Daily Market Newsletter

December 15, 2018Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

December Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Markets crept up to the edge of the abyss on Friday, and did not back up into the close; they are threatening to jump to much lower prices unless “certainty” comes back to the market.

We have two camps of economists at present; the first are those that are looking at the numbers today and saying “zero percent chance of recession, the economy is doing fine,” with the alternate camp stressing that today’s view doesn’t matter because the slope of global growth has already changed, and here is Powell and the rest of the FOMC pressing for another rate hike this week. There is a 76% chance of Powell going forward with the hike as planned. Keep in mind that the Fed is always, ALWAYS behind the curve and if they get this one wrong, they will be leading from behind again as always, scrambling to cut rates and add policy accommodation.It’s not a scenario that breeds confidence, and understand that only educated investors are aware of the current volatility and risks…this news has not yet hit the everyday populace that spends money and drives the economy.

I wrote on Thursday that “…. all of the negative risks are already well-known thus priced into the pie as it sits today. Markets don’t like surprises and any unexpected negative surprises would almost ensure a rapid trip to SPX 2500 before a likely stop at around 2400.” Friday’s “surprise” was one of the Safe Harbors of the market, JNJ…asbestos in baby powder? The timing could not have been worse for this company nor the broader market. When the Bear rears up, markets are hyper-sensitive to any negative surprises and this might be a whopper.

Most readers who get to this point of my narrative probably are wondering, “well, what next?” This has been a very headline-driven market and the negative news is getting overstated as it does in a Bear/Corrective market. This is going to be a hyper-sensitive week for market direction as we have markets coiled into a tight spring and looking for any excuse to move in a big way. Sentiment appears to be leaning in the direction of the Bears, however keep in mind that a positive surprise will quickly lead to a 100+ point rally, even if it’s to a lower high. What I find is best in turbulent times is to just trade the volatility, and stop trying to predict the forward direction which is going to be impossible to do in the short run.

Before markets break into a huge bear, odds, sentiment and history favors that a significant monthly “lower high” would print first, accompanied by feelings of complacency, relief, and survival. Any downside release that we see will be relatively short, quick, and painful, at which point that monthly “lower high” might start the building process.

I do not want to throw on any more “long” risk right now and in fact would prefer to clear what I have. Humans are irrational and so are markets. We are looking at a potential 500-1000 point SPX swing over the next year and getting the first 50 points of it is irrelevant. Be patient. I will continue to layer on long iron condors to play to this volatility, and I will continue to clear long risk that we set up prior to this move.

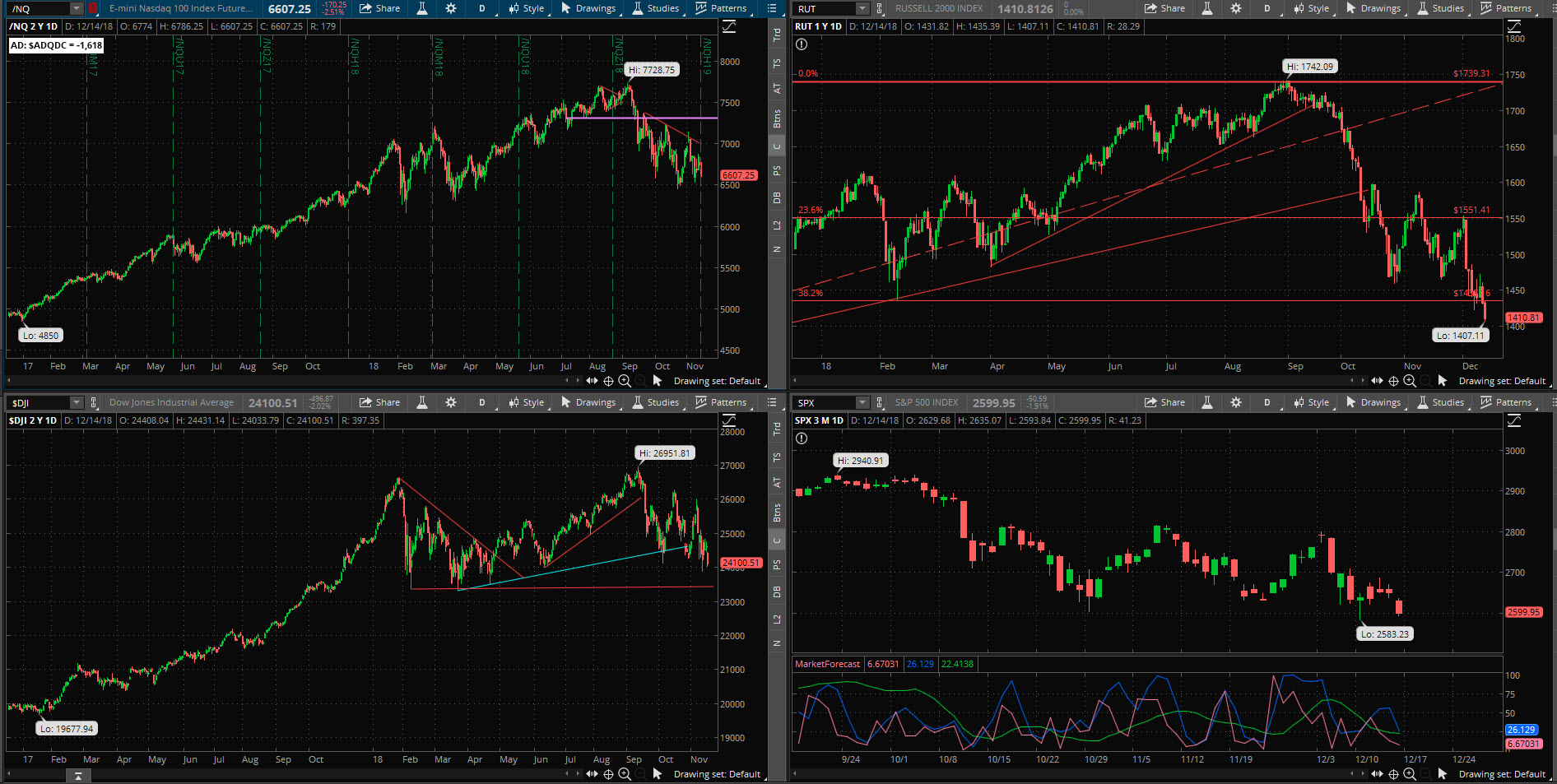

Here is the current scorecard:

- S&P is down ~358 points or 12.17%

- Dow is down 3071 points or 11.4%

- /NQ is down 1279 points or 16.55%

- RUT is down 335 points or 19.23%

What is our approach to trading this market, which has once again moved into a “Sideways/Volatile” character?

- Sell credit spreads/create iron condors on the SPX into relative extremes, beyond the current range of movement.

- Establish long iron condors when the price shows potential of moving a great distance in the near future.

- Exercise caution with long stocks/short puts as we see the 50/200 death cross hit each index

- Look to establish debit spread-based swing trades against sentiment extremes, and/or EM boundaries

Markets are at a very important tipping point going forward; be mentally nimble enough to allow the price to go either way from here.

The scan for the “Cheap Stocks with Weeklys” is available here.

The RSI(2) FE scan is available here.

The current MAIN “high liquidity” watchlist that I’m scanning against in thinkorswim is available here.

Please sign up for our free daily crypto report here.

An embedded flash video is available here.

Offensive Actions

Offensive Actions for the next trading day:

- I will look to enter the SSO (stock) long on a wash-out low based on a single-digit number of advancing stocks in the S&P. (see “Swing” section below)

- I will enter another Long Condor on Monday; see “HP Condors” section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

- I will look for a bounce over the next two weeks to see if our 28DEC Long Condor call spreads can throw off some value.

- I must close my SSO short puts before the Wednesday FOMC policy release; see “stocks” section below.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was above-average Friday and breadth ended the day very weak at -377 advancers minus decliners, with the high on the day at the open with +222 advancers minus decliners.

SPX Market Timer : The Intermediate line turned down just above the Lower Reversal Zone, still showing a bearish bias. No leading signals at this time but this chart is very close to showing a Full Bullish Cluster with all timeframes oversold.

DOW Theory: The SPX is in a long term uptrend, an intermediate downtrend, and a short-term downtrend. The RUT is in a long-term uptrend, an intermediate downtrend, and a short-term downtrend. The Dow is in an intermediate downtrend and short-term downtrend.

VIX: The VIX rose to 21.63 after peaking at 50.3 ten months ago, inside the bollinger bands. The RVX rose to 25.45 and is inside the bollinger bands.

Fibonacci Retracements: The 38.2% Fib Retracement of the entire 2016-2018 swing higher would be at the SPX 2509 level.

Support/Resistance: For the SPX, support is at 2600 … with overhead resistance at 2800 and 2941. The RUT has support at RUT 1400 with overhead resistance at 1553. Only one major index chart that we follow is still showing a Golden Cross with the 50 day moving average above the 200 day average (DJI), however this index will print the Death Cross this coming week unless a huge rally is seen. The S&P500, Russell 2000 and Nasdaq 100 have all printed a Death Cross with the 50ma crossing below the 200ma; this can be a leading signal for a true Bearish move.

Fractal Energies: The major timeframe (Monthly) is super-charged again, with a reading of 67. The Weekly chart has an energy reading of 54. The Daily chart is showing a level of 47 which is below fully charged again, and picking up on the recent swing down. It’s very important that we get “on” the next trend when it shows, regardless which way that it goes.

Other Technicals: The SPX Stochastics indicator fell to 48, mid-scale. The RUT Stochastics indicator fell to 40, mid-scale. SPX MACD histogram fell below the signal line, showing a loss of upside momentum. The SPX is inside the Bollinger Bands with Bollinger Band support at 2583 and resistance at the upper band at 2785 with price is above the lower band. The RUT is back outside the Bollinger Bands with its boundaries at 1410 to 1562 and price is at the lower band.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPY 21DEC 251/252*277/278 Long Iron Condor (11/26) entered for $.16 debit on the puts and $.18 debit on the call spreads. Per my advisory to close any side at 200%, my call spreads were sold off at $.54 credit (11/30) and I used recent weakness to clear off the put spreads (12/6) for a $.17 exit. The overall profit on this trade was $32/contract on the calls and -$3/contract on the puts, for a net profit of $29/contract, or an 85.3% return on capital for the entire trade.

- SPY 28DEC 269/270*289/290 Long Iron Condor (12/3) entered for $.17 debit on the puts and $.17 debit on the call spreads. I sold off the put spreads (12/6) for $.56 credit, leaving the call spreads open and ensuring at least a 50% return on the overall trade. The overall profit on the puts was $35/contract so even if the calls expire worthless at the end of the month we will net a minimum $16/contract net profit after commissions, or a 47% return on capital. I will look for the price to bounce by the end of the month and possibly score a return on the call spreads.

- SPY 04JAN 257/258*281/282 Long Iron Condor (12/7) entered for $.18 debits on both the puts and calls, for a total trade debit of $.36. I will place a 200% return exit on both the puts and calls ($.54 credit) and look for one side to “fire” while keeping the opposite side in play to remove as the volatility allows it.

We are scoring big % returns on the long condors and our risk is very limited in this extreme volatility. I am very glad that we took the opportunity to close our short condors and spreads; absolutely horrible to hold short options in this type of price movement, especially in a short-vega trade.

On Monday I would like to set up the next series of Long Iron Condors. The Expected Move into 11JAN is about 12 SPY points (120 SPX handles) which would correspond to about a SPY 272/273 call spread and a SPY 248/249 put spread. We’re missing some strike prices for that series for the puts, so I might have to wait until sometime this week when that series fills in. I will look on Monday and see if they are created. Regardless of where the price starts on Monday morning, I want to set up opposing debit spreads that cost about $.17 to $.18 apiece on each side.

I’ll wait until the price probes the edge of the current range before I set up the next credit spread. We’ve got to have a massive sentiment extreme before I want to sell again in this volatility. Let’s continue to stay long theta/vega.

I have no positions at this time. We’ll park this strategy until the next high-probability condition shows. We’ll want to see daily exhaustion on the SPX or RUT after a strong move, at the very least. This strategy works best with a quiet/trending market, and not with a sideways/volatile one that we’re currently seeing.

I have no remaining positions. Calendar spreads are good for markets in quiet/trending character, so we’ll want to wait for that type of price action to show again. The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

With three out of the four major indices in a death cross, I am suspending additional short put selling until those signals clear. I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold the 31DEC $15 SLV calls (10/3) for $.16. If this little bounce continues I might be selling $15 calls into FEB.

- SSO – I sold SSO 21DEC $95 puts (11/14) for $1.02 credit. I must close this position before the Fed meeting this Wednesday. I will edit the debit buyback to $.20 to see if any little bounce will allow me an exit. This position is still profitable but Gamma will make this position difficult to manage this week if the price slips off the “edge”

- HPE – I sold 21DEC $14 puts (11/12) for $.23 credit and looking to close for $.05.

- BAC – I sold 18JAN $24 puts (11/19) for a $.25 credit and looking to close for $.05. Starting to transition into a serious downtrend but still OTM. Will need to close these on the next bounce up.

The recent trades were relatively small positions that would create a discount entry should I be assigned. I have entered $.05 GTC exit debits to close out remaining inventory should we get the opportunity. Our priority at this point is to close our open positions and ride out the storm until conditions improve. With that said, if I see truly epic selling that allows me to secure puts at levels where I would be an enthusiastic buyer, I will take those trades. At the very least we would need to wait on Daily/Weekly exhaustion levels.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – The 8/21EMA crossover showed another false signal, which this study is famous for. We have to avoid these false breakouts and aggressively pursue the “real” one when it shows; not an easy task.

- RSI(2) CounterTrend – Looking for the next setup. Lots of these showing now, best to play these during primary uptrend.

- Daily S&P Advancers – if I see the number of daily S&P500 advancers drop into single digits near the close of any trading day, I will go long shares of the SSO.

- Swing – We will look for the next available swing soon.

The crypto market continues to get hit pretty hard recently as it finally broke below support. This could be part of the final capitulation that we’ve been waiting on, before it sets up an extended “base” which will likely be frustrating.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Viewing the SPY from the Friday closing price at 260.47, there is a +/-6.897 EM into this coming Friday. This is smaller than last week’s 8.261 EM. The EM targets for this Friday’s close are 267.37 to the upside, and 253.57 to the downside.

EM fades have not been a good setup lately due to the emotions raging in the markets; we’ll have to evaluate each test as it occurs. This volatility will remain with us for months before it settles down.

Lately we have been seeing the largest moves on Mondays as weekend risk is processed.

We did get some recent experience with this style of trading and quite frankly it’s not as easy as it sounds. Strong bull trends do not give way easily. My conclusion is that this strategy is best reserved for stocks experiencing a snap-back rally in a primary bear trend. If the market starts to print a lower high on the weekly chart then I will become more serious about this strategy.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have no positions at this time.

No other entries at this point. I would prefer to see the market stabilize first before looking long again. We will see big volatility over the next two+ months. If we are able to secure a “higher low” off of the S&P in the short run, this might be a good environment for a couple of weeks.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads. Frankly, selling the “financing” trades has been a huge challenge in this low-vol environment. I will only sell put spreads on decent pullbacks that allow me to secure put spreads 10% OTM. We have no positions at the current time. I have no positions at this time. I cleared out the current puts on the drop to the 200ma. I will “reload” again on the next bounce up.

I passed on the recent entry; I’m going to hold off for a little longer to see if a more complex top is created off of a higher high. Recent entries were expensive due to elevated vol.