Daily Market Newsletter

June 2, 2018Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

June Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Markets are still lacking the catalyst to drive prices out of the current range, at least as it relates to the large caps. The Russell 2000 has left the station and is not looking back. I still believe that a large move lurks very soon for us, so this weekend I’m calling for another long iron condor trade, which will profit for us as long as the price approaches the expected move by the target date.

The best analogy that I can give is that the kindling has been lit and there’s a very small flame going…one gust of wind will either blow it out, or fuel it to ignite the main pile of wood. The FOMC is right around the corner on June 13th, earnings are pretty much over until early July, so a quick break could occur just about any day now.

Global risk will be the wild card that would snuff the flame. We’ll stick to watching how the markets handle these price ranges and not get caught up in the media circus that so often imprints the wrong bias into traders.

The scan for the “Cheap Stocks with Weeklys” is available here.

The RSI(2) FE scan is available here.

The current MAIN “high liquidity” watchlist that I’m scanning against in thinkorswim is available here.

The latest crypto video (Top Ten That Will Be Top Ten) is available here

Please sign up for our free daily crypto report here.

If you need a video link with an embedded player you can use this link.

Offensive Actions

Offensive Actions for the next trading day:

- I will play a long Iron Condor for Monday morning; see the position in the “Weekly EM” section below.

- I will set up a Whale spread on ABT; see Whale section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average Friday and breadth ended the day strong with +306 advancers minus decliners

SPX Market Timer : The Intermediate flattened in the Upper Reversal Zone, now showing a bullish bias. No leading signals at this time, however this chart is very close to a Strong Bearish Cluster.

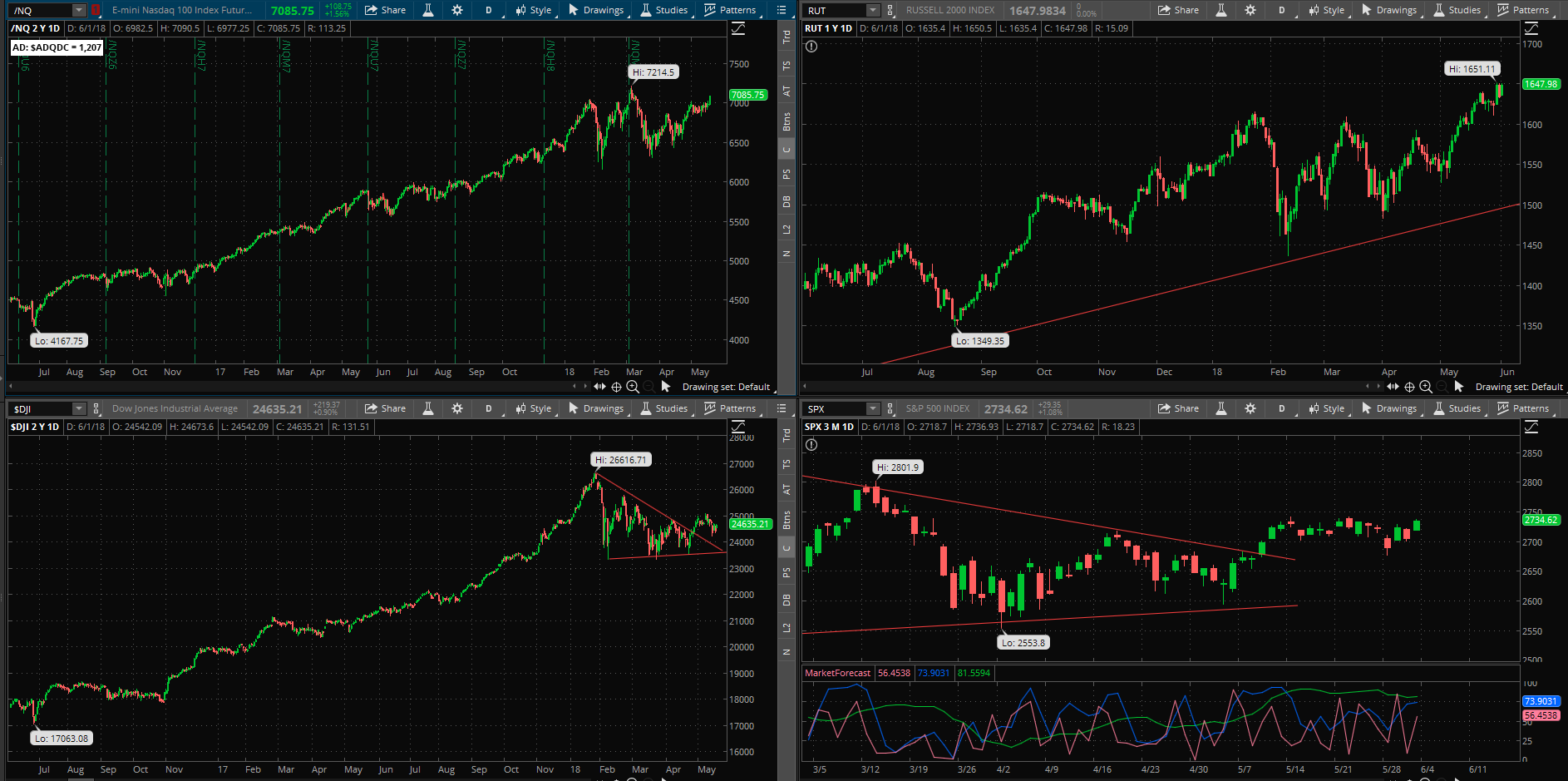

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate uptrend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX fell to 13.46 after peaking at 50.3 three months ago, outside the bollinger bands. The RVX fell to 14.84 and is inside the bollinger bands.

Fibonacci Retracements: The price has retraced 38.2% of the election rally; so far this has been a garden-variety correction.

Support/Resistance: For the SPX, support is at 2600 … with overhead resistance at 2878. The RUT has support at RUT 1530 with no overhead resistance. All three major index charts that we follow are now showing a Golden Cross with the 50 day moving average crossing above the 200 day average.

Fractal Energies: The major timeframe (Monthly) is above exhaustion, with a reading of 44, and recharging quickly. The Weekly chart is now fully charged with an energy reading of 60. The Daily chart is showing a level of 63 which is fully-charged. Markets are doing PRECISELY what they must in order to restore energy that has been incredibly depleted. Extreme Range Expansion leads to extreme range contraction (big swings).

Other Technicals: The SPX Stochastics indicator fell to 65, mid-scale. The RUT Stochastics indicator fell to 81, overbought. The SPX MACD histogram rose below the signal line, showing a return of upside momentum. The SPX is back inside the Bollinger Bands with Bollinger Band support at 2670 and resistance at the upper band at 2755 and price is below the upper band and starting to squeeze again. The RUT is back inside the Bollinger Bands with its boundaries at 1572 to 1659 and price is below the upper band.

We recently saw the market reaching into a full “runaway” condition, where “fear of missing out” means abandoning any former patience and “wait for the dip” strategy. This usually occurs near the top of the intermediate move. Markets are about to release from the sideways/volatile correction.

Position Management – NonDirectional Trades

I have no positions in play.

The next extrapolation trade is a long, long way away from being filled. The price would have to drop more than 100 SPX points before we’d be in a position to even begin to look for a fill. Realized volatility continues to out-run the implied volatility; this is a dangerous time to be complacent, selling options. I will continue to look for long-gamma (directional) trades and wait until we see an appropriate fear-based move to sell spreads into.

I have no positions in play at this time.

We’ll look for the next setup but it won’t be for some time. The Daily chart will have to be fully-exhausted from a linear run.

I have no remaining positions. Calendar spreads are good for markets with some volatility but they are long vega so we can’t enter them during IV spikes or periods of elevated volatility. The IV is starting to resolve lower so we might be back in business if the price resolves back into quiet/trending.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I am targeting stocks using short puts/covered calls that offer a much lower absolute risk point, where in event of crash we can almost define our total risk by the price of the underlying. While this is not how I intend to manage risk in these positions, I view this as fundamentally more solid than trying to actively manage risk on assets that are going for $$$hundreds which have also gone parabolic. I have the following positions in play:

- VXX Stock – I own 12 shares of this stock and will hold until Armageddon occurs.

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold 15JUN SLV $17.5 strikes for an $.18 credit. (4/19).

- NUGT stock – I was assigned on NUGT at the $31.5 price level. I rolled to the 25MAY $31.5 calls for $.35 credit. (4/27) and I closed these (5/18) for a $.02 debit. I rolled these to the NUGT 22JUN $31 calls for $.30 credit (5/18).

- SSO – I sold the 15JUN $70 puts (4/4) for $.70 credit.

No other setups at this time; I want to look for the next “scary” drop in the markets to sell puts again.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – I added the SPY 8JUN 277/278 Call Debit Spread (5/21) for $.30 debit, I will look for about 100% return from this trade. I also added an IWM 15JUN 160/162 debit put spread (5/23) entered for an $.82 debit. I will look for a 50% return from this trade.

- RSI(2) CounterTrend – Looking for the next setup; ANF is showing now but is reacting from poor earnings.

- Daily S&P Advancers – if I see the number of daily S&P500 advancers drop into single digits near the close of any trading day, I will go long shares of the SSO.

- Swing – I entered a GLD 20JUL 128/129 call spread for $.40 (4/12) and will hold this for the eventual breakout.

The crypto market has come under a lot of pressure lately and I attribute this to the market still being under the influence of a bear. Until a major “higher low” is printed these rallies will persist and be faded.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Viewing the SPY from the Friday closing price at 273.60, there is a +/- 3.262 EM into this Friday. This is smaller than last week’s EM of 3.322.

The EM targets for this Friday’s close is 276.86 to the upside, and 270.34 to the downside.

I believe that we are on the brink of a big move; I suspect that it should be to the upside but anything can happen. Lately we’ve seen big moves in BOTH directions in these circumstances. Let’s set up a long Iron Condor into the back week expiration of 15JUN. The EM is +/- 5.789 points, so based on Friday’s closing price of 273.60, then our targets would be 279.39 to the upside and 267.81 to the downside.

The maximum risk that I would take would be BOTH debit spreads expiring worthless because the price approached neither of those targets. If you have a stronger “sense” for direction you can simply play the “side” that would feel has a higher probability.

Markets will gap so I will re-calculate on Monday morning from whatever the starting point is, however I will use the same EM to calculate targets. I will show how to set up this trade in today’s video.

I have no current positions. I will consider setting up another ratio fly as price approaches resistance:

Entry criteria are:

- Using calls

- 17 to 50 calendar days

- center strike .25 to .40 delta

- ratio is 1/3/2 quantity, from the bottom, calls are long/short/long

We will exit the spread at a 60-70% level of credit received. The max risk on the trade is defined on the graph if the price goes much higher. There are no early exits, only exiting the week of expiry to avoid assignment. Also avoid dividend periods. I am currently trialing some trades and will discuss them in the newsletter; after a few cycles, I will start adding these trades to circulation. TOS scan code: http://tos.mx/hvWmMl

I have the following position:

- INTC 29JUN 55/57 debit call spread (5/29) was entered for a $.97 debit; I will look for a 50% return from this position. I have a $1.50 exit credit set GTC.

I would like to go after some additional setups this week that look really good. On Monday I will add the ABT 6JUL 62/63 debit call spread IF I can secure the entry for $.52 or better. If not, then I will turn this into a $2-wide spread and secure it for about $1.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads. Frankly, selling the “financing” trades has been a huge challenge in this low-vol environment. I will only sell put spreads on decent pullbacks that allow me to secure put spreads 10% OTM

- I entered the 17AUG SPY 245 puts (5/14) for a $1.41 debit. I will hold these through the next test of the 200 dma.