Daily Newsletter

September 28, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

October Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

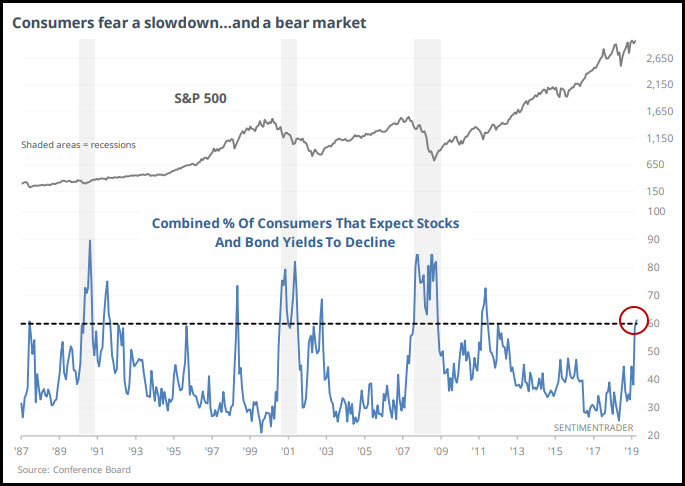

I saw an interesting report from Jason at Sentimentrader on Friday; it’s summarized by this graph:

.

Consumers fear a slowdown in the economy; here is his read on the graph: “We typically only see readings like this during recessions, at least protracted ones. It has spiked to this kind of extreme a few times outside of recessionary periods all leading to large gains going forward. The table (above) shows every time this percentage first exceeded 60% in at least a year. Consumers were presciently apprehensive ahead of the last two recessions, with stocks showing large losses within the next 6 months. But other than that, the S&P showed very large gains from 9 months forward. So it comes down to what’s most likely going forward – if one believes there is a high probability of recession, then this wouldn’t necessarily be a positive data point, Outside of that scenario, it’s wildly bullish.”

So there we have it; markets are near all-time highs, but consumers feel like Wallenda on a tightrope. We haven’t had this much pessimism since 2011, which is saying something….as that was a particularly nasty stretch. This means that the media has done an excellent job of fanning the flames of fear and skepticism, and consumers are responding in the manner that they’ve been taught..

The choice appears to be fairly clear; either start preparing for a slow-motion crash, or be prepared to see prices rocket to new highs and far beyond that. I do believe that the probabilities favor the latter scenario.

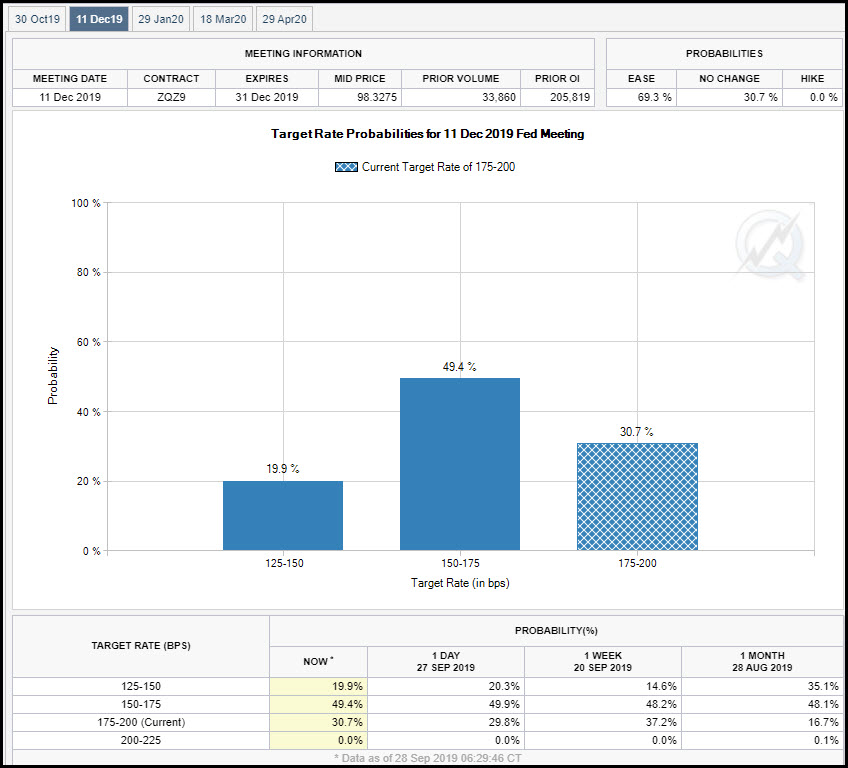

But just because Bond Markets are anticipating another interest rate cut by the end of the year doesn’t mean that stocks have to follow.

The latest numbers show a 69% chance of further easing into year-end. Powell has lost control and knows it.

The next bounce in the markets will tell me most of what I need to know going forward, and I’ll discuss this in today’s video.

Short-Term Outlook: We’ve been in a massive consolidation pattern since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, but we’ll know which price levels to respect to warn us if that energy’s going lower instead.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- Setting up the next round of Long Condors on the SPY Monday; see “HP NonDirectional” section below as well as today’s video..

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average Friday with advancers minus decliners showing a mixed value of -88.

SPX Market Timer : The Intermediate line has fallen below the Upper Reversal Zone and is now “Neutral.” No leading signals at this time.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term downtrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term downtrend. The Dow is in an intermediate uptrend and short-term downtrend.

VIX: The VIX rose to 17.22, inside the Bollinger bands. The RVX rose to 21.24, and is inside the Bollinger bands.

Fibonacci Retracements: The S&P has tested the 38.2% retracement from the recent August pullback.

Support/Resistance: For the SPX, support is at 2730 and overhead resistance at 3028. The DOW has support at 24800 and overhead resistance at 28399. The RUT has support at 1450 and resistance at 1618.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 52. The Weekly chart has an energy reading of 62, now fully-charged. The Daily chart is showing 59, fully charged again . Larger timeframe energies are waiting on a very big move, which will start with the smallest timeframes.

Other Technicals: SPX Stochastics fell to 61, mid-scale. RUT Stochastics fell to 58, mid-scale. The SPX MACD faded below the signal line, showing a loss in positive momentum. The SPX is above the lower bollinger band with the range 2924 to 3035. The RUT is inside the bollinger bands with the range 1474 and 1607.

Position Management – NonDirectional Trades

I have the following positions in play at this time:

- SPY 30SEP 271/272*299/300 Long Iron Condor (8/26) was entered for $.18 debits on both the put and call side. I closed the call spreads (9/5) for $.54 credit and effectively locked in a minimum 50% gross return on this position. Unlikely that we’ll see a massive drop by Monday to put the put spreads in play

- SPY 18OCT 289/290*308/309 Long Iron Condor (9/16) was entered for a $.16 debit on the put spreads and an $.18 debit on the call spreads. I will look for about a 200% gain on either side to close that position.

On Monday I will set up the next cycle for 15NOV monthly options; the EM is about 15 points on the SPY or an expected move of 150 S&P handles. This is pretty large regardless of how high markets are; that’s about a 5% move. In today’s video I’ll show how I’ll set up these $1-wide debit spreads on Monday morning, shooting for about a $.17 debit on each side of the price.

I have no positions in play:

This is not the right character of market for this strategy at this point.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold the SEP $17.50 calls (8/13) for $.18 credit and closed down this position (9/5) for a $.44 debit. I will let this price chart trend as much as it wants to in the near future before writing against it again.

- CSCO – My cost basis is now $48.80/share prior to the latest trade. I sold the JAN20 $50 calls for $1.94/contract. I don’t want to see this trade below $46/share.

No other trades at this time.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – The next signal has fired; we’ll see if a re-entry is available;

- RSI(2) CounterTrend – None at this time.

- Daily S&P Advancers – Looking for the next signal to go long with single-digit advancers to close the day.

- Swing – None at this time..

Crypto got absolutely hammered last week and is testing to see how low that it can probe; support seems to be around $8k on bitcoin and $6500 below that.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 295.40, there is a +/-5.551 EM into this coming Friday; this is somewhat larger than last week’s 4.822 EM. The EM targets for this Friday’s close are 300.95 to the upside, and 289.85 to the downside.

The price came very close to the lower EM this past week but no test/entry. My preference is still to look for the downside marker fade trades back to the upside.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have no positions in play at this time:

- MSFT 11OCT 139/140 Debit Call Spread (9/9) entered for $.48 debit and looking for a 50% return.

- WMT 25OCT 118/119 Debit Call Spread (9/23) entered for $.50 debit and looking for a 50% return.

No other entries at this time.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no open positions at this time. Skew is making OTM puts really expensive now.

If we see a decent bounce back up I might consider reloading.