Daily Market Newsletter

January 15, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

January Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Today’s squeeze to the upside out of the five-day flag pattern might have done it for the time being. We were aggressive about spotting the bottom into the panic/fear of the Christmas Eve Massacre, and now the sentiment has flipped. This is precisely what must happen if price is to go lower into a Bear this year…price must go higher first, and create complacency for the wave of selling to have maximum impact.

Or are we heading lower? At this point we don’t know where the price will be in a couple of months, however the daily SPX chart is now solidly into “exhaustion” and it might be reasonable to expect a short consolidation or pullback.

We continued to clear our bullish inventory placed prior to the “death cross” and today we closed the second half of our SSO swing trade, a seemingly impossible target at SSO 100 when we first placed the trade.

In the short-to-medium term, we have three possible outcomes:

- Bottom Re-Test: Still very much in play if the next shoe drops, we would see a second bout of panic selling that would re-test or potentially undercut the December 24 low. Take your pick from the potential list of doom/gloom factors that might cause this. This outcome would likely show by late January to mid-February.

- Grinding Rally to Monthly Lower High: It’s possible for the bottom re-test to be bypassed through the use of a “scary higher low” that creates the same slingshot effect. In this case, we’d see about a three-month rally to recapture as much as 61.8% of the drop from the September highs.

- A 1998 LTCM Repeat: This one featured a bottom re-test (like above) and then a blistering “melt-your-face-off” rally higher. This was a very different rally from a “grind higher to a monthly lower high” so we’ll recognize that if it occurs.

I think that the next couple of months will be particularly hard to secure a “direction” on price. Just when the siren blows for “all clear” is when the next down-leg will materialize. And just when everyone gives up hope (see LAST THURSDAY!) a rip-yo-face-off rally like last Friday’s will show up. This type of market is not typically one where the newer trader will flourish.

If you’re not sure where you fit in this continuum, use this period to experiment trading AGAINST your emotions. When all looks bleak and hopeless, place very small long positions. When all looks clear and the world is bullish, close those long positions and set up very small bearish trades. Continuing to read/watch the same news as everyone else and trade based on that news will almost certainly guarantee poor performance.

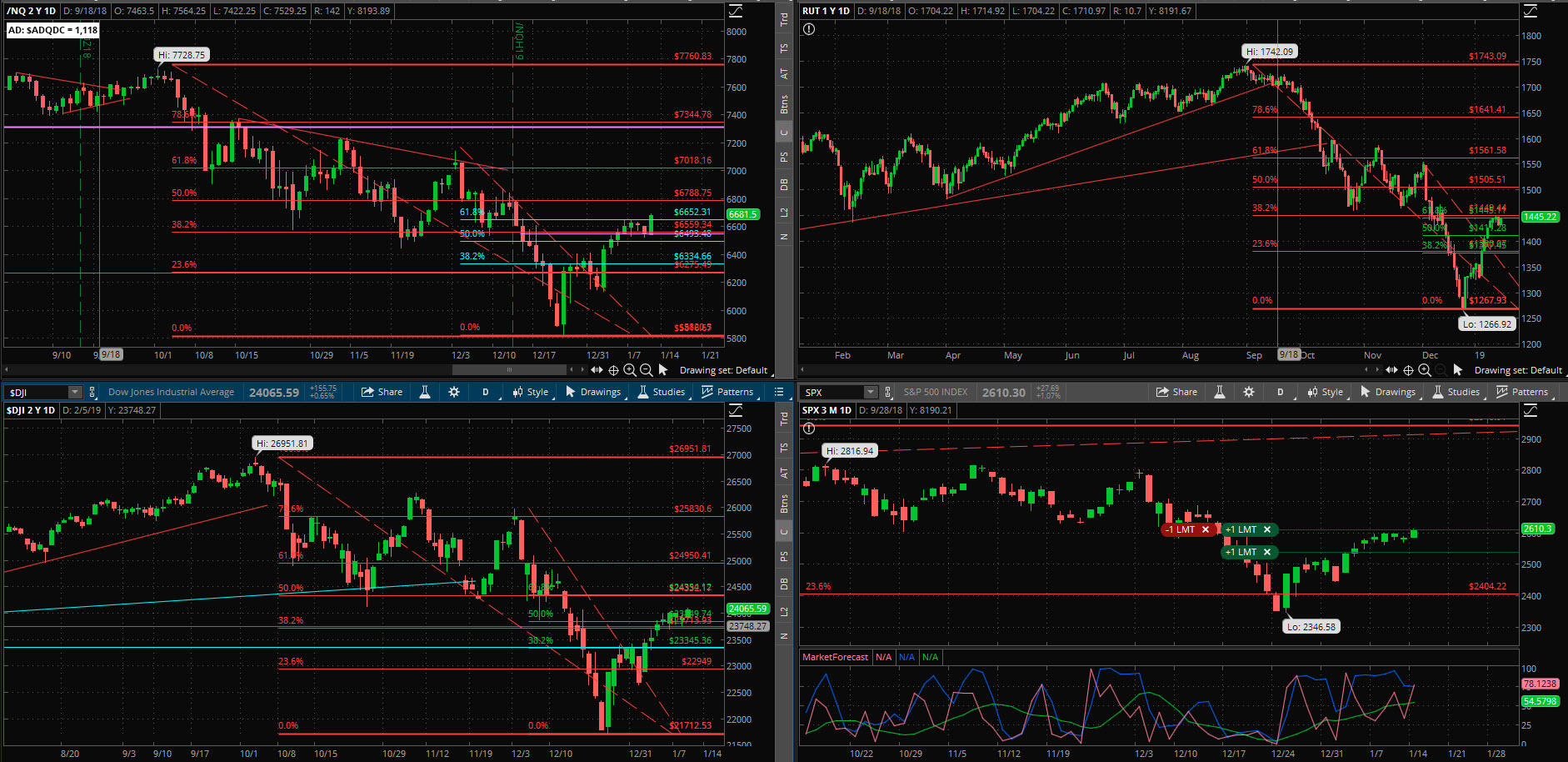

Here is the current scorecard for the correction from the September 2018 highs:

- S&P is down ~594 points or 20.20%

- Dow is down 5239 points or 19.44%

- /NQ is down 1908 points or 24.69%

- RUT is down 475 points or 27.27%

What is our approach to trading this market, which has now moved into a “Volatile/Trending” character?

- Sell credit spreads/create iron condors on the SPX into relative extremes, beyond the current range of movement.

- Establish long iron condors when the price shows potential of moving a great distance in the near future.

- Exercise caution with long stocks/short puts since the 50/200 death cross has hit each index

- Look to establish debit spread-based swing trades against sentiment extremes, and/or EM boundaries

- Use short-term long options to play within the intraday volatility

Please sign up for our free daily crypto report here.

An embedded flash video is available here.

Offensive Actions

Offensive Actions for the next trading day:

- I will look to enter a MSFT Whale setup tomorrow morning; see “whale” section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

- I will look for a way to clear the call spreads on our Long Condors.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

0

Technical Analysis Section

Market Internals: Volume is declining to average levels again and breadth ended the day modestly stronger at +255 advancers minus decliners, from the high water mark of +284.

SPX Market Timer : The Intermediate line rose above the Lower Reversal Zone, still showing a bullish bias. No leading signals at this time but this chart is very close to showing a bearish cluster short-term.

DOW Theory: The SPX is in a long term uptrend, an intermediate downtrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate downtrend, and a short-term uptrend. The Dow is in an intermediate downtrend and short-term uptrend.

VIX: The VIX fell to 18.58 after peaking at 50.3 eleven months ago, inside the bollinger bands. The RVX fell to 21.31 and is inside the bollinger bands.

Fibonacci Retracements: The price has moved through the first important confluence level for most charts on the bounce back up.

Support/Resistance: For the SPX, support is at 2350 … with overhead resistance at 2700, 2800 and 2941. The RUT has support at RUT 950 with overhead resistance at 1500 and 1553. The S&P500, Russell 2000, Dow, and Nasdaq 100 have all printed a Death Cross with the 50ma crossing below the 200ma; this can be a leading signal for a true Bearish move.

Fractal Energies: The major timeframe (Monthly) is charged again, with a reading of 57. The Weekly chart has an energy reading of 48, recharging quickly again. The Daily chart is showing a level of 37 which is now in exhaustion on the move from the recent bottom. A couple more weeks of non-linear movement and we’ll be ready for the next major swing.

Other Technicals: The SPX Stochastics indicator rose to 84, overbought. The RUT Stochastics indicator rose to 85, overbought. SPX MACD histogram rose above the signal line, showing a return of upside momentum. The SPX is inside the Bollinger Bands with Bollinger Band support at 2387 and resistance at the upper band at 2649 with price is below the upper band. The RUT is inside the Bollinger Bands with its boundaries at 1267 to 1478 and price is below the upper band.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPY 18JAN 232/233*262/263 Long Iron Condor (12/21) entered for $.17 debits on the puts and calls. I have placed $.51 GTC credit orders on each “side” of the trade but I might have to do anything that I can to secure a profit on the call spreads for whatever I can book this week, as this position runs out of time.

- SPY 25JAN 231/232*266/267 Long Iron Condor (12/28) entered for $.18 debits on the puts and calls. I have placed $.54 GTC credit orders on each “side” of the trade.

- SPX 15FEB 2150/2140 put credit spread (12/20) entered for $.80 credit. I will close this position if the delta of the short option hits .45; it is currently showing a delta of .02 on the short option. My target closing debit is $.10 and should fire shortly.

The volatility appears to be coming in over the last couple of weeks; this is very normal after the panic low. Our edge might be over on this trade in the near term, as long as we see a grinding upside move. I believe I have enough inventory for now. I will start to add more as the energies increase/recharge and the price approaches my upside targets.

The big opportunity for us would be a relief rally where we could clear our call spreads from the long condor inventory that we hold. The problem at this point with the current inventory is that vol crush is preventing any early exits; we will need to see the price approach the SPY 262 level this week for us to have a shot at exiting the last two long condors profitably.

We do have one short put spread on the SPX at what I believe would be an unattainable level for this first swing down, but we will manage it by the numbers.

What is our next credit spread entry? This is governed by my desire to not accept a fill that is below 2820 on the call spreads, nor above 2200 on the put spreads. That is our “safe” range. (if you’re more of a random-walk trader then knock yourself out!)

I would like to add a short call credit spread on the SPX as this rally finishes out, but only if I can secure the short calls at SPX 2820 or higher. Right now we’re looking at the MAR options cycle. I’ve placed this order on Monday morning for a 15MAR SPX 2820/2830 for a minimum $.80 credit but it would take a fairly strong move higher for this order to be filled; that might coincide with the final “tail” of this short-term rally.

If we see a very sharp move lower in the near future instead, then we’ll start to scope out a downside put spread entry for MAR. In a perfect world we’d be filled at the bottom re-test but there might be a “higher low” that shows up first.

I have the following position in play:

- SPX 4FEB 2515/2520*2640/2645 Iron Condor (1/14) was entered for a $2.50 credit based on this weekend’s advisory. I will look for a $1.80 debit exit.

I have no remaining positions. Calendar spreads are good for markets in quiet/trending character, so we’ll want to wait for that type of price action to show again. The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

With all of the four major indices in a death cross, I am suspending additional short put selling until those signals clear. I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I opened up new short calls for the 15FEB cycle at SLV $15 calls, securing a $.23 fill (12/28). SLV is really rallying so I might have to roll this position higher in the near future.

- SSO – I sold the SSO 15FEB $65 puts (12/21) for a $1.15 credit. I will look to close these positions for a $.05 debit.

- HPE – I was assigned 500 shares in the DEC2018 cycle and my initial cost basis on this position is $13.78/share. I sold the 15FEB $14 calls (12/24) for a $.23 credit.

- BAC – I sold 18JAN $24 puts (11/19) for a $.25 credit and I closed these for $.05. (1/14). This gave me a net profit after commissions of $19/contract, or a .8% return on capital for the period.

No additional entries at this time due to the death cross.

The only remaining long positions that I need to clear yet are the HPE covered call position, as well as the SSO short puts.

The recent trades were relatively small positions that would create a discount entry should I be assigned. Our priority at this point is to close our open positions and ride out the storm until conditions improve. With that said, if I see truly epic selling that allows me to secure puts at levels where I would be an enthusiastic buyer, I will take those trades. At the very least we would need to wait on Daily/Weekly exhaustion levels.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking for the next signal, which surprisingly just hit on Friday. I will consider taking the next pullback to the space between the 8 & 21 ema with a debit call spread.

- RSI(2) CounterTrend – Looking for the next setup. Lots of these showing now, best to play these during primary uptrend.

- Daily S&P Advancers – Per the 12/24 Trade Update I bought shares of the SSO at $84.35/share (12/24). I sold half of this position at the SSO $97.67 level, (1/8) booking a $13.32/share profit on that first half. I sold the rest of this position at SSO 100, (1/15) and earned $15.65/share on the last half of the position. This position is now fully closed and earned $1448.50 per 100 shares that we invested, or a 17.17% return on capital.

- Swing – I have the following positions:

- SPY 30JAN 247/248 debit put spread (1/3) for a $.42 debit. I will look for a 50% return.

- AAPL 25JAN 157.5/160 debit call spread (1/7) entered for a $.44 debit. I closed this position (1/9) for an $.87 credit; after commissions, this gave me a $39/contract profit or an 88.6% return on capital.

Crypto markets have been strong when equities are weak; it appears like they might be negatively correlated and could create some important opportunities for us in 2019 if the equities market takes a dump.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Viewing the SPY from the Friday closing price at 258.98, there is a +/-4.653 EM into this coming Friday. This is about 25% lower than last week’s 6.124 EM, for the second week in a row. The EM targets for this Friday’s close are 263.63 to the upside, and 254.33 to the downside.

The upper EM level was exceeded last week although not by much; there were brief opportunities to fade the upper EM with a long intraday put option, however few of them occurred the way that I was looking for, which was an early morning gap-up rally faded in the first hour.

I would fade either level this week; a drop from here is likely to create a higher low, and a move to the upper EM might be the finishing move on this swing.

My conclusion after recent experience is that this strategy is best reserved for stocks experiencing a snap-back rally in a primary bear trend, which we magically now have. I would like to remain patient for this snap-back rally as it could be intense.

We will look for the next bounce back up on the indices (to about SPX 2574 or higher) to start playing directional bear spreads

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have no positions at this time.

Per today’s video, I’ll see if I can secure a MSFT 1FEB ATM $1-wide call spread for about $.50, based on whatever tomorrow’s opening gap is. I showed a later cycle in the video, but we need to be out of the position before earnings so 1FEB is fine .

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time. I cleared out the most recent set of puts on the drop to the 200ma back in October. I will “reload” again soon. The three-month puts are still somewhat expensive. (3 months out/90% of current price).