Daily Market Newsletter

April 30, 2018Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

May Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

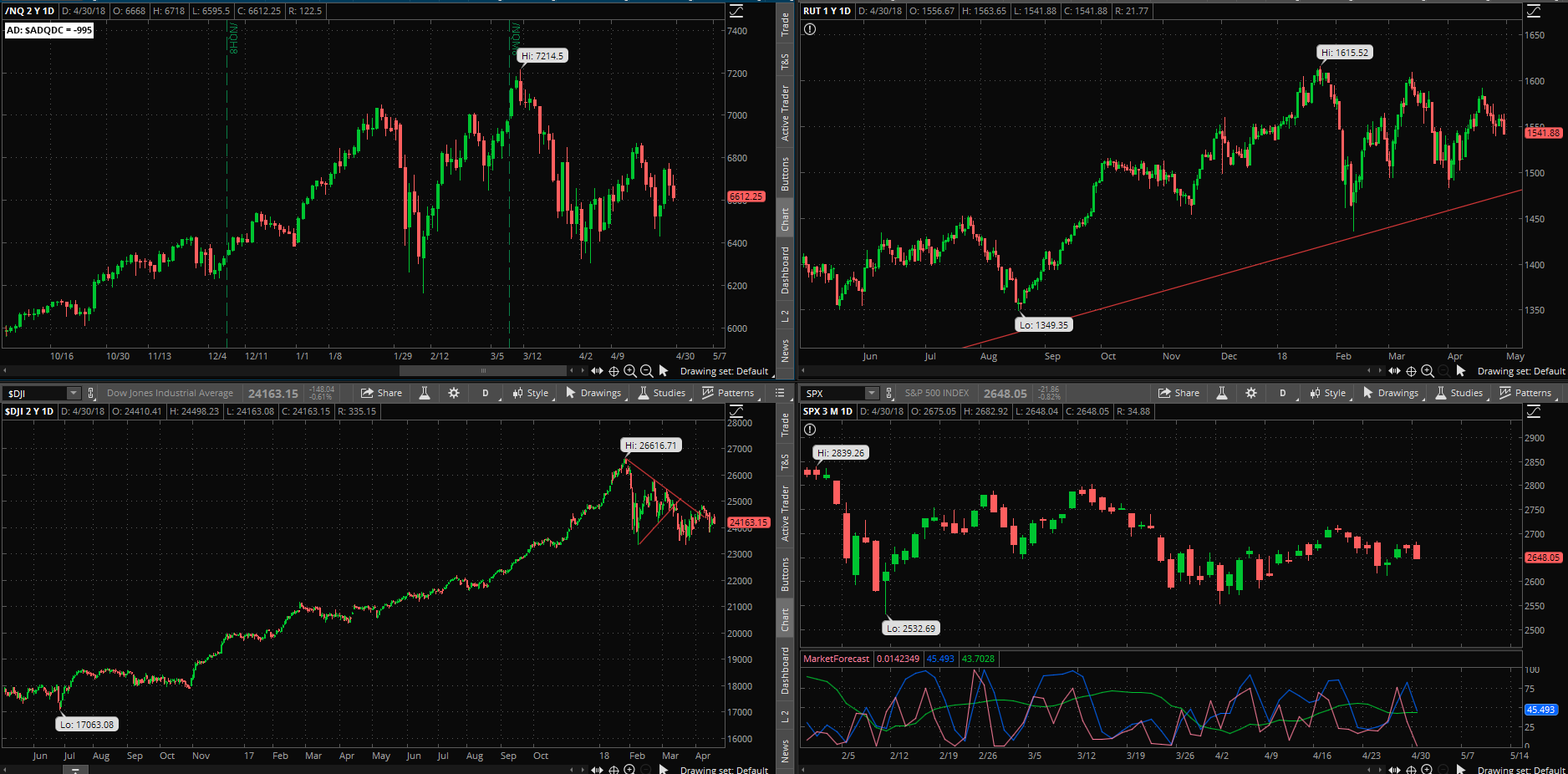

Do we have the formation of a “lower high” in the index charts? In today’s report, I’ll show what the possible next move might be and we should get resolution of this pattern pretty quickly. Between some of the catalysts that we have this week – ADP, FOMC, AAPL, Jobs, etc…we will get movement from this range. Which way it goes, I don’t know yet which is why we added the long condor today.

Markets have been in a wide-ranging, long-overdue correction for the past three months. I’m expecting a break from the range before too long as the Monthly chart continues to build up energy. The majority will get the break wrong.

The scan for the “Cheap Stocks with Weeklys” is available here.

The RSI(2) FE scan is available here.

The current MAIN “high liquidity” watchlist that I’m scanning against in thinkorswim is available here.

The latest crypto video (Top Five Ways to Prepare for a Crypto Bull) is available here

Please sign up for our free daily crypto report here.

If you cannot view today’s video, please click here to view an embedded flash video.

Offensive Actions

Offensive Actions for the next trading day:

- No new trades for tomorrow.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- I’ll add GTC orders to my new long condor position.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average today and breadth ended the day very weak with -302 advancers minus decliners

SPX Market Timer : The Intermediate flattened above the Lower Reversal Zone, now showing a neutral bias. No leading signals at this time.

DOW Theory: The SPX is in a long term uptrend, an intermediate downtrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate uptrend, and a short-term downtrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX rose to 15.96 after peaking at 50.3 three months ago, inside the bollinger bands. The RVX rose to 16.46 and is inside the bollinger bands.

Fibonacci Retracements: The price has retraced 38.2% of the election rally; so far this has been a garden-variety correction.

Support/Resistance: For the SPX, support is at 2650 … with overhead resistance at 2878. The RUT has support at RUT 1436 with overhead resistance at 1619. All three major index charts that we follow are now showing a Golden Cross with the 50 day moving average crossing above the 200 day average.

Fractal Energies: The major timeframe (Monthly) is above exhaustion for the first time in months, with a reading of 41. The Weekly chart is now fully charged with an energy reading of 56. The Daily chart is showing a level of 55 which is fully-charged and is ready to trend. Markets are doing PRECISELY what they must in order to restore energy that has been incredibly depleted. Extreme Range Expansion leads to extreme range contraction (big swings).

Other Technicals: The SPX Stochastics indicator flattened at 60, mid-scale. The RUT Stochastics indicator fell to 59, mid-scale. The SPX MACD histogram fell above the signal line, showing a loss of upside momentum. The SPX is back inside the Bollinger Bands with Bollinger Band support at 2602 and resistance at the upper band at 2713 and price is below the upper band after starting to squeeze again. The RUT is back inside the Bollinger Bands with its boundaries at 1510 to 1589 and price is below the upper band.

We recently saw the market reaching into a full “runaway” condition, where “fear of missing out” means abandoning any former patience and “wait for the dip” strategy. This usually occurs near the top of the intermediate move. We should be in sideways/volatile behavior for months.

Position Management – NonDirectional Trades

I have no positions in play.

The next extrapolation trade is a long, long way away from being filled. The price would have to drop more than 100 SPX points before we’d be in a position to even begin to look for a fill. Realized volatility continues to out-run the implied volatility; this is a dangerous time to be complacent, selling options. I will continue to look for long-gamma (directional) trades and wait until we see an appropriate fear-based move to sell spreads into.

I have no positions at this time. Not the right type of market for these trades. As we can see by the price blowing through the EM on a weekly basis, IV < HV these days.

I have no remaining positions. Calendar spreads are good for markets with some volatility but they are long vega so we can’t enter them during IV spikes or periods of elevated volatility. The IV is starting to resolve lower so we might be back in business if the price resolves back into quiet/trending.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I am targeting stocks using short puts/covered calls that offer a much lower absolute risk point, where in event of crash we can almost define our total risk by the price of the underlying. While this is not how I intend to manage risk in these positions, I view this as fundamentally more solid than trying to actively manage risk on assets that are going for $$$hundreds which have also gone parabolic. I have the following positions in play:

- VXX Stock – I own 12 shares of this stock and will hold until Armageddon occurs.

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold 15JUN SLV $17.5 strikes for an $.18 credit. (4/19).

- NUGT stock – I was assigned on NUGT at the $31.5 price level. I opened up the $31.5 04MAY calls for a $.50 credit (4/13) and closed them for $.04 (4/27). I rolled these to the 25MAY $31.5 calls for $.35 credit. (4/27).

- SSO – I sold the 15JUN $70 puts (4/4) for $.70 credit.

No other setups at this time; I want to look for the next “scary” drop in the markets to sell puts again.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – This reminds me one more time why moving average crossover strategies do not work in a range. I’m glad that we did not press the call spread entry; another false cross on the 8/21. The “real” breakout and crossover will usually have no one taking the entry. Let’s be on guard as the next upside crossover could be real.

- RSI(2) CounterTrend – Looking for the next setup. Several were showing recently but I avoid this strategy during corrective action.

- Daily S&P Advancers – if I see the number of daily S&P500 advancers drop into single digits near the close of any trading day, I will go long shares of the SSO.

- Swing – I entered a GLD 20JUL 128/129 call spread for $.40 (4/12) and will hold this for the eventual breakout.

The crypto market is starting to perk up and rally off of the bottom. Market character might be changing to quiet/trending again which would be a surprise, as strong as this bear has been.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Viewing the SPY from the current Friday closing price at 266.56, there is a +/- 4.215 EM into next Friday. This is smaller than last week’s EM was at +/- 4.768 points.

The EM targets for this Friday’s close is 270.78 to the upside, and 262.35 to the downside.

I don’t really have any interest in fading the EM this week, because the market is in transition, and we are more likely to see expanded range movements during this type of character. Realized volatility is out-running the Implied right now. We saw the lower EM level get tested this past week, but it held.

With the amount of energy present in the weekly/daily SPX charts, it’s time again for another long condor. I am going to go out two weeks for this one because I am traveling at the end of this coming week. The EM out to 11MAY is +/-6.25 points, which puts the targets at 272.8 to the upside, and 260.3 to the downside.

I have the following positions in play:

- SPY 11MAY 261.5/262.5 debit put spread (4/30) was entered for a $.16 debit.

- SPY 11MAY 273/274 debit call spread (4/30) was entered for an $.18 debit.

I will target at 200% return on each of the spreads, knowing that only one side will have a chance to profit. Anything above 100% return on the “winning” side ensures that I pay for the trade, and a 200% win ensures that I walk with a net 100% return.

I have no current positions. I will consider setting up another ratio fly as price approaches resistance:

Entry criteria are:

- Using calls

- 17 to 50 calendar days

- center strike .25 to .40 delta

- ratio is 1/3/2 quantity, from the bottom, calls are long/short/long

We will exit the spread at a 60-70% level of credit received. The max risk on the trade is defined on the graph if the price goes much higher. There are no early exits, only exiting the week of expiry to avoid assignment. Also avoid dividend periods. I am currently trialing some trades and will discuss them in the newsletter; after a few cycles, I will start adding these trades to circulation. TOS scan code: http://tos.mx/hvWmMl

I have no positions at the current time.

No new trades for this week; we’ll mostly be doing swings on the S&P500 in the next week or two. We want to see markets in a consistent upswing first.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads. Frankly, selling the “financing” trades has been a huge challenge in this low-vol environment. I will only sell put spreads on decent pullbacks that allow me to secure put spreads 10% OTM

I have no positions at this time and need to see the price rally to recent highs again to reload. It’s not just the price, it’s also the implied vol which needs to drop. I missed my opportunity by a couple of days on the recent bounce back up. Conditions are never perfect to enter this trade, you have to do it mechanically.