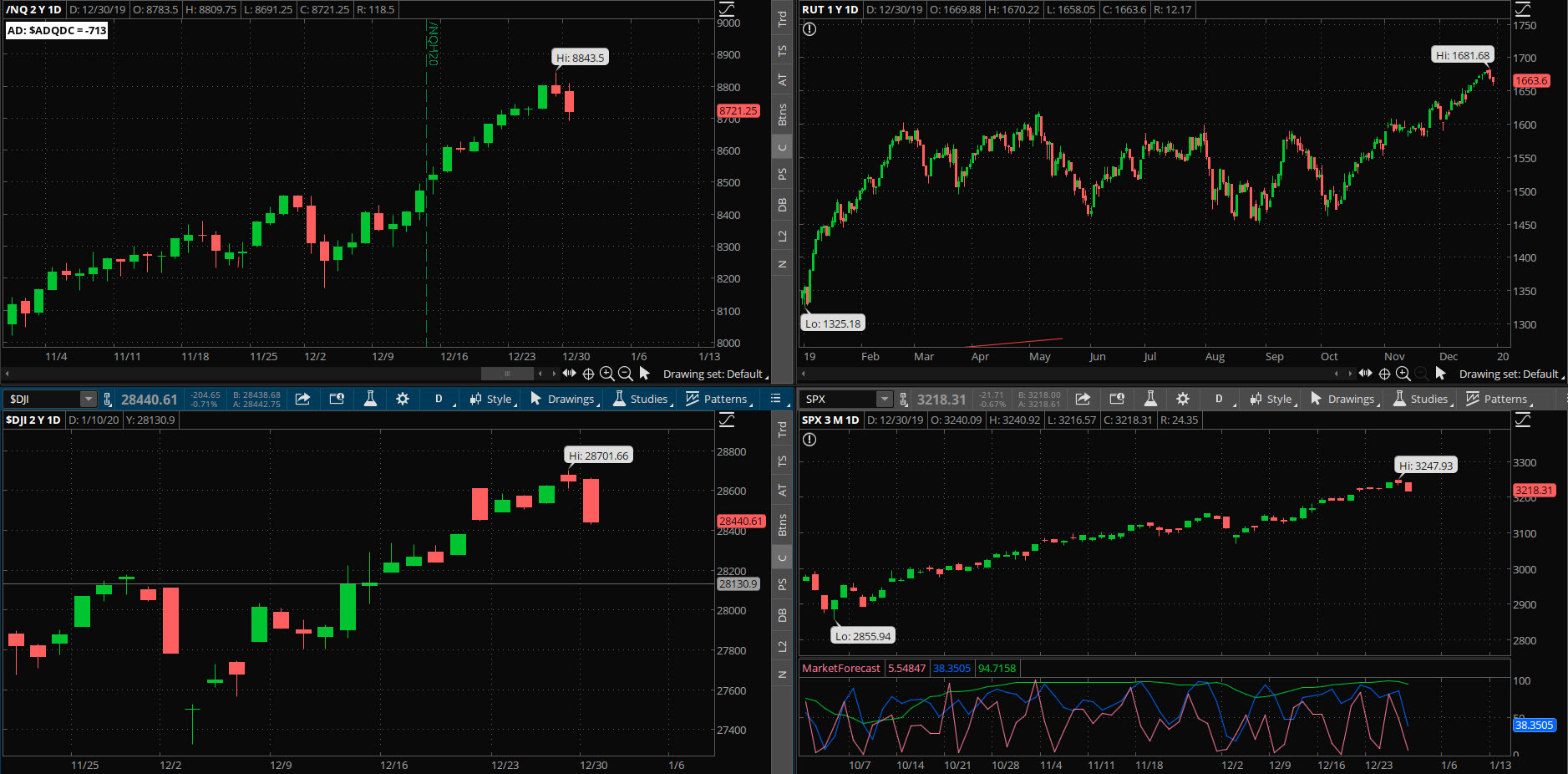

Market Internals: Volume was average today, with the advancers minus decliners showing a relatively negative -309.

SPX Market Timer : The Intermediate line has flattened in the Upper Reversal Zone and is still “Bullish.” After Friday’s Strong Bearish Cluster (two strongest timeframes) prefaced by Thursday’s Full Bearish Cluster, we got the expected pause today.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX rose to 14.94, inside the Bollinger bands. The RVX rose to 16.71 and is inside the Bollinger bands.

Fibonacci Retracements: The price is near new highs again and no point in looking at retracements yet.

Support/Resistance: For the SPX, support is at 2825 with no overhead resistance. The DOW has support at 25500 and no overhead resistance. The RUT has support at 1450 and resistance around 1742.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 40, and is starting to reflect the very linear trend from late 2018. The Weekly chart has an energy reading of 26, deeper into exhaustion. The Daily chart is showing 25, WAY into exhaustion again. We’re seeing a runaway bull once again but both Weekly and Daily charts into exhaustion. Very few daily trends continue when the energy level is at 25 or lower.

Other Technicals: SPX Stochastics flattened at 94, overbought. RUT Stochastics flattened at 91, overbought. The SPX MACD fell above the signal line, showing a decrease in positive momentum. The SPX is below the upper bollinger band with the range 3082 to 3266. The RUT is below the upper bollinger band with the range 1598 and 1694.

Position Management – NonDirectional Trades

I have the following positions in play at this time:

- SPY 27JAN 320/321*330/331 long condor (12/27) entered for $.25 debit on the put spreads and $.23 debit on the call spreads, for a total $.48 debit. I will seek a total 25% return on the entire trade, or a $.60 credit with a GTC limit order. At the time of entry, the price was about SPY 323.4 with a +/-9.25 EM.

We are not in a good mode for the traditional “High Probability” short iron condors since the price movement has been incredibly directional, and the Implied Vol is reflective of this with a very low/complacent value. Not good odds to sell options right now, better odds to buy them and go “long gamma.”

I have no positions in play.

No further trades with this strategy until this parabolic runaway move terminates and volatility gets out of the gutter. This is a great strategy while the price is in quiet/trending character with “stair-stepping” price movement, but a poor strategy when price is in a runaway “tail” move.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. The issue that we have in the short run is the volatility inflation on the back end of the curve, implying that we’ll see movement into January, but none is priced into options in the short-term. We’ll have to wait until January to kick our offense off.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. Looking for the next rally to sell calls against.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – The long cross has fired and is gone. The next entry would be off of the 21ema which occurred the week of Dec 2.

- RSI(2) CounterTrend – I’ll look for the next setup.

- Daily S&P Advancers – Looking for the next signal to go long with single-digit advancers to close the day.

- Swing – None at this time..

BTC and other top-ten coins are once again in a downtrend; could this be the final capitulation after slipping into a Bear almost two years ago?

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 322.86 there is a +/-3.589 EM into this coming Friday; this is larger than the 2.897 EM from last week. The EM targets for this Friday’s close are 326.45 to the upside, and 319.27 to the downside.

The price hit the upper weekly EM of the SPY last week on Friday and executed a dead stop there. We have a larger EM for this coming week on 4 trading days, as opposed to 3.5 days last week. Nothing really outstanding about this coming week’s EM value, about in line for normal.

I have the following positions in play:

- SPY 31JAN 312/313 debit put spread (12/30) entered for $.14 debit. I am looking for a 100% return from this trade. This should be an inexpensive speculative “flier” for capturing profits should we see a sharp downdraft in prices during the month.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- PYPL 3JAN 108/109 debit call spread (12/2) was entered for $.50 debit. I will seek 50%.

- DIS 10JAN 147/148 debit call spread (12/13) was entered for $.49 debit. I will seek 50%.

- WMT 24JAN 121/122 debit call spread (12/16) was entered for $.50 debit. I will seek 50%.

- V 24JAN 185/187.5 debit call spread (12/17) was entered for $1.25 debit and was closed (12/27) for $1.80 credit. This gave me a net profit/contract after commissions of $52.40, or a net 42% return on capital.

- COST 24JAN 295/297.5 debit call spread (12/23) was entered for $1.25 debit, seeking 50%.

No further trades at this time. My job at this point is to harvest some kind of profit on as many of these trades as possible this week, prior to what we believe will be a higher level of volatility coming soon.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

If we see a continued rally into January, I will double up on my puts to add another position, at 10% OTM using APR puts.

I have the following open positions at this time:

- SPY 21FEB 279 long puts (11/15) entered for $2.21 debit. I will look to clear half of the position on any test of the 200 sma, and the other half upon a 10% haircut in price.