Daily Market Newsletter

October 13, 2018Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

October Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

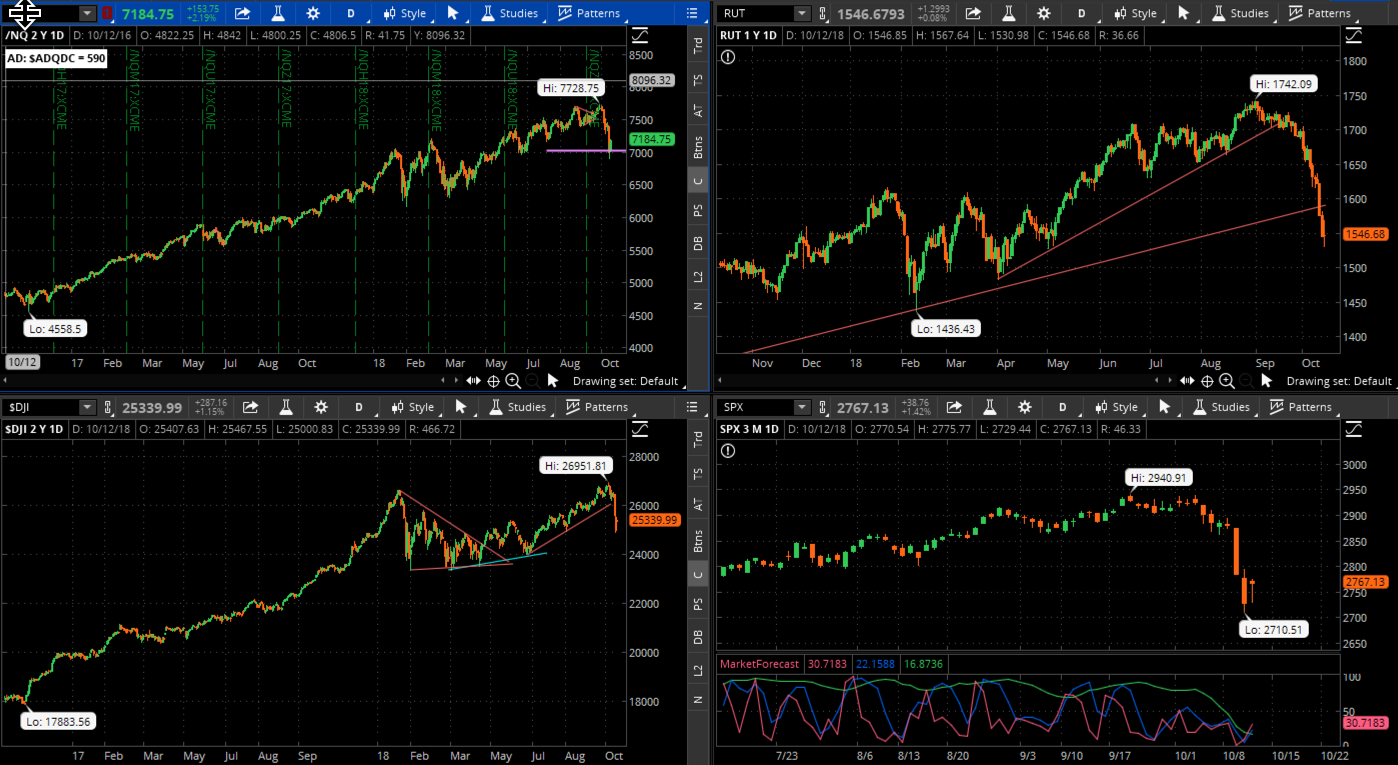

Friday’s price action did exactly what I hoped for: a steep drop at the open to the tune of about 43 handles from the open…enough to make anyone believe that it had fallen into the abyss…and then it recovered about 40 handles into the close. It was enough to create a 26 handle gain on the day for about a percent, with a nice-looking hammer candle to boot.

Is that it for the drop? I don’t believe so. Tech and Small Caps have fallen into Correction, and the Dow and S&P are not far behind. Bottoms in corrections can be very “noisy” and this one will likely be no different. This is normally where we see a tortured bounce back up to somewhere betwee the 38.2% to 61.8%fib retracements of the move down, and then the next wave of selling hits to re-test the lows. But this volatility is here to stay for at least the next two-three months. I had said this summer that we’re going to see more of a “2012” type market which was the year after the big 2011 correction. That might still be the case, but we’ll also have to see if this monster is going to tip over, which we’ll find out as the next lower high sets up.

Bank earnings came out on Friday and were “good” but got sold into. When markets correct, everything is interpreted as “bad.”

I’m going to play for the bounce this week with a small limited risk play. We’ll also have to monitor our RUT condor put spreads, but they are very small and have quite a bit of “room” left to go before we have to hit the eject button.

The scan for the “Cheap Stocks with Weeklys” is available here.

The RSI(2) FE scan is available here.

The current MAIN “high liquidity” watchlist that I’m scanning against in thinkorswim is available here.

Please sign up for our free daily crypto report here.

Sorry, no embedded player available today.

Offensive Actions

Offensive Actions for the next trading day:

- I’ve set up my GTC call spread orders on the RUT to secure a fill just above recent highs; see details in the HP Condors section below. This is unlikely to fill now that the price is trending hard to the downside, however I’ll keep the order in play.

- I’m going to set up a small bullish credit spread on the SPY to play for a short-term bounce back up next week; see “swing trades” below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was large on Friday and breadth ended the day relatively strong with +237 advancers minus decliners.

SPX Market Timer : The Intermediate line fell into the Lower Reversal Zone, still showing a bearish bias. This chart bounced after showing a full bullish cluster with all three timeframes oversold on Thursday; this is a leading signal for a bounce.

DOW Theory: The SPX is in a long term uptrend, an intermediate downtrend, and a short-term downtrend. The RUT is in a long-term uptrend, an intermediate downtrend, and a short-term downtrend. The Dow is in an intermediate uptrend and short-term downtrend.

VIX: The VIX fell to 21.31 after peaking at 50.3 eight months ago, back inside the bollinger bands. The RVX fell to 23.32 and is back outside the bollinger bands.

Fibonacci Retracements: The price is pulling back slightly, so we might get a chance to use Fib retracements from the latest swing. The 38.2% fib retracement of the entire bull swing on the SPX is down at 2785 and was hit today. The RUT has pulled below the 50% fib retracement from the February lows and the 61.8% retracement is at the 1553 level.

Support/Resistance: For the SPX, support is at 2700 … with overhead resistance at 2941. The RUT has support at RUT1530 with overhead resistance at 1742. All three major index charts that we follow are now showing a Golden Cross with the 50 day moving average crossing above the 200 day average.

Fractal Energies: The major timeframe (Monthly) is almost recharged again, with a reading of 54. The Weekly chart is above exhaustion with an energy reading of 43, however it is picking up the trend on the downtrend now. The Daily chart is showing a level of 29 which is now exhausted to the downside.

Other Technicals: The SPX Stochastics indicator fell to 35, mid-scale. The RUT Stochastics indicator fell to 9, oversold. SPX MACD histogram fell below the signal line, showing a loss of upside momentum. The SPX is still outside the Bollinger Bands with Bollinger Band support at 2775 and resistance at the upper band at 2999 and price is below the lower band. The RUT is still outside the Bollinger Bands with its boundaries at 1555 to 1769 and price is below the lower band and is releasing from a squeeze.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPY 19OCT 282/283*295/296 Long Iron Condor (9/17) entered for $.16 debit puts and $.18 debit calls for a total debit of $.34. I closed out the put spreads (10/11) for a $.51 credit in the last hour of trading to lock in an overall profit on this trade, and a most unexpected one. This gave me a net profit on the put spreads of $31/contract after commissions, and we’ll see if we’re able to sell the call spreads for anything in the next week. This was after we almost closed out the call spreads for a target profit a couple of weeks ago.

- RUT 16NOV 1490/1500 Short Put Spreads (10/8) entered for $.80 credit. I will close this position if the RUT 1500 delta reaches .45. It is currently showing a value of .31

I will now look for a bounce to fill the companion call spreads on the 16NOV RUT condor. Probably not going to get it now unless we see a vicious bounce in the next week.

RUT 16NOV 1745/1755 short call spreads for $.80 credit

I’m going to keep this position SMALL and I’ll look to complete the condor by selling above resistance.

I have no positions at this time.

We’ll park this strategy until the next high-probability condition shows. We’ll want to see daily exhaustion on the SPX or RUT after a strong move, at the very least. This strategy works best with a quiet/trending market.

I have no remaining positions. Calendar spreads are good for markets in quiet/trending character, so there is a good shot that we can start to play these again.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I am targeting stocks using short puts/covered calls that offer a much lower absolute risk point, where in event of crash we can almost define our total risk by the price of the underlying. While this is not how I intend to manage risk in these positions, I view this as fundamentally more solid than trying to actively manage risk on assets that are going for $$$hundreds which have also gone parabolic. I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold the 31DEC $15 SLV calls (10/3) for $.16.

- SSO – I sold SSO 16NOV $109 puts (10/8) for $1.20 credit. I’m still fine with this position

No other entries at this time.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – No current positions. The 8/21 is now crossing to the downside.

- RSI(2) CounterTrend – Looking for the next setup. Lots of these showing now, best to play these during primary uptrend.

- Daily S&P Advancers – if I see the number of daily S&P500 advancers drop into single digits near the close of any trading day, I will go long shares of the SSO.

- Swing – I have the following trades in play:

- AAPL 26OCT 220/222.5 debit put spread (9/18) entered for $1.23 debit. I closed this position (10/11) today for $1.52 credit as the “bottom” was very volatile and likely to reverse quickly, plus we were running out of time. This gave me a net $25/contract profit after commissions, or about a 20% return on capital.

- SPY Bullish Swing – I will set up a 19OCT $1-wide put credit spread for between $.40 – $.50 credit on Monday morning. The strike prices will be determined by the gap that morning. I will look for a $.10 closing debit to close the trade. The risk on the trade is the spread width minus credit received.

The crypto market is holding tough while equities get slammed.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Viewing the SPY from the Friday closing price at 275.95, there is a +/-7.161 EM into this coming Friday. This is significantly larger than last week’s 4.886 EM and reflects the fear/indecision in the markets from last week.

The EM targets for this Friday’s close are 283.11 to the upside, and 268.79 to the downside.

The lower marker was blown through this week and did not survive; this is even with a larger-than-normal EM. It’s going to be difficult for the price to make it to one of these EM markers next week so they might be a good fade level.

This is a new section for this newsletter; I would like to start to carefully build some bearish positions that would be the virtual opposite of a covered call, yet I will use deep ITM long puts as the short stock substitute, and write short covered puts against those long puts.

I would like to add one additional consideration to the criteria, in that I’d like to see the price print a “lower high” first on the daily chart. Otherwise what is “high” can go “higher” as we’ve seen repeatedly over the years.

I will also publish the criteria for managing the short and long positions with this strategy. This is definitely counter-trend for now but might prove to be valuable down the road.

We previously were seeing LOW and UNP show up on this scan, and both would be winners now. . Quite honestly nothing has really faded after showing on this scan. We might need to wait for larger timeframes to exhaust themselves as it appears like 2017 is repeating again.

Previously I was seeing MRK, PFE, and LLY show up on this scan; I added the MRK 16NOV $75 puts for about $7.00/contract as a paper trade. I’ll just track this one on paper for now while we develop management rules. If the price drops I will sell short-term puts against it (on paper). Even these NOV puts are still underwater after today’s distribution.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz

I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions at this time:

- IWM 19OCT 170/172 debit call vertical (9/17) entered for $1.03 debit and will look for 50% return on this position. This one looks dead with only two weeks to go.

- NVDA 02NOV 285/287.5 debit call spread (10/1) entered for $1.22 debit, looking for 50% return on this trade. I might have missed my opportunity to make a quick 30% and get out.

No other entries at this point .

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads. Frankly, selling the “financing” trades has been a huge challenge in this low-vol environment. I will only sell put spreads on decent pullbacks that allow me to secure put spreads 10% OTM. We have no positions at the current time.

I have the following positions:

- SPY 16NOV 257 Puts (8/23) entered for $1.50 debit. I closed these (10/11) for a $2.15 credit. This gave me a net $63/contract profit after commissions, or a 42% return on capital

- SPY DEC 262 Puts (9/17) entered for $1.72 debit. I closed these (10/11) for a $4.20 credit. This gave me a net $246/contract profit, or a 143% return on capital.

I will “reload” again on the next bounce up.