Daily Newsletter

September 3, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

September Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Hello everyone.

Alex Here covering for Doc while he is jetsetting across the world.

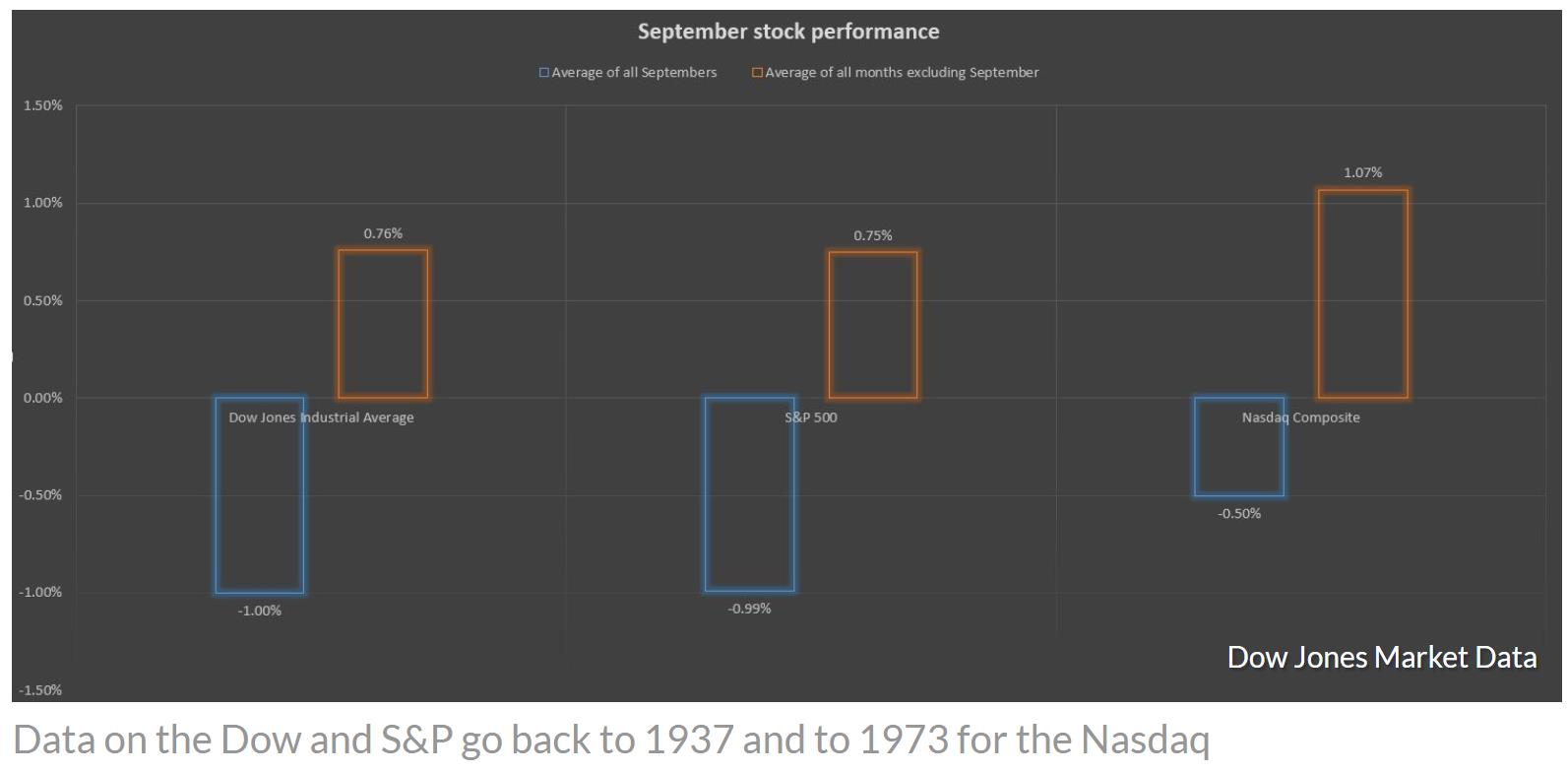

Well, September is usually a 4 letter word in the trading circles. And for good reason – have a look at this chart (stay away in May or stay away in September?)

Today was a bear’s playground in pessimistic activity. Be it the coming in force of China-US trade sanctions, British politics going completely sideways with Boris’ master plan Royally kicking him in the butt, China going to the WTO over unfair US policy, lack of firm dates for trade negotiation resumption – you name it, it was a target rich environment of negative sentiment. Yet with all that we almost ended up with a dogi after a hard hit at the open being down almost 427 on the advancers versus decliners right out of the gate, only to end up some 175ish in the negative. Our Expected Move (EM) for the week for a 4 day trading session was close to 60 points but with all the negative sentiment we only ended down net 20 points. We did bleed some fractal energy off on the daily, but with a new week, dropping of a large previous candle on the weekly we have seen the weekly energy peak up to 59. On the M/W/D we are now showing 50/59/58 meaning that even with all the bouncing around we did today we still have a lot of gas in the tank to make some significant moves. We are still in a tight box of consolidation meaning we are getting closer and closer to a breakout.

Short-Term Outlook: We’ve been in a massive consolidation pattern since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, but we’ll know which price levels to respect to warn us if that energy’s going lower instead.

Great chatting with all of you again and talk soon.

Alex.

Please sign up for our free daily crypto report here.

Offensive Actions