Daily Newsletter

June 20, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

June Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

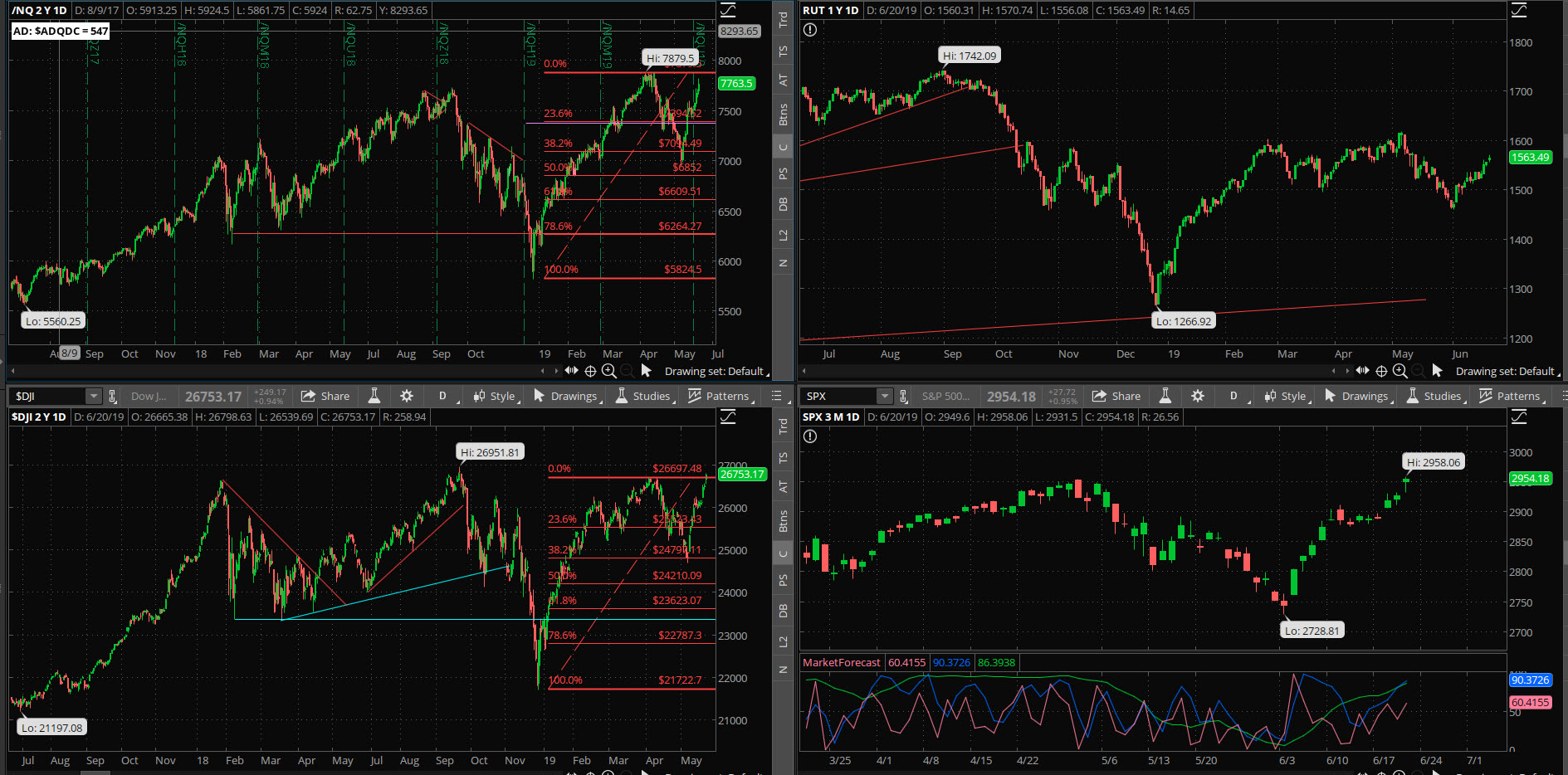

New highs on the S&P500, and just shy of that on the NASDAQ and Dow. This is what easy money can do, or at least the implication of it. There’s no telling what kind of “sell the news” reaction will occur when the Fed actually does start to ease interest rates, but think about it for a minute…..all of the savers MUST pull their money out and put it to work in an instrument that actually produces a yield.

I don’t recall the last time I saw a daily chart at the “21” level on the S&P. This would be an excellent place for the S&P to rest.

Short-Term Outlook: I’m left to conclude that after some short-term histrionics, which should include some form of “scary higher low,” we’ll ultimately see the market continue higher. We’ve been in a massive consolidation pattern since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, but we’ll know which price levels to respect to warn us if that energy’s going lower instead.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- I still have a GTC order for short calls on SLV by selling the 19JUL $15 calls; see “stocks” section below.

- I like MCD as a call spread entry, however it might be just a little premature.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- I will take profits on my SPY Long Condor call spreads tomorrow.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was above-average today with advancers minus decliners showing a strong level of +344, after a high-water mark of +411 earlier in the session.

SPX Market Timer : The Intermediate line has turned higher into the Upper Reversal Zone and is still bullish. The two strongest timeframes are clustered in the Upper Reversal Zone, creating a Strong Bearish Cluster for the second day in a row. This can be a leading signal for a pause.

DOW Theory: The SPX is in a long term uptrend, an intermediate trend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX rose to 14.75, inside the Bollinger bands. The RVX rose to 17.74, and is inside the Bollinger bands.

Fibonacci Retracements: We have seen a full 38.2% retracement of the Christmas Eve rally, and now the price has exceeded the 61.8% fib of the May distribution sell-off. .

Support/Resistance: For the SPX, support is at 2730 and resistance at 2954. The DOW has support at 24800 and resistance at 26700. The RUT has support at 1460 and resistance at 1618.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 56. The Weekly chart has an energy reading of 54, starting to pick up on the uptrend. The Daily chart is at exhaustion from this recent uptrend with a reading of 21, about the lowest value I’ve seen. Larger timeframe energies are waiting on a very big move, which will start with the smallest timeframes, but the daily chart needs a rest from the recent bounce.

Other Technicals: The SPX Stochastics indicator rose to 89, overbought. The RUT Stochastics rose to 84, overbought. The SPX MACD histogram rose above the signal line showing an increase in momentum. The SPX is at the upper Bollinger Bands with support at 2735 and resistance at the upper band at 2964. The RUT remains near the upper Bollinger Band with its boundaries at 1464 to 1565.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPY 15JUL 278/279*298/299 Long Iron Condor (6/17) was entered for $.17 debits on both call and put spreads. I will look for a 200% return on either spread. .

I have front-run what I believe will be the next burst of volatility. I believe that I would rather take profits on the call spreads, which are close to my target, than force the trade to live through another few weeks hoping for just a little more upside.

I have no positions in play at this time.

No additional trades at this time; the timing is absolutely crucial on these trades so we have to find absolutely exhausted conditions prior to taking these entries. There is simply too much weekly chart energy to believe that we’ll see neutral price action in the near future.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I will go out to the 19JUL series and sell the $15 calls for at least $.15 credit.

- CSCO – I sold the 16AUG $50 puts (6/10) for a $.64 credit. I will look to close this one for $.05 to $.10 debit.

We’ll see if any subsequent pullbacks allow better entries.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking at the next signal; I would like to see a pullback first closer to the 21ema.

- RSI(2) CounterTrend – None at this time.

- Daily S&P Advancers – Looking for the next signal to go long when we have single-digit advancers on the ADSPD.

- Swing – None at this time..

Crypto “top ten” coins have been positive since early April, although the rally has lost steam lately with the larger timeframes needing a rest. Bitcoin continues to be viewed as a long-term store of value. Litecoin is coming up on a halvening event, which has been pushing price higher due to scarcity.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 289.26, there is a +/-4.544 EM into this coming Friday; this is similar to last week’s 4.711 EM. The EM targets for this Friday’s close are 293.80 to the upside, and 284.72 to the downside.

The price obliterated the upper EM this morning on the gap up so there is no EM fade this week.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- WMT 12JUL 107/108 debit call spread (6/10) entered for $.50 debit; per my weekend comments I closed this trade (6/17) for a $.70 credit. This gave me a net $16/contract profit after commissions, or a 32% return on capital.

I like MCD again, especially if we see it re-test $200 from above.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time.