Daily Market Newsletter

June 4, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

June Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Hello all. It is Alex here covering for Doc who is on vacation until the end of the week.

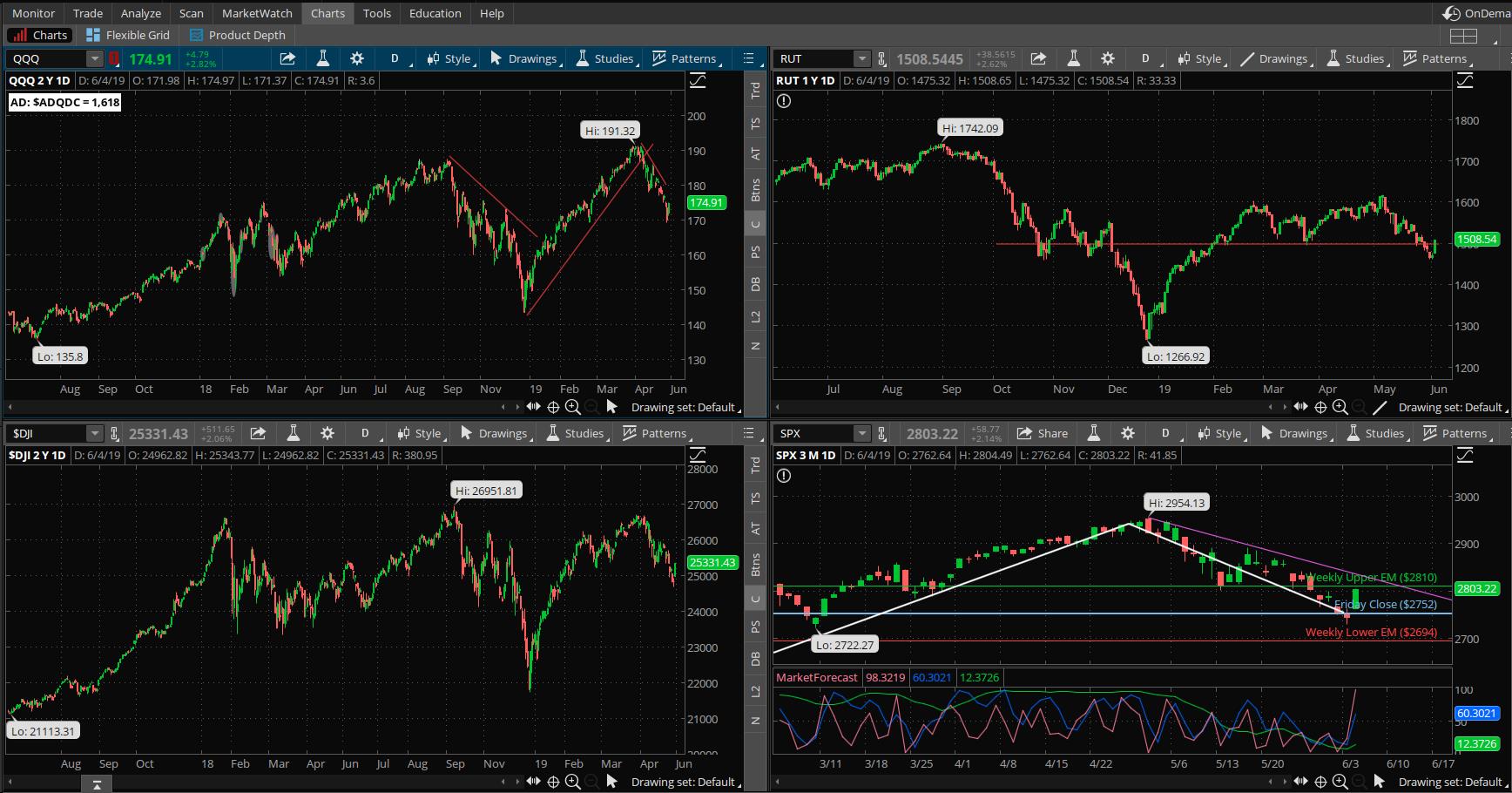

Today saw the market react positively to little in the way of news. Yes, the Fed did speak today and stated it would react ‘as appropriate’ to monetary issues such as tariffs, global economic contraction and domestic growth, however the markets were already will in the green in the pre-market hours. All the indices were strongly in the green today with the Dow up over 500 points ending up over 2.1% today. Similarly the Russel, S&P’s and Nasdaq were all up 2.6%, 2.1% and 2.8% respectively. The Nasdaq recovered the most from the pummeling it felt yesterday after warnings of regulatory crackdown on some of the FANG stocks elicited a significant market rotation out of big tech. It is, however, interesting to note that yesterday the FANGs dropped more than double the Nasdaq index to the downside, but on today’s price movement they were in lock step, not recovering the same amount of ground they had lost yesterday. Today the Market Forecast technical indicators provided one of the first buy signals in some time. Other leading indicators such as the 10 Year Treasury Note and Oil both saw positive moves today, however, both are a long way from setting up a reversal – more like a resting point.

The fractal energy on the SPX daily chart remained level today with today’s positive move counteracting the linearity that we had seen in the downward movement of the last week of steady losses. The fractal energy is just above the exhaustion level which means that we still could stay in and around the current price level and chop for some time until it recharges. Today’s price movement was impressive however closing only 7 points off of the entire week’s expected move. I will be looking for price to pull in some tomorrow and then look at selling an iron condor with it’s wings outside of next Friday’s expected move

Cheers

Alex

If you have any questions, please feel free to reach out to me at alex_docs_trading@outlook.com

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- I will set up the next series of short calls on SLV by selling the 19JUL $15 calls; see “stocks” section below. I will keep this as an open order.

- No new orders for Monday.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average as markets bounced significantly. Average volume on the bounce indicates that while the indices were all up there wasn’t overwhelming participation. The advancers versus decliners closed up +398 thanks to early pre-market sentiment and, while it did fade during the day, the ADSPD closed at near session highs.

SPX Market Timer : The Intermediate, momentum and near-term lines have all turned upwards and are now showing a long entry signal.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term downtrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term downtrend. The Dow is in an intermediate uptrend and short-term downtrend. All indices breached their support levels today with the SPX and RUT closing below support

VIX: The VIX contracted significantly by over 10% ending the day at 16.97, inside the Bollinger bands. The RVX decreased 8.1%, closing at 19.60, and is inside the Bollinger bands.

Fibonacci Retracements: Price is approaching the 38.2% retracement of the rally that kicked off on Boxing day and peaked out in early May.

Support/Resistance: For the SPX, having breached it’s previous support level, opens the 2650 level which is also the 50% Fibonacci level with overhead resistance at 2954. The RUT breached it’s 1500 support level to the upside with overhead resistance at 1617 and 1742.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 53. The Weekly chart has an energy reading of 52. The Daily chart remains at near exhaustion at 39. There is no clear direction where the price action may go based on the fractal energy levels.

Other Technicals: The SPX Stochastics indicator jumped to 22 and is nearing a long crossover signal point. The RUT Stochastics similarly jumped to 24, achieving a long signal crossover. The SPX MACD histogram is below the signal line, but trending upwards towards the long signal crossover line. The SPX closed above the lower Bollinger Band with support at 2749 and resistance at the upper band at 2914. The RUT remains above the lower Bollinger Bands with its boundaries at 1459 to 1596.

Position Management – NonDirectional Trades

I have no remaining positions in play:

- SPY 17MAY 282.5/283.5*297/298 Long Iron Condor (4/22) entered for $.16 on the put side and $.17 on the calls. The puts were closed (5/13) for a $.48 credit. This gave us a net $140 profit from the puts alone. The calls expired for a net $95 loss so our return on this trade was a net 27.2% after commissions.

With the S&P500 charts nearly at full energy again across the board, it might be time soon for another long condor.

I have no positions in play at this time.

No additional trades at this time; the timing is absolutely crucial on these trades so we have to find absolutely exhausted conditions prior to taking these entries.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I will go out to the 19JUL series and sell the $15 calls for at least $.15 credit.

No additional stock plays until I return from travel 2nd week June; I’d like to see if the current pullback plays out a little deeper.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking for the next signal. I don’t like these signals to the short side.

- RSI(2) CounterTrend – None at this time.

- Daily S&P Advancers – Looking for the next signal to go long when we have single-digit advancers on the ADSPD.

- Swing – I set up a long swing trade on the Russell 2000 via the IWM (4/24), with a 24MAY IWM 163/164 debit call spread (4/24) for $.20 debit. At this point any kind of positive return on this trade would be welcome as I’m running out of time, a shame as this trade was within a penny of firing at my target.

Crypto had a big rally this week, and Bitcoin had a monstrous dump on Friday, effectively shaking off all of the late-to-the-party longs. So far the price action is positive.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Thursday’s close at SPY 285.84, there is a +/-5.309 EM into this coming Friday; this is about the same as last week’s 5.539 EM. The EM targets for this Friday’s close are 291.15 to the upside, and 280.53 to the downside.

The lower EM for this week lines up with the low test of last week, so this might be a good level to fade with an ITM call option should it be tested and offer support.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have no remaining positions in play at this time:

- TGT 17MAY 80/82.5 debit call spread (4/9) entered for $1.25 debit and expired OTM for a net $254 loss on two contracts.

- SBUX 31MAY 77/78 debit call spread (4/29) entered for $.48 debit and closed (5/16) for $.72 credit. This gave me a net profit of $20/contract or 42% net return on capital after commissions. .

- MCD 7JUN 197.5/200 debit call spread (5/6) entered for $1.14 debit and closed (5/17) for $1.57 credit, giving us a net $39/contract profit or a 34.2% return on capital after commissions.

We are also keeping an eye on the Momentum stocks in this section. Most of those are a little extended at this point and this pullback might do the rest of the market a lot of good. I would like to let the market settle first before going heavily long.

No other entries at this point.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time.