Weekend Edition Newsletter

August 17, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

September Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

A big week awaits us; sleepy old August is normally reserved for grinding market moves with little direction, but based on the “ripples in the pond” that the Fed started on July 31st by intimating that “no further cuts were coming” which led to the current 206 point/6.8% haircut mini-correction….we get to peer once again into the Fed’s backyard by first getting a read on the latest Fed Minutes on Wednesday at 1400ET, and then once again with Powell’s address at Jackson Hole on Friday at 1000ET. Remember that it was Bernanke’s Jackson Hole address back in 2010 that really started the whole “quantitative easing” thing, and the resulting rally created the first major “higher low” on the monthly chart out of the recession, and has been burning bears ever since.

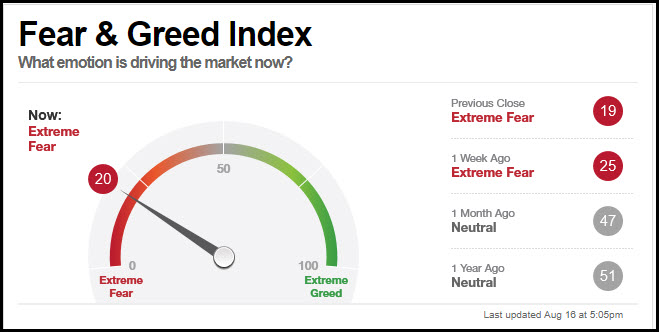

This “disconnect” between the Bond Markets and the Fed is really what’s worrying investors right now, and has led to an “extreme fear” reading two weeks in a row; this could be JUST the “reset” that I was looking for back in July.

.

.

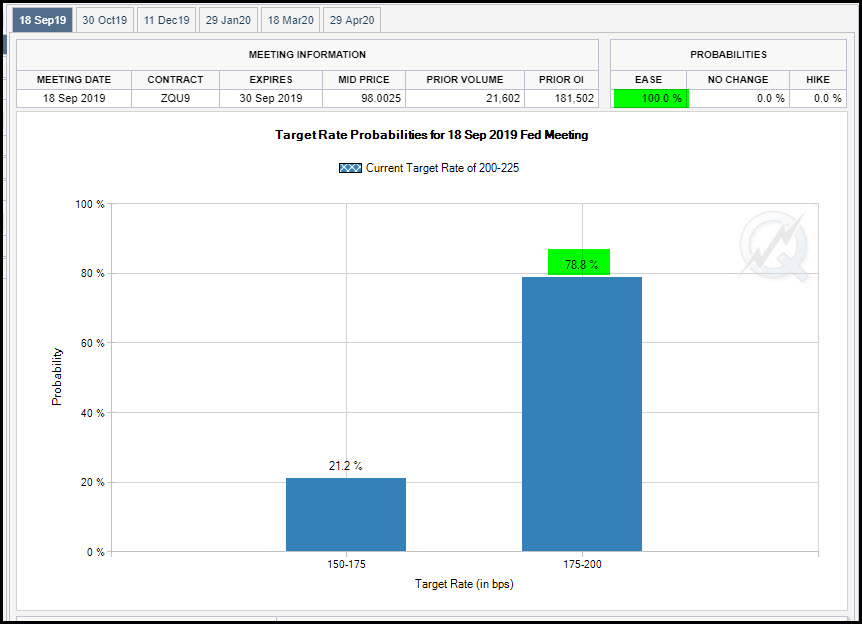

The Bond Market has Jerome Powell trapped and everyone knows it, based on the latest Fed Fund Futures reading for the next policy meeting in mid-September; they are forecasting a ONE HUNDRED percent chance of another rate cut by the Fed, regardless of Powell’s July comments (and perhaps his upcoming Wednesday minutes) and the split is about 79% for a quarter-point basis cut and 21% for a half-point cut. NO accommodation for holding pat!

It comes down to THIS point for the week: if Powell leans into being agreeable to a forward cut, either through the Minutes or most especially during Friday’s speech, then markets will challenge the July highs again and we’re off to the races. If Powell continues his behavior of “I’ll show THEM” intransigence, then we will at the very least re-test the June lows again. A lot at stake this week and the Fed is behind the curve again…will they catch up or fight back?

Short-Term Outlook: We’ve been in a massive consolidation pattern since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, but we’ll know which price levels to respect to warn us if that energy’s going lower instead.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- I will write calls against my new CSCO position on Monday; see the “Stocks” section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was above-average Friday with advancers minus decliners showing a huge value of +454, closing just off the highs of the day.

SPX Market Timer : The Intermediate line has fallen above the Lower Reversal Zone and is now bearish again. No leading signals Friday but still close to a bullish cluster.

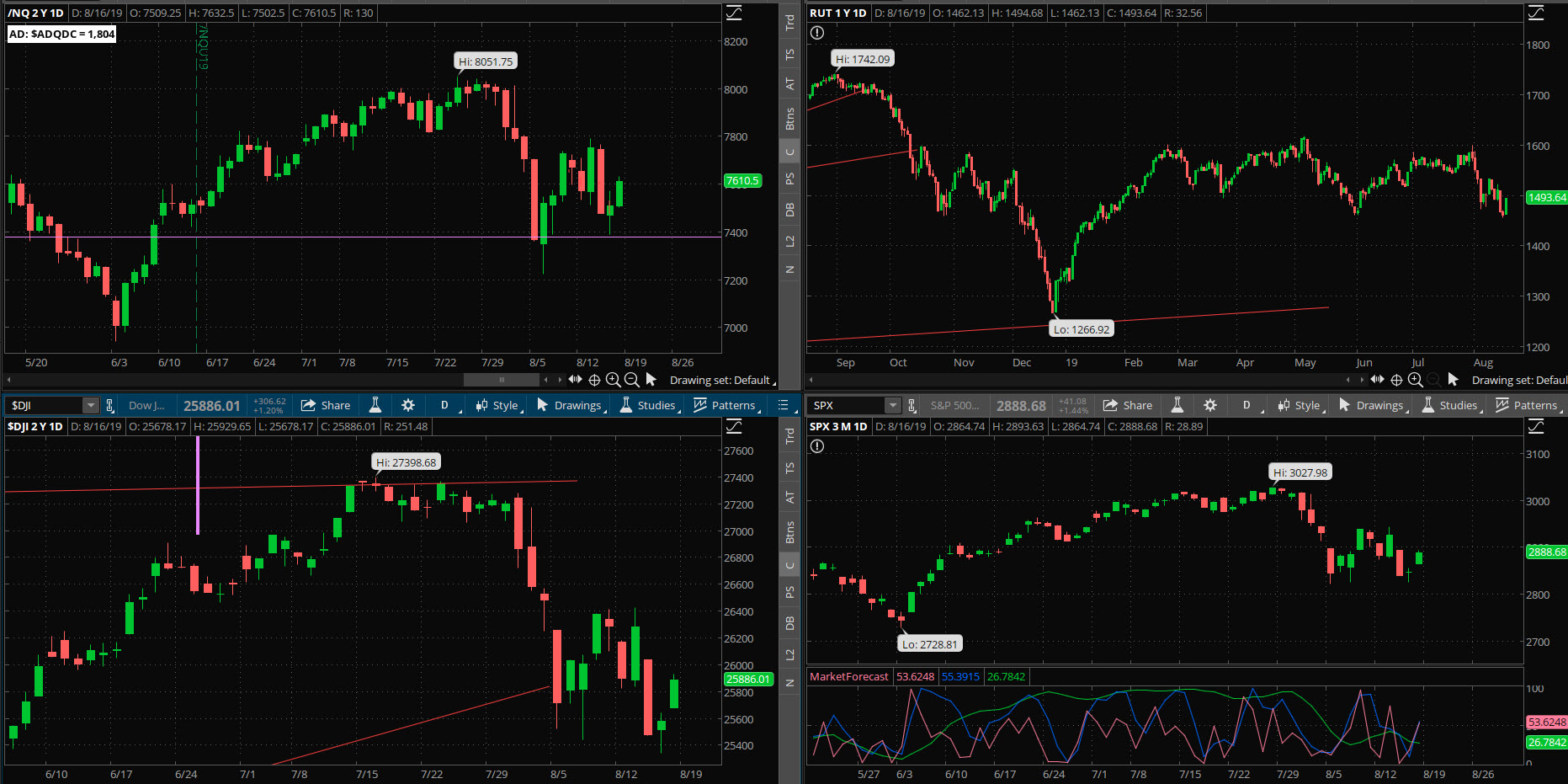

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term downtrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term downtrend. The Dow is in an intermediate uptrend and short-term downtrend.

VIX: The VIX fell to 18.47, inside the Bollinger bands. The RVX fell to 21.51, and is inside the Bollinger bands.

Fibonacci Retracements: The SPX is showing a deep pullback to the 6.18% fib retracement of the most recent swing, and the price has now bounced back up to about the 50% retracement of the swing down from the previous week.

Support/Resistance: For the SPX, support is at 2730 and overhead resistance at 3028. The DOW has support at 24800 and overhead resistance at 28399. The RUT has support at 1460 and resistance at 1618.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 52. The Weekly chart has an energy reading of 49, just below fully-charged. The Daily chart is showing 52, recovering from exhaustion from the downside move . Larger timeframe energies are waiting on a very big move, which will start with the smallest timeframes.

Other Technicals: The SPX Stochastics indicator flattened at 31, below mid-scale. The RUT Stochastics fell to 22, almost oversold. The SPX MACD histogram rose below the signal line showing an increase in momentum and positive divergence. The SPX is above the lower Bollinger Band with support at 2814 and resistance at the upper band at 3065. The RUT is above the lower Bollinger Band with its boundaries at 1453 to 1606.

Position Management – NonDirectional Trades

I have the following positions in play at this time:

- SPY 9SEP 276/277*301/302 Long Iron Condor (8/12) was entered for $.17 debits on both the put and call side. I will look for a 200% return on either side of the trade .

The 9SEP SPY cycle had about an 11.8 point EM when we spec’ed this out, it’s well within the potential of this chart to hit it.

I have no positions in play:

This is not the right character of market for this strategy at this point.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I closed the SLV 30AUG $16 calls for $.42 debit, and rolled out to the SEP $17.50 calls (8/13) for $.18 credit. This was a debit roll but the price of the SLV rising hedged it off.

- CSCO – I sold the 16AUG $50 puts (6/10) for a $.64 credit and this will help drop my cost basis to $49.36/share. I was assigned on the stock this weekend and now it’s time to write calls against our inventory. . I was not able to close the trade prior to the distribution so will either look for an exit by tomorrow or will accept assignment of CSCO shares and write calls against them on Monday. I will write the CSCO 27SEP $50 calls against them on Monday, for at least a $.50 credit

Even though this has been a decent pullback, I’d like to stay conservative in the near term and look for something a little deeper before we go back to the well.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking at the next signal;

- RSI(2) CounterTrend – None at this time.

- Daily S&P Advancers – This signal was green on 8/14. I took a long position in the SSO (8/15) for a cost basis of $118.18. I have no stop on the position and will manage it as inventory should the price drop from here. I will sell half of the position at $125 and the other half at $130.

- Swing – None at this time..

The Bear appears to be over. In the near term I expect to see large consolidation swings, which might provide “value” entries for these coins on a dip.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 288.85, there is a +/-5.874 EM into this coming Friday; this almost exactly the same as last week’s 5.875 EM. The EM targets for this Friday’s close are 294.72 to the upside, and 282.98 to the downside.

The lower EM got punched out again last week for the second time in a row, but recovered higher to close the week. It might be time for the opposite reaction to occur this week.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- MSFT 30AUG 141/142 Debit Call Spread (7/28) entered for a $.50 debit and will look for 50% return.

No more entries in the short run.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have the following positions at this time:

- SPY 18OCT 269 puts (7/23) were entered for $1.70 debit. I closed these puts down for a $4.29 credit (8/6) as the /ES futures tested/undercut the 200 ma overnight, and rebounded hard. This gave me a profit of $257/contract, or a 151% return on capital.

If we see a decent bounce back up I might consider reloading. I do think that we might see another wave of selling to come yet.