Daily Newsletter

November 9, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

November Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

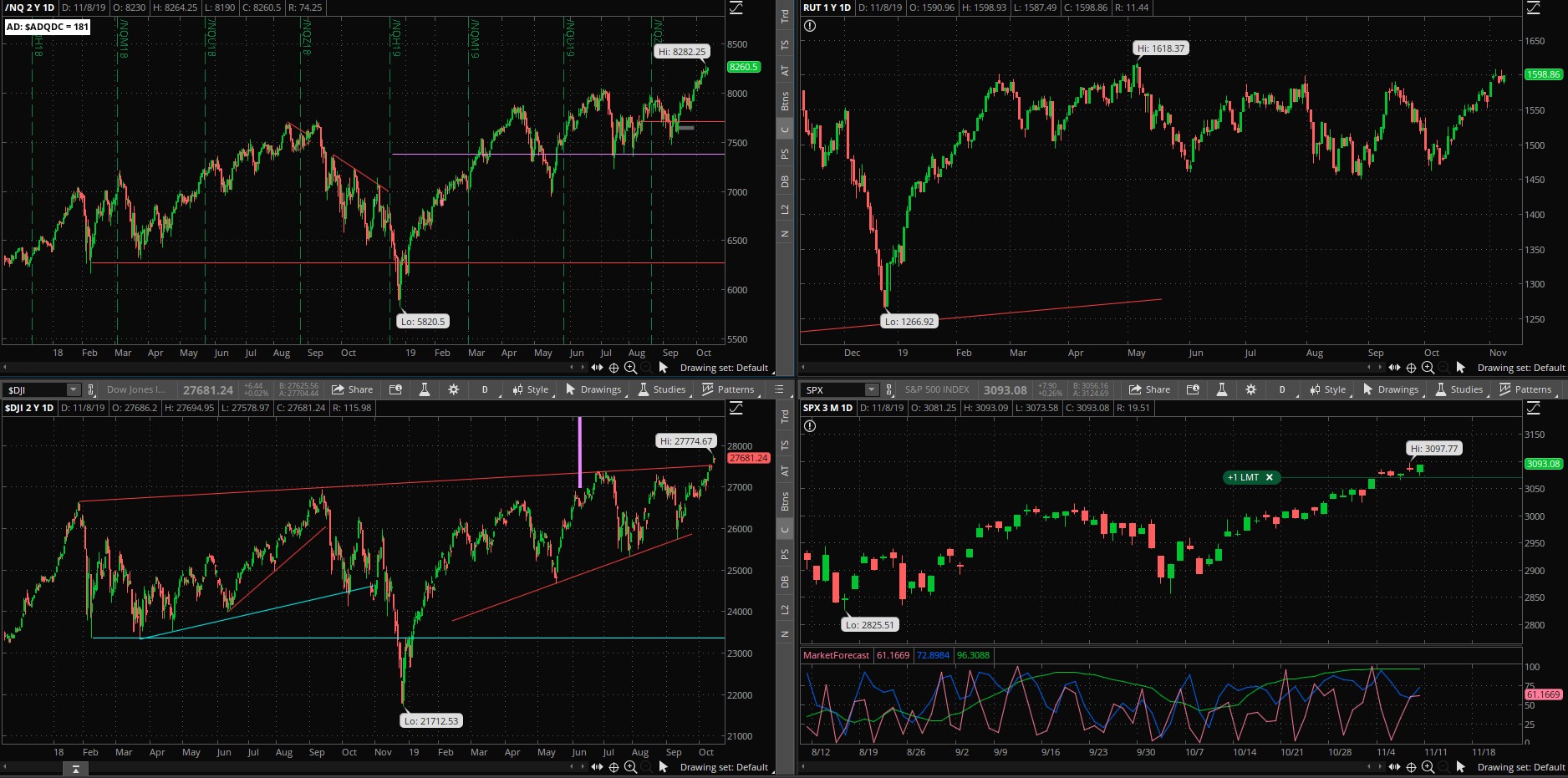

We are seeing a strong trend breakout from a massive consolidation and there’s every reason to believe that it is the “real deal.” I think that this has occurred due to the usual reasons, most likely 1) dropping rates giving everyone no choice but to pile into equities, and 2) all of the pervasive negativity about an upcoming recession.

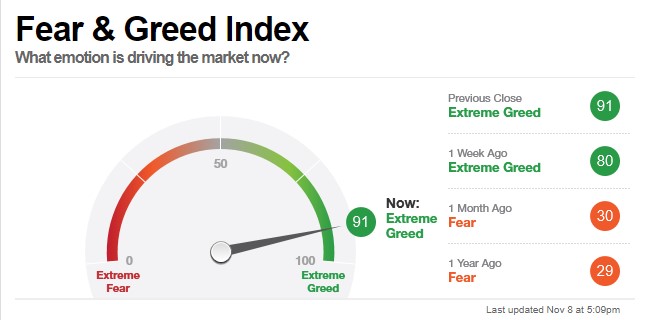

The problem, however, is that markets are a wee bit stretched to the upside, and are vulnerable to some profit-taking, or a nasty reaction on the first piece of news that creates uncertainty. The CNN Fear & Greed index is really hot:

But keep in mind that runaway markets can go much higher than reason, as we saw at the beginning of 2018.

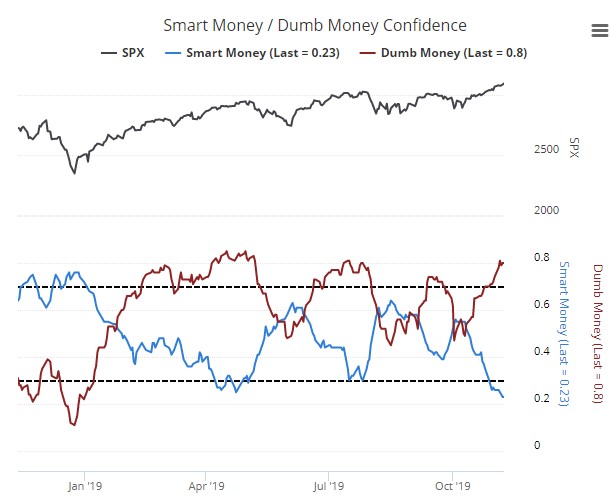

The other warning signal comes from Sentimentrader.com with their “smart money vs. dumb money” readings, with extremes at both ends:

The last time we had such a large spread was April 24th of this year, which was about a week prior to a 7% haircut. Things are a little stretched so this might not be a great time to go fishing for longs. I may consider adding a Hindenburg position this week as well. We are set with “long gamma” with the long condors for now.

An occasional market-moving stock will announce earnings over the next couple of weeks, however they will be infrequent so I’ll stop looking for them. .

Short-Term Outlook: We’ve been in a massive consolidation pattern since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, but we’ll know which price levels to respect to warn us if that energy’s going lower instead.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- There are a lot of stocks breaking out on our “OEX Momentum” watchlist which we can now place on our Momentum stock watchlist; unfortunately, most of the stocks that we can play are either too exhausted to jump on board after reporting earnings, or too illiquid to play with options. I’ll look later on this week for another entry.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average Friday with advancers minus decliners showing a modest value of +99 at the closing bell.

SPX Market Timer : The Intermediate line has turned up into the Upper Reversal Zone and is now “Bullish.” This chart was showing a Strong Bearish Cluster earlier this past week, but has faded. This chart is once again close to a bearish cluster.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX fell to 12.07, inside the Bollinger bands. The RVX rose to 16.40 and is inside the Bollinger bands.

Fibonacci Retracements: The price is back near the highs and fibs are not in play.

Support/Resistance: For the SPX, support is at 2825 with no overhead resistance. The DOW has support at 25500 and overhead resistance at 27399. The RUT has support at 1450 and resistance around 1600.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 49. The Weekly chart has an energy reading of 52, still near fully-charged. The Daily chart is showing 35, into exhaustion again. Larger timeframe energies are waiting on a very big move, which will start with the smallest timeframes.

Other Technicals: SPX Stochastics flattened at 91, overbought. RUT Stochastics flattened at 86, overbought. The SPX MACD fell above the signal line, showing a decrease in positive momentum. The SPX is below the upper bollinger band with the range 2956 to 3105. The RUT is inside the bollinger bands with the range 1508 and 1617.

Position Management – NonDirectional Trades

I have the following positions in play at this time:

- SPY 15NOV 281/282*310/311 Long Iron Condor (9/30) was entered for a $.16 debit on the puts and $.18 debit on the calls. I closed down the call spreads (11/7) for a $.38 credit; this ensures that we at least profit from the overall trade.

- SPY 20DEC 296/297*319/320 Long Iron Condor (11/4) was entered for a $.17 debit on the puts and a $.16 debit on the calls. I will look for a 200% return on either side.

No additional positions now.

I have the following positions in play:

- SPX 15NOV 3040/3045*3095/3100 Iron Condor (11/6) entered for $2.50 credit. I will seek a 25% return on risk profit by entering a $1.85 exit debit GTC. The price is starting to threaten the upper boundary but I don’t have any plans to exit just yet.

No other entries at this time.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold the SEP $17.50 calls (8/13) for $.18 credit and closed down this position (9/5) for a $.44 debit. I will let this price chart trend as much as it wants to in the near future before writing against it again.

- CSCO – My cost basis is now $47.95/share after the latest trade and dividend payment. I sold the JAN20 $50 calls for $1.94/contract so our cost basis could be as low as $46.01 depending on the outcome of those JAN calls. I don’t want to see this trade below $46/share on a closing basis. Next earnings are 11/13.

No other trades at this time.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – The long cross has fired and is gone. The next entry would be off of the 21ema.

- RSI(2) CounterTrend – I’ll look for the next setup.

- Daily S&P Advancers – Looking for the next signal to go long with single-digit advancers to close the day.

- Swing – None at this time..

Bitcoin had a huge day on Friday the 25th, effectively interrupting the downtrend. We’ll see if it can build on this bounce. So far it’s staying above the 61.8% fib of the thrust higher.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 308.94 there is a +/-3.103 EM into this coming Friday; this is slightly smaller than last week’s 3.249 EM. The EM targets for this Friday’s close are 312.04 to the upside, and 305.84 to the downside.

In this market we will continue to seek tests against the lower EM marker and not necessarily stand in front of the upper marker, since the trend has appeared to unfurl to the upside again.

I have the following positions in play:

- SPY NOV 299/300 Debit Put Vertical (10/17) entered for a $.37 debit. I will seek a 50% return on this trade.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- NKE 22NOV 96.5/97.5 debit call spread (10/21) entered for $.50. I will seek a 50% return on the trade, however this one looks dead.

- MSFT 29NOV 145/146 debit call spread (10/28) entered for $.50 debit. I will seek a 50% return from the trade.

- V 29 NOV 180/182.5 debit call spread (10/29) entered for $1.15 debit. I will seek a 50% return.

No other trades at this time. My scans came up with RTN and ACN but the chains that are about 30 days out are too illiquid to trade.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no open positions at this time. I’ll look to add a position this week.