Daily Newsletter

March 4, 2020Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

March Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Today was the “Uncle Joe Super Tuesday Rally.” One of the fears of last week was that if the economy gets crushed because of COVID-19, then the Democratic challenger would step right in similar to how Obama won in the backdrop of the 2008 recession. And until yesterday, that presumed winner was Bernie Sanders, noted Wall Street antagonist. Markets will sell first and ask questions later when it comes to a risk like that.

Uncle Joe to the rescue. I believe that the stock market does not care whether Trump is re-elected…or if the nod went to Biden.

We’re still evaluating the three possibilities that markets will take from here; I’ll discuss in today’s video.

Watch these levels for the S&P “circuit breakers.”

My New Book is Available! – Fractal Energy Trading is now available on amazon.com for paperback or kindle!

Subscriber Update: I will be “grandfathering” OptionsLinebacker and DocsTradingTools customers over to a new advisory service, targeting THIS SATURDAY FOR THE FIRST EDITION. I intend to make this service more “actionable” with more trade alerts, and plan to include guest contributors who are experts in their specific strategies. If there are any elements of the OLD (existing) service that you want to make sure are carried into the new service, please let me know by dropping me at line at doc@docstradingtools.com

Short-Term Outlook: We’ll be in a corrective pattern for several months as markets transition to sideways/volatile.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- No trades for tomorrow.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- I’d like to do what I can to close down the 17APR SPY put spreads that I sold this week; see “HP NonDirectional” section below.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was above-average today, not as large as last week, with the advancers minus decliners showing a closing value of +454 by the closing bell, close to the high of the day and precisely opposite to yesterday.

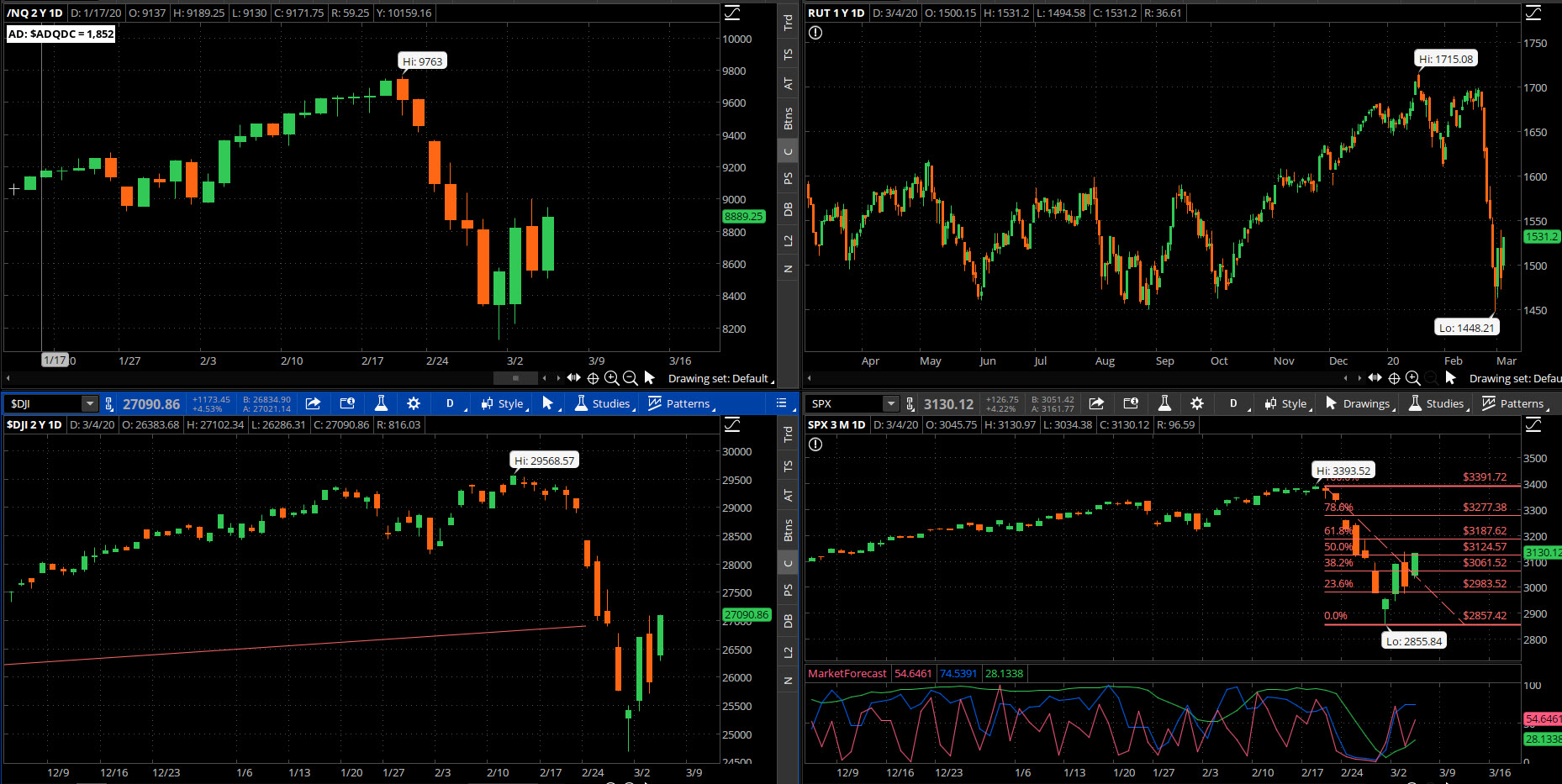

SPX Market Timer : The Intermediate line has bounced out of the Lower Reversal Zone and is now “neutral.” No leading signals at this time .

DOW Theory: The SPX is in a long term uptrend, an intermediate downtrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate downtrend, and a short-term uptrend. The Dow is in an intermediate downtrend and short-term uptrend.

VIX: The VIX moved lower to close at 31.99, back inside of the Bollinger bands. The intraday high on Friday was 49.48 The RVX fell to 30.75 and is inside the Bollinger bands.

Fibonacci Retracements: The price has come down to undercut the 50% fib retracement of the entire 2018-2020 swing, and amazingly, the entire October-February swing has been wiped out.

Support/Resistance: All of the previous support lines have failed; once the capitulation occurs we’ll re-draw.

Fractal Energies: The major timeframe (Monthly) is above exhaustion now with a value of 49, and is starting to gain energy from the counter-trend move. The Weekly chart has an energy reading of 38, now into exhaustion from the move down. The Daily chart is showing 30, still exhausted to the downside and Friday was THE LOWEST VALUE THAT I CAN FIND, equal to the 1987 crash.

Other Technicals: SPX Stochastics fell to 30, below mid-scale. RUT Stochastics fell to 31, below mid-scale. The SPX MACD rose below the signal line, showing an increase in positive momentum. The SPX is above the lower bollinger band with the range 2949 to 3545. The RUT is above the lower bollinger band with the range 1464 and 1781.

Position Management – NonDirectional Trades

I have the following positions in play at this time:

- SPY 17APR 278/280 put credit spread (3/2) entered for $.44 credit. I will look to close down these spreads for a $.20 debit.

I would like to use any continued bounce to clear our positions and go back to cash for the next move lower, if it occurs.

I have no positions in play.

I have no open positions at this time.

This is the wrong type of price character to play Time Spreads; we’re seeing vol crush and a huge buying panic.The previous fear about Corona has disappeared overnight.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. Looking for the next rally to sell calls against.

- BAC 03APR $32.5 Puts (2/18) were sold for $.33 credit.

- SSO 17APR $100 short puts (3/2) entered for $3.15 credit. It’s my intention to burn these options to the ground or get assigned, either way.

No further trades at this time. If there is a re-test of the bottom put in on Friday I will consider adding additional inventory. .

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Awaiting the next signal.

- RSI(2) CounterTrend – We have a ton of signals that showed up all at once.

- Daily S&P Advancers – Looking for the next signal to go long with single-digit advancers; I entered the SSO long (2/25) at a price of 142.18/share. I added a second half of the position on Friday at $120.46/share for a blended cost basis of $131.32. Per Tuesday’s Trade Update, I closed both halves of the position at $135.9401 and $140.7881 for a blended exit price of $138.364. That gave me a final profit of $1408.82 or a 5.3% return on capital.. I will look for the next signal with the Advancers minus Decliners on the S&P to be in the single digits.

- Swing – I have no positions in play:

BTC and other top-ten coins have been breaking higher in 2020, but pulling back short-term due to what I believe are margin calls from the larger markets.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 296.26 there is a +/-17.97EM into this coming Friday; this is enormous. The EM targets for this Friday’s close are 314.23 to the upside, and 278.29 to the downside.

Energy that hit the market last week will cause ripples of volatility for weeks to come, perhaps even months. Fading the EM markers is unlikely to work. The price is already closing in on the upper EM after one day.

I have the following positions in play:

- SPY 17APR 285/279 debit put spread (3/3) entered for $.96 debit based on the Trade Update from 3/3. I will take off this position if the price re-tests the lows from last week.

I sent out this morning’s Trade Update as the Fed made the announcement on the half-point rate cut, and we saw the huge rally higher as a result. These are ideal times to set up downside bearish trades. No additional trades at this time.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- XLF 6MAR 31/32 debit call spread (2/6) was added for a $.45 debit. I will look for a 50% return.

- FB 13MAR 212.5/215 debit call spread (2/10) was added for a $1.18 debit. I will look for a 50% return.

- INTC 20MAR 65/67.5 debit call spread (2.18) was added for a $1.25 debit. I will look for a 50% return.

- GDX 20MAR 29/31 debit call spread (2/20) was added for an $.86 debit and was closed (2/24) for a $1.29 credit. This gave us a gross profit of $43/contract or a 50% return on capital.

No additional trades at this time. Unless we see a V-bottom recovery these trades will have a difficult time reaching profitability, thus the whole purpose for limited-risk trading.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads. The timing on these credit spreads has been nearly impossible to determine with today’s declining-rate environment, and we might be in the process of one final mighty blow-off.

I will continue to buy long puts into extreme upside strength. Puts won’t be cheap any time soon now, I’ll have to wait on the next bounce up and over-pay for protection until we get a VIX in the low teens again.

I have no open positions at this time.