Daily Newsletter

November 5, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

November Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

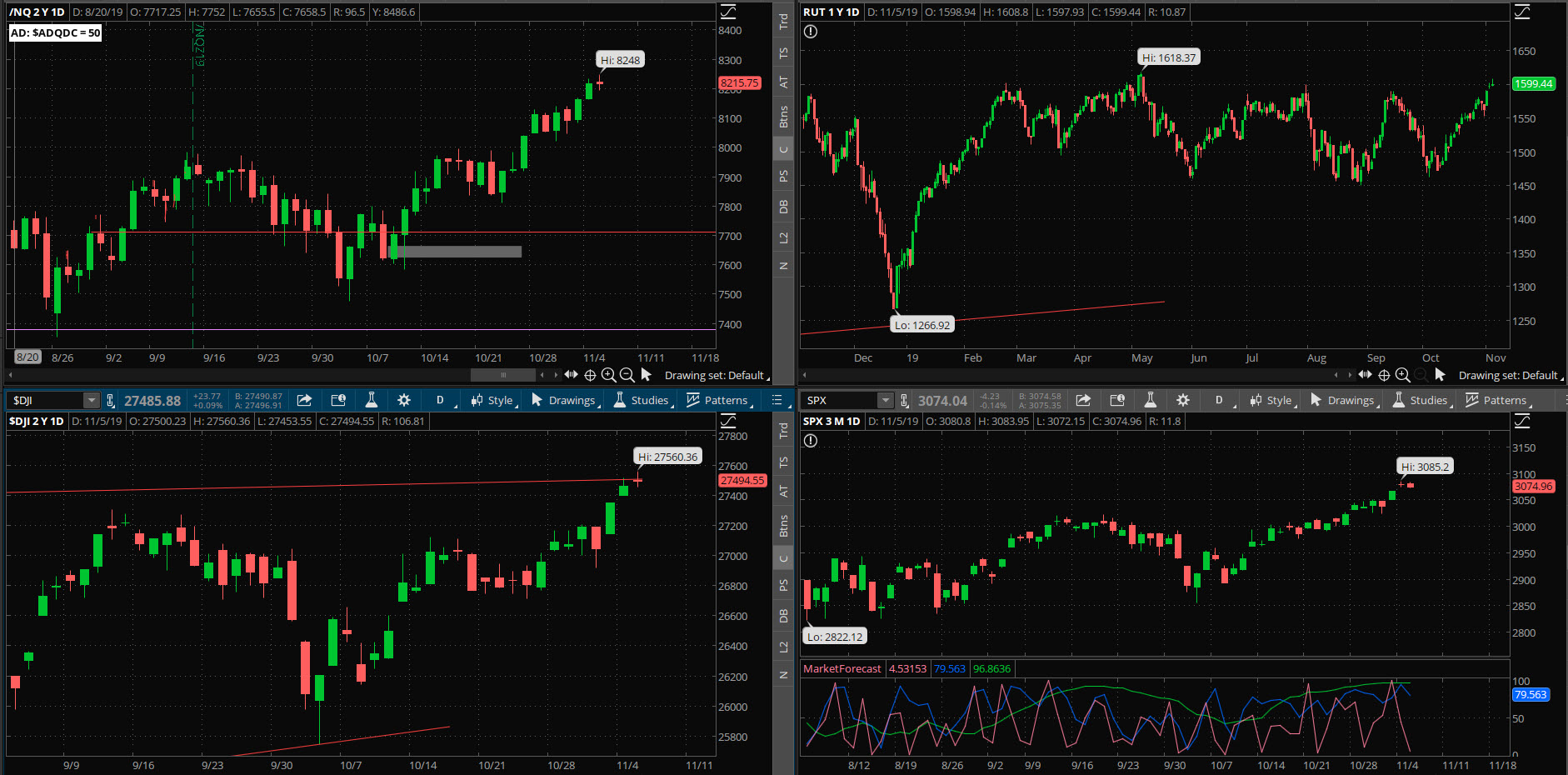

A very low-volume, benign day as the market consolidated just below the all-time highs printed yesterday, while it used the time to eat into Monday’s gap higher. The daily chart of the SPX and RUT are in exhaustion, so we might see a few days as the price consolidates at this level.

There are only occasional earnings report of consequence from this point; most are small-caps going forward over the next few weeks.

Short-Term Outlook: We’ve been in a massive consolidation pattern since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, but we’ll know which price levels to respect to warn us if that energy’s going lower instead.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- See the “LP Condor” section below for more detail on tomorrow’s entry.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- If we tag the upper weekly EM on the SPY we should consider closing down the 15NOV Iron Condor for a profit.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average today with advancers minus decliners showing a mixed value of +0 at the closing bell, after seeing a strong +166 number to open the day.

SPX Market Timer : The Intermediate line has turned up into the Upper Reversal Zone and is now “Bullish.” This chart was showing a Strong Bearish Cluster yesterday, but faded today.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX rose to 13.10, inside the Bollinger bands. The RVX rose to 16.76 and is inside the Bollinger bands.

Fibonacci Retracements: The price is back near the highs and fibs are not in play.

Support/Resistance: For the SPX, support is at 2825 with no overhead resistance. The DOW has support at 25500 and overhead resistance at 27399. The RUT has support at 1450 and resistance around 1600.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 49. The Weekly chart has an energy reading of 54, still fully-charged. The Daily chart is showing 36, into exhaustion again. Larger timeframe energies are waiting on a very big move, which will start with the smallest timeframes.

Other Technicals: SPX Stochastics flattened at 91, overbought. RUT Stochastics flattened at 90, overbought. The SPX MACD fell above the signal line, showing a decrease in positive momentum. The SPX is below the upper bollinger band with the range 2926 to 3092. The RUT is inside the bollinger bands with the range 1480 and 1614.

Position Management – NonDirectional Trades

I have the following positions in play at this time:

- SPY 15NOV 281/282*310/311 Long Iron Condor (9/30) was entered for a $.16 debit on the puts and $.18 debit on the calls. I will look for a 200% return on either side.

- SPY 20DEC 296/297*319/320 Long Iron Condor (11/4) was entered for a $.17 debit on the puts and a $.16 debit on the calls. I will look for a 200% return on either side.

No additional positions now; we need to see if we can secure an exit on the 15NOV call spreads soon.

I have no positions in play:

Per tonight’s video I will set up an SPX LP Iron Condor with $5-wide spreads seeking a $2.50 credit using the 15NOV PM-settled Weeklys. I will find the short strikes based on the .30 delta strike prices, and the long strikes are 1 strike OTM from the shorts.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold the SEP $17.50 calls (8/13) for $.18 credit and closed down this position (9/5) for a $.44 debit. I will let this price chart trend as much as it wants to in the near future before writing against it again.

- CSCO – My cost basis is now $47.95/share after the latest trade and dividend payment. I sold the JAN20 $50 calls for $1.94/contract so our cost basis could be as low as $46.01 depending on the outcome of those JAN calls. I don’t want to see this trade below $46/share on a closing basis. Next earnings are 11/13.

No other trades at this time.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – The long cross has fired and is gone. The next entry would be off of the 21ema.

- RSI(2) CounterTrend – I’ll look for the next setup.

- Daily S&P Advancers – Looking for the next signal to go long with single-digit advancers to close the day.

- Swing – None at this time..

Bitcoin had a huge day on Friday the 25th, effectively interrupting the downtrend. We’ll see if it can build on this bounce. So far it’s building into a bull flag.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 306.14 there is a +/-3.249EM into this coming Friday; this is slightly smaller than last week’s 3.423 EM. The EM targets for this Friday’s close are 309.39 to the upside, and 302.89 to the downside.

In this market we will continue to seek tests against the lower EM marker and not necessarily stand in front of the upper marker, since the trend has appeared to unfurl to the upside again.

I have the following positions in play:

- SPY NOV 299/300 Debit Put Vertical (10/17) entered for a $.37 debit. I will seek a 50% return on this trade.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- NKE 22NOV 96.5/97.5 debit call spread (10/21) entered for $.50. I will seek a 50% return on the trade.

- MSFT 29NOV 145/146 debit call spread (10/28) entered for $.50 debit. I will seek a 50% return from the trade.

- V 29 NOV 180/182.5 debit call spread (10/29) entered for $1.15 debit. I will seek a 50% return.

No other trades at this time. My scans came up with RTN and ACN but the chains that are about 30 days out are too illiquid to trade.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no open positions at this time. Skew is making OTM puts really expensive now.

If we see a decent bounce back up I might consider reloading.