Daily Market Newsletter

February 9, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

February Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

No direction. The Market’s on its own for the next couple of weeks as it will get very little direction externally from the FOMC or earnings reports. The pattern lately has been for the “realized” price move to be outside of the range that was “implied” in the options chain ahead of the time….we had this scenario throughout the fall into the final crash, and then once again on the rally higher. While I don’t think that energy will dissipate any time soon (i.e. “tremors), we might be in for a short period of calm since we have fewer outside influences in the near term.

So…we’re going to have a strange little period of odd volatility in the next couple of weeks as the Market tries to figure out what to do. I believe that the best opportunity for all would be a quick, sharp drop lower to incite fear…which gets bought and drives the price higher again. In the meantime I’m transitioning some trades back to normal “long” again.

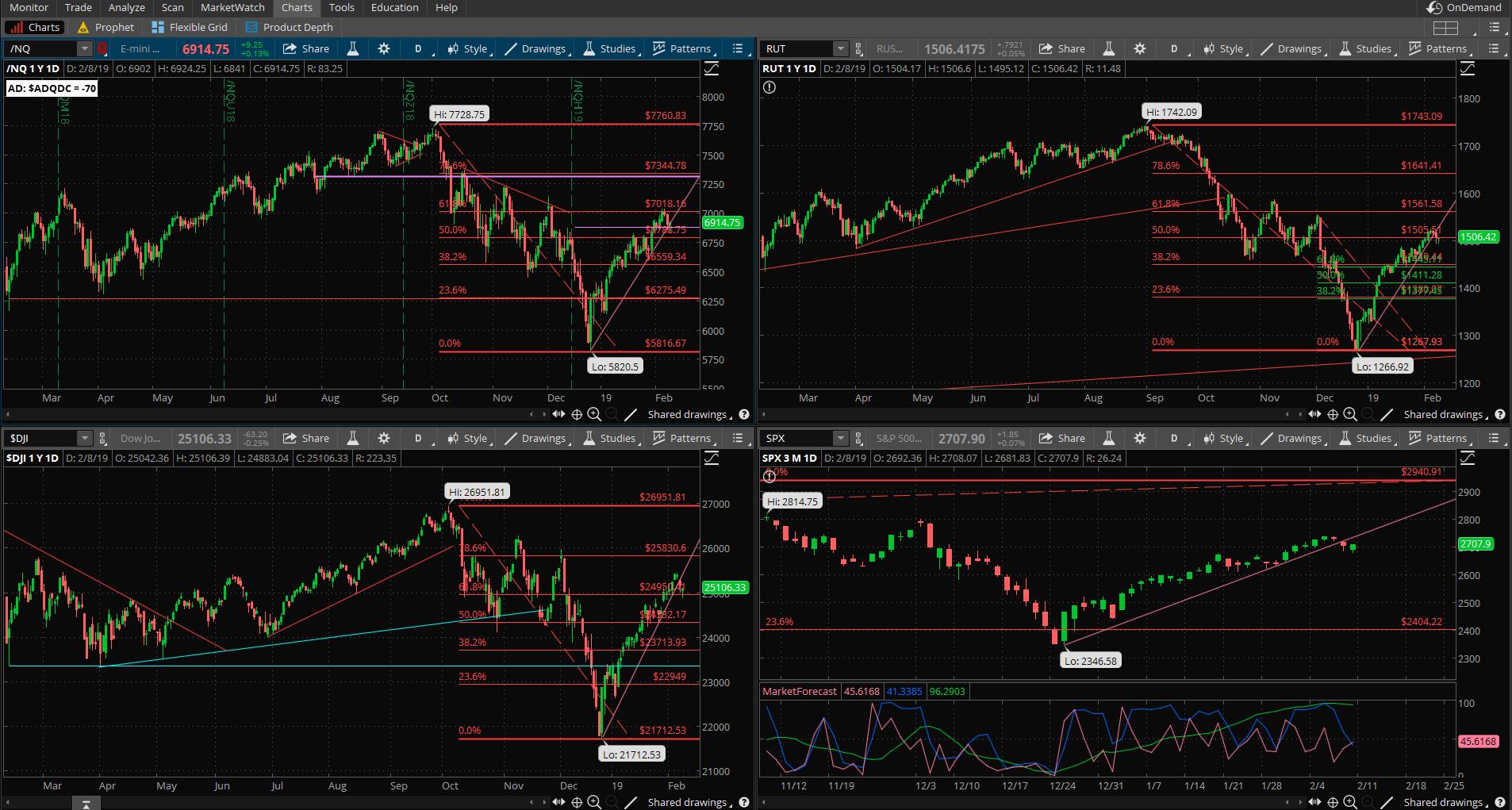

Here is the current scorecard – up and down – for the correction from the September 2018 highs:

- S&P was down ~594 points or 20.20%, now up 392 points or 16.7% from the bottom.

- Dow was down 5239 points or 19.44%, now up 3527 points or 16.24% from the bottom.

- /NQ is down 1908 points or 24.69%, now up 1213 points or 20.8% from the bottom.

- RUT is down 475 points or 27.27%, now up 257 points or 20.3% from the bottom.

The majority of the market-moving earnings heavyweights have already reported (FB, AAPL, AMZN, GOOGL). The FOMC meeting and most of the important economic numbers have been printed. The Market’s on its own from this point, perhaps with the help of a little FedSpeak. Anything can happen, but as long as the FOMC is operating with the “implied put” to backstop this market (even though there is LITTLE that they can do!) then I believe that the price is showing us higher in the near term. The Bear will not re-appear as long as the Fed is market-friendly.

Please sign up for our free daily crypto report here.

An embedded flash video is available here.

Offensive Actions

Offensive Actions for the next trading day:

- I will roll my 15FEB SLV calls to the 18APR series; see “stocks” section below.

- I will open a new short put position on AMD; see “stocks” below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

- Watch the upper delta limit on the SPX call spreads.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

0

Technical Analysis Section

Market Internals: Volume was average Friday and breadth ended the day mixed at +52 advancers minus decliners, with the low-water mark at -349 early in the day.

SPX Market Timer : The Intermediate line flattened into the Upper Reversal Zone, still showing a bullish bias. The Intermediate line fell below it after recently forming a Strong Bearish cluster for the previous five days in a row; this eventually was a leading signal for a pause.

DOW Theory: The SPX is in a long term uptrend, an intermediate downtrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate downtrend, and a short-term uptrend. The Dow is in an intermediate downtrend and short-term uptrend.

VIX: The VIX fell to 15.72 after peaking at 50.3 a year ago, inside the bollinger bands. The RVX fell to 18.12 and is back inside the bollinger bands.

Fibonacci Retracements: The price has moved through several important Fib levels and is not caring about any confluence levels that these present.

Support/Resistance: For the SPX, support is at 2350 and 2600 … with overhead resistance at 2800 and 2941. The RUT has support at RUT 1267 with overhead resistance at 1553. The S&P500, Russell 2000, Dow, and Nasdaq 100 have all printed a Death Cross with the 50ma crossing below the 200ma; this can be a leading signal for a true Bearish move. It can also signal “false” and create a massive swing higher.

Fractal Energies: The major timeframe (Monthly) is charged again, with a reading of 58. The Weekly chart has an energy reading of 46, starting to reflect the uptrend. The Daily chart is showing a level of 47 which is starting to recharge again. This chart is just about ready for the next major swing.

Other Technicals: The SPX Stochastics indicator flattened at 85, overbought. The RUT Stochastics indicator rose to 87, overbought. SPX MACD histogram fell above the signal line, showing a loss of upside momentum but also negative divergence. The SPX is inside the Bollinger Bands with Bollinger Band support at 2573 and resistance at the upper band at 2755 with price is below the upper band. The RUT is inside the Bollinger Bands with its boundaries at 1427 to 1532 and price is below the upper band.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPX 15MAR 2820/2830 call credit spread (1/17) entered for $.80 credit. I will look for the next retracement to remove this position for a profit. If the price continues to advance higher, my exit point is at a .35 delta.

- SPY 27FEB 225/256*275/276 Long Iron Condor (1/25) entered for $.18 debit on the put spreads and $.20 debit on the call spreads for a total $.38 overall debit. I will look to fill either side at a 200% gain by using separate GTC credit limit orders.

If we continue to see bullish price action, then the long condor will somewhat neutralize/hedge the short call spreads. .

If we see a very sharp move lower in the near future, then we’ll start to scope out a downside put spread entry for MAR. There might be a “higher low” that shows up first.

I have the following position in play:

- SPX 15FEB 2590/2595*2710/2715 Iron Condor (1/22) was entered for a $2.50 credit, and closed (2/8) for a $2.10 debit based on Thursday’s advisory. This gave me a net profit of $32/contract after commissions, or a 12.8% return on risk.

Waiting for the next condition to sell options again; realized vol is out-pacing implied vol again.

I have no remaining positions. Calendar spreads are good for markets in quiet/trending character, so we’ll want to wait for that type of price action to show again. The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

With all of the four major indices in a death cross, I am suspending additional short put selling until those signals clear. I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I opened up new short calls for the 15FEB cycle at SLV $15 calls, securing a $.23 fill (12/28). Let’s roll these to the SLV 18APR $15.5 calls on Monday.

- HPE – I was assigned 500 shares in the DEC2018 cycle and my initial cost basis on this position is $13.78/share. I sold the 15FEB $14 calls (12/24) for a $.23 credit. I closed out the short calls for a $2.17 debit, (2/7)and sold the remaining shares for $16.15. This means that I paid out a net debit of $1960 on ten contracts, and I made a net profit of $2150 on the stock shares. This gave me a net profit of $190 on the position.

I am open to adding a little bit of inventory on stocks that are not in a death cross at this time. I like AMD and I will sell the AMD 15MAR $19 puts on Monday morning for at least a $.19 credit. Let’s keep them small for now .

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking for the next signal, which at this point would be the test of the 21ema.

- RSI(2) CounterTrend – Looking for the next setup.

- Daily S&P Advancers – Looking for the next signal to go long when we have single-digit advancers on the ADSPD.

- Swing – I have the following positions:

- SPY 8FEB 260/261 debit put spread (1/17) for $.40 debit. This one expired on Friday.

- BAC 26.5/27.5 debit put spread (2/8) entered for $.24 debit per Thursday’s advisory. I will look for 100% return.

Crypto markets have been strong when equities are weak; it appears like they might be negatively correlated and could create some important opportunities for us in 2019 if the equities market takes a dump.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Viewing the SPY from the Friday closing price at 270.47, there is a +/-4.206 EM into this coming Friday. This is just about the same as last week’s EM. The EM targets for this Friday’s close are 274.68 to the upside, and 266.26 to the downside.

The confluence of the upper EM and the 200 SMA provided too much overhead resistance this week; the price never really got high enough into Wednesday for us to go long the puts. With the market on its own this week, and very few market-moving announcements in the queue, it might be a quiet week that stays within the EM markers. With that said, there is 80 SPX points of room that the price can roam and still not hit the EM markers.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I had the following positions in play:

- V 1MAR 140/141 debit call spread (2/4) entered for $.52 debit; I will look for a 50% return.

- NFLX 1MAR 347.5/350 debit call spread (2/4) entered for $1.28 debit. I will look for a 50% return.

- MSFT 1MAR 106/107 debit call spread (2/5) entered for $.52 debit. Looking for 50% return.

Probably enough inventory for right now until I’m able to take some of these off for a profit. .

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time. I cleared out the most recent set of puts on the drop to the 200ma back in October. I will “reload” again soon. The three-month puts are still somewhat expensive. (3 months out/90% of current price).