Weekend Edition Newsletter

June 22, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

July Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

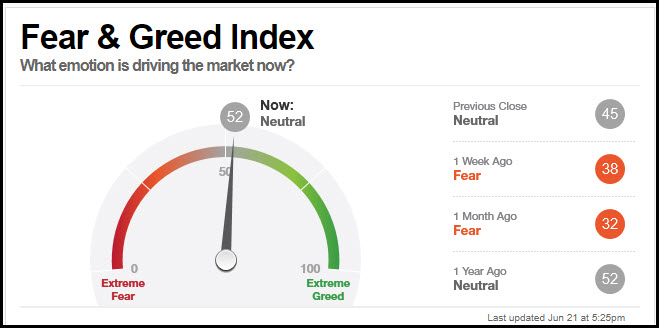

Pretty convincing performance by the S&P500 this week, rising 76 points to its high-water mark from the “wall of worry.” The CNN Fear/Greed index was 38 last week, and saw a big jump in optimism this week:

.

.

So NOW what?! Reporting on 2Q earnings are weeks away in mid-July, and the summer is starting to kick in. Things might start to get a little choppy from here, and I believe the probabilities are very high for the overall market to take a well-deserved rest for a week.

I’m going to do something that I rarely do, which is to add a one-week Iron Condor; details in today’s video.

Short-Term Outlook: I’m left to conclude that after some short-term histrionics, which should include some form of “scary higher low,” we’ll ultimately see the market continue higher. We’ve been in a massive consolidation pattern since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, but we’ll know which price levels to respect to warn us if that energy’s going lower instead.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- I like MCD as a call spread entry, let’s start to look for one per the “Whale” section details below.

- I will enter a weekly iron condor using the 28JUN series; details in LP Condor section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- I will take profits on my SPY Long Condor call spreads tomorrow.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

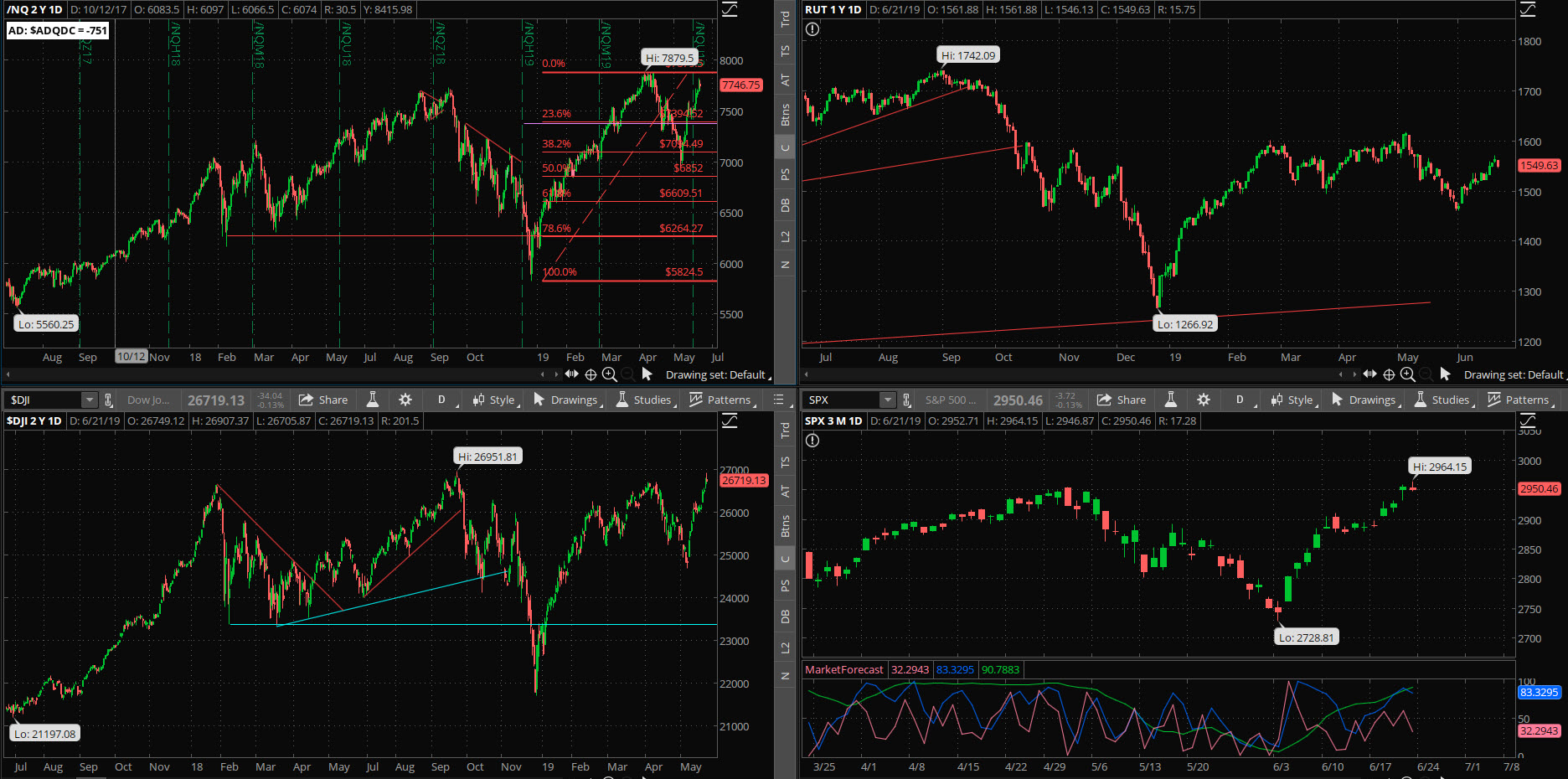

Market Internals: Volume was above-average Friday with advancers minus decliners weakening at -107, after a low-water mark of -279 earlier in the session.

SPX Market Timer : The Intermediate line has turned higher into the Upper Reversal Zone and is still bullish. The two strongest timeframes are clustered in the Upper Reversal Zone, creating a Strong Bearish Cluster for the third day in a row. This can be a leading signal for a pause.

DOW Theory: The SPX is in a long term uptrend, an intermediate trend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX rose to 15.40, inside the Bollinger bands. The RVX rose to 17.85, and is inside the Bollinger bands.

Fibonacci Retracements: We have seen a full 38.2% retracement of the Christmas Eve rally, and now the price has exceeded the 61.8% fib of the May distribution sell-off. .

Support/Resistance: For the SPX, support is at 2730 and resistance at 2954. The DOW has support at 24800 and resistance at 26700. The RUT has support at 1460 and resistance at 1618.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 55. The Weekly chart has an energy reading of 53, starting to pick up on the uptrend. The Daily chart is at exhaustion from this recent uptrend with a reading of 25, with Thursday showing the lowest value I’ve seen. Larger timeframe energies are waiting on a very big move, which will start with the smallest timeframes, but the daily chart needs a rest from the recent bounce.

Other Technicals: The SPX Stochastics indicator flattened at 89, overbought. The RUT Stochastics rose to 85, overbought. The SPX MACD histogram flattened above the signal line showing a decrease in momentum. The SPX is at the upper Bollinger Bands with support at 2734 and resistance at the upper band at 2977. The RUT remains near the upper Bollinger Band with its boundaries at 1465 to 1569.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPY 15JUL 278/279*298/299 Long Iron Condor (6/17) was entered for $.17 debits on both call and put spreads. Per Thursday’s advisory I closed the call spreads (6/21) for a $.40 credit. This gave me a net profit of $19/contract on the call spreads; I will look for any kind of dip over the course of the next week to remove the put spreads .

I have no positions in play at this time.

The daily chart is so exhausted and right up against overhead supply; I believe that it’s worth a shot to see if the daily chart will just spend a few days range-bound to allow it to catch a breather

I will set up a LP 1:1 risk/reward short condor with the SPX 28JUN series, looking to set up $5-wide credit spreads for a net $2.50 credit. I show these as being the SPX 2915/2920*2975/2980 strikes afterhours but that will move by Monday morning’s gap. I’ll discuss trade entry in this weekend’s video.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold the SLV 19JUL $15 calls (6/20) for $.15 credit.

- CSCO – I sold the 16AUG $50 puts (6/10) for a $.64 credit. I will look to close this one for $.05 to $.10 debit.

We’ll see if any subsequent pullbacks in the short term allow better entries.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking at the next signal; I would like to see a pullback first closer to the 21ema.

- RSI(2) CounterTrend – None at this time.

- Daily S&P Advancers – Looking for the next signal to go long when we have single-digit advancers on the ADSPD.

- Swing – None at this time..

Crypto “top ten” coins have been positive since early April, and Bitcoin has gone parabolic above $10k again. The Bear appears to be over.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 294.00, there is a +/-4.565 EM into this coming Friday; this is similar to last week’s 4.544 EM. The EM targets for this Friday’s close are 298.57 to the upside, and 289.44 to the downside.

The price obliterated the upper EM last week due to Fed forces, so I would expect to see a more mild week this week where either EM is fair game to fade. See the “LP Iron Condor” section above for a possible weekly condor trade we can enter.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- WMT 12JUL 107/108 debit call spread (6/10) entered for $.50 debit; per my weekend comments I closed this trade (6/17) for a $.70 credit. This gave me a net $16/contract profit after commissions, or a 32% return on capital.

I like MCD again, let’s enter the MCD 26JUL 202.5/205 debit call spread but try to get an entry near $1.25 debit. .

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time.