Daily Market Newsletter

September 15, 2018Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

September Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

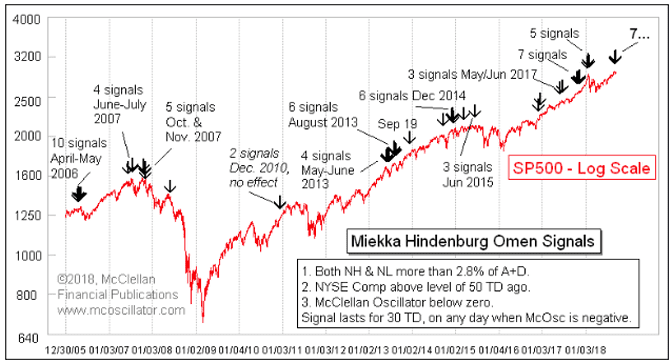

Lately my analysis on the market has been “it’s moving higher, but….” and it’s the “but” that I’ve been trying to define. We’re seeing odd things with this market lately, like big gap days to the upside on essentially mixed markets in terms of advancers minus decliners. And then I picked up on this note from sentimentrader.com: “Another one. Due to a still-high number of securities sinking to 52-week lows, another Hindenburg Omen was triggered on Friday.” Ah yes, the Hindenburg Omen. Recall that we had several of these showing right before the big February swoon hit. But how accurate is this “omen?” The chart below (source) shows that “clusters of signals” are more important than individual ones.

The accuracy of these signals is somewhat similar to the “death cross” of the 50 and 200 day moving averages; most of the time the signals are false, however on occasion the signal fires true and it precedes a huge decline.

The accuracy of these signals is somewhat similar to the “death cross” of the 50 and 200 day moving averages; most of the time the signals are false, however on occasion the signal fires true and it precedes a huge decline.

Not to be a bandwagon player, but this appears to be a good time to play both sides of the forward move with our offense this week. Some charts (like the Russell) show potential of big moves again, however the direction is not clear. Others, like the S&P, have fully-charged daily charts, but exhausted weekly ones. Again, mixed signals, so we might want to look for big moves in both directions.

Next week is devoid of any market-moving earnings reports, and there are only a few interesting economic reports, like Housing Starts and Philly Fed. The market’s on its own with the backdrop of big Trade talks.

The market is pricing in a 97.4% probability of a 26 SEP rate hike.

I have started to update my Trading Plan in the left-hand sidebar and the Non-Directional portion has been uploaded. I will populate the rest of the trading plan going forward. Again, the trading plan is designed to fit “today’s” market.

The scan for the “Cheap Stocks with Weeklys” is available here.

The RSI(2) FE scan is available here.

The current MAIN “high liquidity” watchlist that I’m scanning against in thinkorswim is available here.

The latest crypto video (Cryptocurrency Market Visualized) is available here

Please sign up for our free daily crypto report here.

For an embedded video player version of today’s market video, please click here.

Offensive Actions

Offensive Actions for the next trading day:

- I will enter an IWM “Whale” call spread; see “whale” section below.

- I will enter a SPY Hindenburg position; see “hindenburg” section below.

- I will enter a SPY HP Long Condor position; see HP Condor section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads; the limit order on my SPX Iron Condor should fire in the next two days.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average Friday and breadth ended the day fairly strong with +209 advancers minus decliners.

SPX Market Timer : The Intermediate line rose into the Upper Reversal Zone, now showing a bullish bias. The Intermediate and Near Term lines are now in the Upper Reversal Zone, creating a Strong bearish cluster.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate uptrend, and a short-term sideways trend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX fell to 12.07 after peaking at 50.3 eight months ago, inside the bollinger bands. The RVX fell to 13.64 and is inside the bollinger bands.

Fibonacci Retracements: The price has now broken above February highs on the S&P500, NASDAQ, & Russell 2000 so we might actually switch over to looking at Fib Extensions going forward.

Support/Resistance: For the SPX, support is at 2700 … with overhead resistance at 2917. The RUT has support at RUT 1630 with overhead resistance at 1742. All three major index charts that we follow are now showing a Golden Cross with the 50 day moving average crossing above the 200 day average.

Fractal Energies: The major timeframe (Monthly) is almost recharged again, with a reading of 49. The Weekly chart is at exhaustion with an energy reading of 37. The Daily chart is showing a level of 60 which is massively charged up and ready to trend.

Other Technicals: The SPX Stochastics indicator fell to 55, mid-scale. The RUT Stochastics indicator fell to 47, below overbought. The SPX MACD histogram rose below the signal line, showing a return of upside momentum. The SPX is inside the Bollinger Bands with Bollinger Band support at 2847 and resistance at the upper band at 2920 and price is below the upper band. The RUT is inside the Bollinger Bands with its boundaries at 1698 to 1743 and price is below the upper band. The S&P is breaking higher but the RUT has gone dormant.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPX 19OCT 2760/2770*3015/3025 Short Iron Condor (9/4) entered for $1.70 credit. We will target an $.85 debit as our profitable exit. We’ll also target exits if the short call delta hits .35 or the short put delta hits .45. We want to be out of this position approximately 30 days prior to expiration, or roughly by September 24th. Right now I’m showing the position to be profitable with about an $.875 debit to buy back the trade.We should be hitting our limit order on this trade in the next day or so barring a large move.

With the daily chart energy revved up again, it’s time for a big move and it could go either way in a hurry, or maybe both ways. On Monday I will enter a 19OCT Long Condor position looking for about a $.16 to $.18 debit on both sides. We’ll have to see where the market opens to know what strikes those will be. I will look for a 200% return on each side (individual orders) to ensure that we hit at least a 50% profit overall on the trade.

I have no positions at this time.

We’ll park this strategy until the next high-probability condition shows. We’ll want to see daily exhaustion on the SPX or RUT after a strong move, at the very least.

I have no remaining positions. Calendar spreads are good for markets in quiet/trending character, so there is a good shot that we can start to play these again.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I am targeting stocks using short puts/covered calls that offer a much lower absolute risk point, where in event of crash we can almost define our total risk by the price of the underlying. While this is not how I intend to manage risk in these positions, I view this as fundamentally more solid than trying to actively manage risk on assets that are going for $$$hundreds which have also gone parabolic. I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I will look for the next bounce to sell calls into.

No entries at this time; I’d like to see a decent pullback before we go shopping again for new stock candidates.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – No current positions.

- RSI(2) CounterTrend – Looking for the next setup.

- Daily S&P Advancers – if I see the number of daily S&P500 advancers drop into single digits near the close of any trading day, I will go long shares of the SSO.

- Swing – I have the following trades in play:

- QQQ 14SEP 186.5/187.5 debit call spreads (9/6) for $.17 debit; this trade expired worthless on Friday. Right idea, just not enough time to let it work.

- SPY 19SEP 292/293 debit call spread (9/10) for $.19 debit. I will close this position out on Monday.

The crypto market is catching a little bit of a bid into the week’s end and there is some thought that at the very least the ETH massacre is overdone.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Viewing the SPY from the Friday closing price at 290.88, there is a +/-3.435 EM into this coming Friday. This is somewhat smaller than last week’s 4.153 EM.

The EM targets for this Friday’s close are 294.32 to the upside, and 287.46 to the downside.

This week I would once again be enthusiastic about fading the lower EM marker.

This is a new section for this newsletter; I would like to start to carefully build some bearish positions that would be the virtual opposite of a covered call, yet I will use deep ITM long puts as the short stock substitute, and write short covered puts against those long puts.

I would like to add one additional consideration to the criteria, in that I’d like to see the price print a “lower high” first on the daily chart. Otherwise what is “high” can go “higher” as we’ve seen repeatedly over the years.

I will also publish the criteria for managing the short and long positions with this strategy. This is definitely counter-trend for now but might prove to be valuable down the road.

Right now we are seeing LOW and PFE (again!) show up on this scan.

Previously I was seeing MRK, PFE, and LLY show up on this scan; I added the MRK 16NOV $75 puts for about $7.00/contract as a paper trade. I’ll just track this one on paper for now while we develop management rules. If the price drops I will sell short-term puts against it (on paper). We’re seeing a very bullish market right now so I would not expect this strategy to be easy to trade right now; this is why we’re getting our feet wet and looking to build inventory when things go really off the rails.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz

I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have no current positions at this time.

I will enter the following long call vertical on Monday:

- IWM 19OCT 171/172 or 171/173 debit call vertical for as close to “unity” cost as possible, or whatever combination of strikes gives us a close-to-unity entry after the morning gap. I will look for a 50% return from this trade.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads. Frankly, selling the “financing” trades has been a huge challenge in this low-vol environment. I will only sell put spreads on decent pullbacks that allow me to secure put spreads 10% OTM. We have no positions at the current time.

I have the following position:

- SPY 16NOV 257 Puts (8/23) entered for $1.50 debit. I would close these on a test of the 200 day moving average.

I will enter a SPY 21DEC 262 long put Hindenburg position on Monday.