Daily Market Newsletter

November 10, 2018Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

November Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

After a huge move off the recent lows. markets were looking for any excuse to consolidate gains and “energy” gave them that excuse. News is generated to fit the requirements of the market, not the other way round.

In this weekend’s video report, I stressed how it’s important not to have a bias leading into the next period, because literally anything can happen, and not in the manner that you might expect. We will definitely know more about the fate of this market for year-end based on what happens in the next two weeks, and the market is all by itself without the Fed’s help, or without any major earnings to goose things. Geopolitical risk could be the main market driver until the next Fed meeting in December.

I’ll sell into a gap fill if we can establish put spreads for the DEC cycle at 2500 or lower. I also have a couple of other minor moves that are described in the video.

Here is the current scorecard:

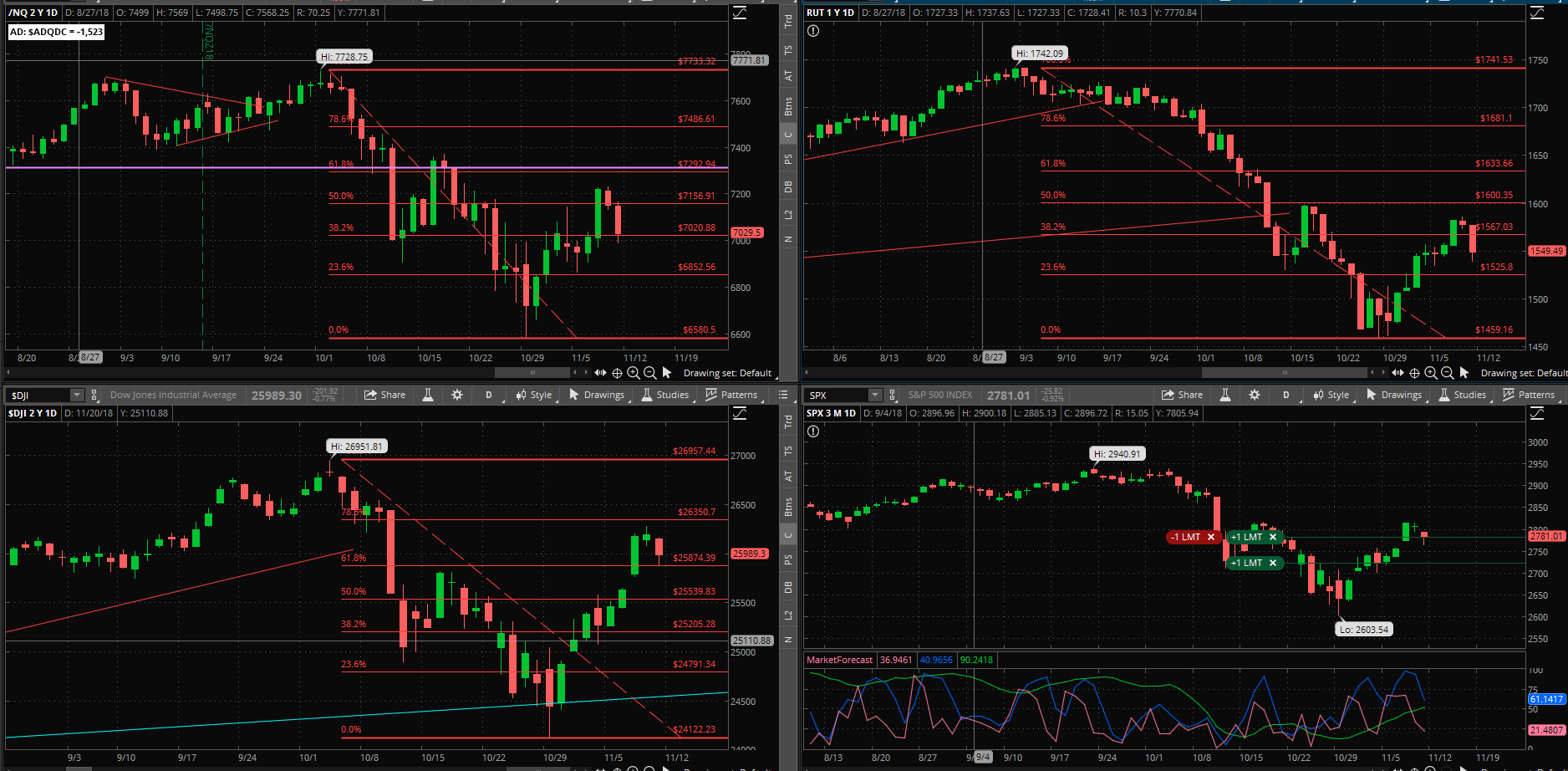

- S&P is down ~337 points or 11.46%

- Dow is down 2830 points or 10.5%

- /NQ is down 1148 points or 14.85%

- RUT is down 283 points or 16.3%

Earnings are now pretty much out of the way for the quarter.

Our approach will be to sell credit spreads into what we perceive as relative extremes, and look to take directional trades into swings. We need to be looking to take the trades that “feel” bad, as well as sell profitable positions too early. It’s going to be a period filled with opportunity for those willing to go against the grain.

The scan for the “Cheap Stocks with Weeklys” is available here.

The RSI(2) FE scan is available here.

The current MAIN “high liquidity” watchlist that I’m scanning against in thinkorswim is available here.

Please sign up for our free daily crypto report here.

An embedded flash video is available here.

Offensive Actions

Offensive Actions for the next trading day:

- I will look for a quick pullback to sell 21DEC SPX put spreads; see “HP Condors” section below.

- I will look to enter the SSO (stock) long on a wash-out low based on a single-digit number of advancing stocks in the S&P.

- I will enter an 8/21ema swing; see “swing trades” section below.

- I will sell puts against HPE; see “stocks” section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

- I will look to close the short puts that we sold recently for a $.05 debit.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was above-average Friday and breadth ended the day fairly negative with -187 advancers minus decliners.

SPX Market Timer : The Intermediate line rose further above the Lower Reversal Zone, now showing a bullish bias. No leading signals at this time.

DOW Theory: The SPX is in a long term uptrend, an intermediate downtrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate downtrend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX rose to 17.36 after peaking at 50.3 nine months ago, inside the bollinger bands. The RVX rose to 22.36 and is back inside the bollinger bands.

Fibonacci Retracements: Now we’ll start to watch the progress on the way back up; the price has topped out right at the 61.8% retracement of the swing down. If we continue to see strength above that level, it’s very likely that we’ll see the entire “triangle” closed in and a V-bottom will result.

Support/Resistance: For the SPX, support is at 2600 … with overhead resistance at 2941. The RUT has support at RUT 1436 with overhead resistance at 1742. All three major index charts that we follow are now showing a Golden Cross with the 50 day moving average crossing above the 200 day average. Some charts are approaching a Death Cross potentially later this month.

Fractal Energies: The major timeframe (Monthly) is super-charged again, with a reading of 62. The Weekly chart has an energy reading of 43. The Daily chart is showing a level of 49 which is almost fully charged again. The RUT has the weekly chart showing massive exhaustion now; we normally see trends “pause” or reverse in this state. With the bounce back up, all SPX timeframes could be in position to support a massive move.

Other Technicals: The SPX Stochastics indicator rose to 65, mid-scale. The RUT Stochastics indicator rose to 65, mid-scale. SPX MACD histogram fell above the signal line, showing a loss of upside momentum. The SPX is inside the Bollinger Bands with Bollinger Band support at 2638 and resistance at the upper band at 2843 and price is below the upper band. The RUT is inside the Bollinger Bands with its boundaries at 1466 to 1610 and price is below the upper band.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPX 7DEC 2490/2500 Short Put Spreads (10/22) entered for $.80 credit. I will first look to add short call spreads on the next bounce back up. I would close this position if the short put delta (1500) hits the .45 level. It is currently showing a .06 delta. I have also placed a $.05 debit limit order to close this one early if possible. The midpoint of this spread is currently $.30 so the trade is profitable and could be closed if you have any concerns.

- SPX 21DEC 2950/2960 Short Call Spreads (11/7) entered for $.80 credit. I would close this position if the short call delta hits the .35 level. It is currently at the .07 level. I will also look to close this spread early for $.05

If we see the price doing a quick dive this week to fill the major gap, I will look for a fill at the 21DEC SPX 2490/2500 put spreads (or better) for minimum $.80 credit.

I have no positions at this time.

We’ll park this strategy until the next high-probability condition shows. We’ll want to see daily exhaustion on the SPX or RUT after a strong move, at the very least. This strategy works best with a quiet/trending market, and not with a sideways/volatile one.

I have no remaining positions. Calendar spreads are good for markets in quiet/trending character, so we’ll want to wait for that type of price action to show again. The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I am targeting stocks using short puts/covered calls that offer a much lower absolute risk point, where in event of a crash we can almost define our total risk by the price of the underlying. While this is not how I intend to manage risk in these positions, I view this as fundamentally more solid than trying to actively manage risk on assets that are going for $$$hundreds which have also gone parabolic. I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold the 31DEC $15 SLV calls (10/3) for $.16.

- SSO – I sold SSO 16NOV $109 puts (10/8) for $1.20 credit. I’m still fine with this position and will accept assignment should the price drop from these levels. I will buy back this position for $.05 should I get the opportunity.

- GLW – I sold GLW 21DEC $26 puts (10/22) for $.26 credit; I closed this position (11/7) for a $.05 debit. This gave me a net profit of $19/contract, or a .73% return on capital for the period.

- CSCO – I sold CSCO 21DEC $40 puts (10/22) for $.40 credit.

- INTC – I sold INTC 21DEC $37 puts (10/22) for $.37 credit. This one is very close to an exit.

On Monday I will sell the HPE 21DEC $14 puts for at least a 1% return; they are currently showing about a $.20 credit. Should the price gap lower on Monday I’ll move down a strike as long as I can get at least a $.15 credit.

The recent trades were relatively small positions that would create a discount entry should I be assigned. I have entered $.05 GTC exit debits to close out INTC, and CSCO early should we get the opportunity.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – No current positions. The 8/21 EMA pair has crossed to the upside again. A pullback to fill the gap from Wednesday might give an excellent upside swing entry. I’m going to enter a SPY 23NOV 280/281 debit call spread (currently showing about a $.45 entry) and will look for a 50% return. Keep the position size small.

- RSI(2) CounterTrend – Looking for the next setup. Lots of these showing now, best to play these during primary uptrend.

- Daily S&P Advancers – if I see the number of daily S&P500 advancers drop into single digits near the close of any trading day, I will go long shares of the SSO.

- Swing – I have no trades in play at this time. I will set up a swing trade to the downside if the S&P prints a daily lower high.

The crypto market is just flat-lining lately. So far I am not seeing a lot of correlation between these markets. Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Viewing the SPY from the Friday closing price at 277.76, there is a +/-5.078 EM into this coming Friday. This is about 20% smaller than last week’s 6.529 EM and reflects the decent bounce that we have seen over the last two weeks to ease some of the tensions, however obviously not all of them since the EM is still well above the normal ~3.0 point SPY Weekly EM. The EM targets for this Friday’s close are 282.84 to the upside, and 272.68 to the downside. The upper EM for last week was blown through on Wednesday but ultimately held by week’s end.

I would look to fade either level this week.

We did get some recent experience with this style of trading and quite frankly it’s not as easy as it sounds. Strong bull trends do not give way easily. My conclusion is that this strategy is best reserved for stocks experiencing a snap-back rally in a primary bear trend. If the market starts to print a lower high on the weekly chart then I will become more serious about this strategy.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have no positions at this time.

No other entries at this point. I would prefer to see the market stabilize first before looking long again. We will see big volatility over the next two+ months. If we are able to secure a “higher low” off of the S&P in the short run, this might be a good environment for a couple of weeks.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads. Frankly, selling the “financing” trades has been a huge challenge in this low-vol environment. I will only sell put spreads on decent pullbacks that allow me to secure put spreads 10% OTM. We have no positions at the current time. I have no positions at this time. I cleared out the current puts on the drop to the 200ma. I will “reload” again on the next bounce up; I would like to see the price retrace the 61.8% fib and for the VIX to drop below 20 again.

The entry for FEB19 would be the SPY 15FEB19 250 puts, but they are rather expensive still at $2.70. I’m going to hold off for a little longer to see if a more complex top is created off of a higher high.