Weekend Newsletter

July 6, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

July Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

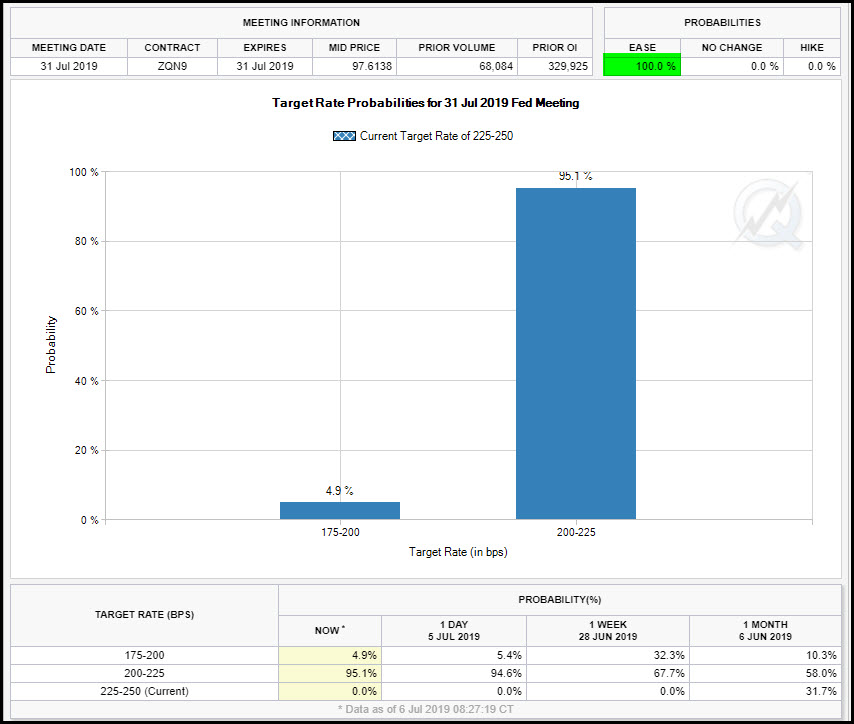

On Wednesday I stated “Bad news is “good news” again” since the ADP report came in light and led to the Fed Funds Futures showing a 100% rate cut probability for late July. But does “good news equal bad news?” The Friday Jobs report was a blowout at +224k, well up from 165k consensus. Does that mean that the July rate cut party is off? Seems like the bond market is still pricing a cut in at a 100% probability:

As long as the market believes that to be the case, then markets should be supportive to the upside. A rumor that negates that cut would bring on a very quick, severe downdraft, unless there were mitigating circumstances. So for now, the game of musical chairs continues. When the music stops, there will be no chairs to be found, but we don’t know whether that will be one month or five years from now. Anyone who says otherwise can join the long line of skeptics who have been run over for the past decade.

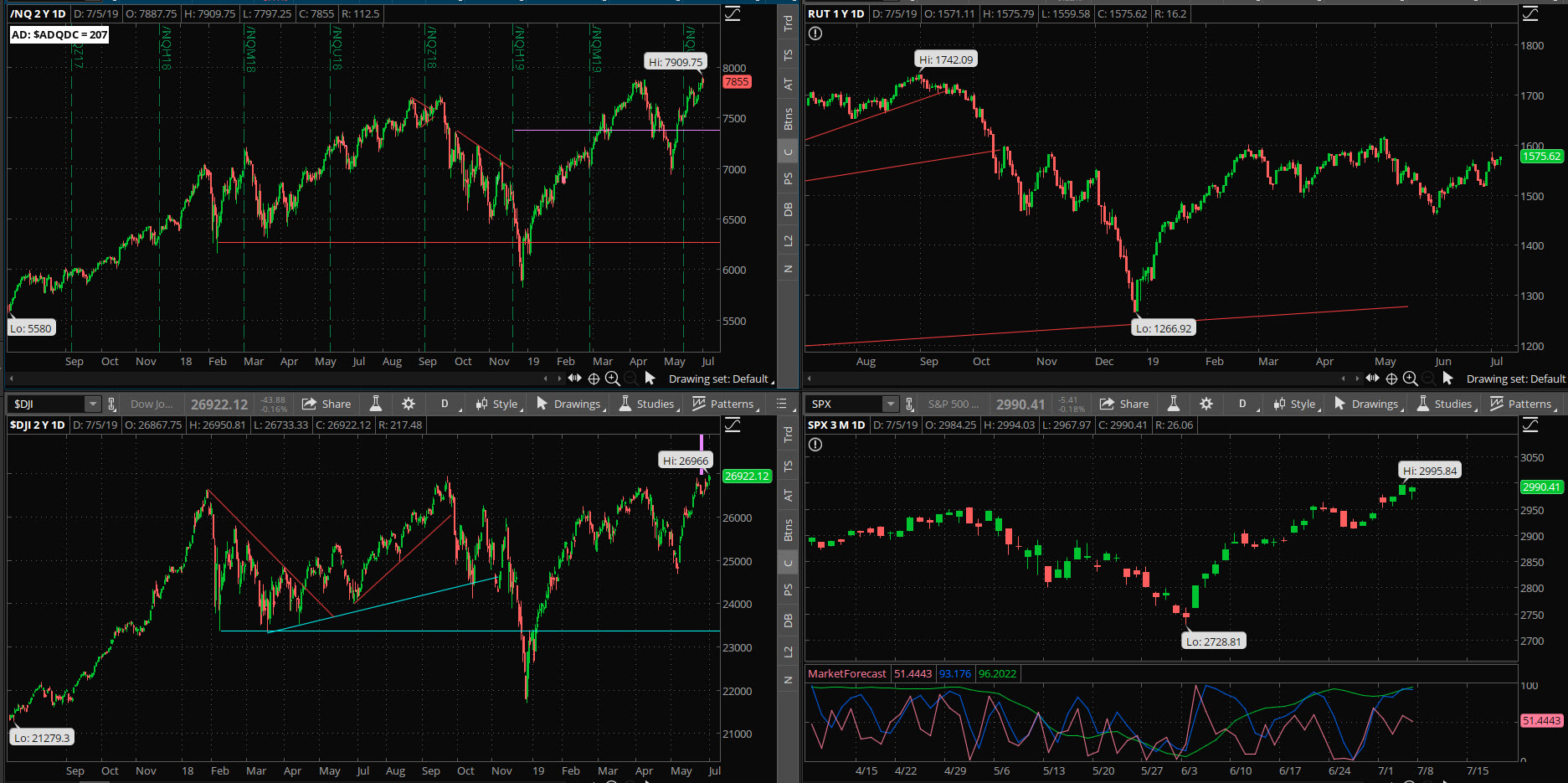

Accordingly, markets have become a bullish haven as price action transitions to “quiet and trending” behavior, which has brought about more complacency:

.

.

As long as charts don’t run away, then the current trajectory could be sustainable throughout the rest of this year. Reporting on 2Q earnings performance starts in earnest in about a week with the big banks.

Short-Term Outlook: We’ve been in a massive consolidation pattern since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. All that energy that’s been coiled up has to go somewhere, the policy and odds favor it to go higher, but we’ll know which price levels to respect to warn us if that energy’s going lower instead.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- Multiple opportunities listed below in the “Whale” section, and will be discussed in today’s video.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- I will look to close SBUX Monday (again).

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was below-average Friday with advancers minus decliners showing a mixed value of -81, closing near the highs of the session.

SPX Market Timer : The Intermediate line has flattened in the Upper Reversal Zone and is still bullish. The two stronger timeframes are now showing a Strong Bearish Cluster in the Upper Reversal Zone for the fourth day in a row; this can be a leading signal for a pause.

DOW Theory: The SPX is in a long term uptrend, an intermediate trend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX rose to 13.28, inside the Bollinger bands. The RVX rose to 15.77, and is inside the Bollinger bands.

Fibonacci Retracements: Fibs are out of play now with the price near all-time highs.

Support/Resistance: For the SPX, support is at 2730 and resistance at 2964. The DOW has support at 24800 and resistance at 27000. The RUT has support at 1460 and resistance at 1618.

Fractal Energies: The major timeframe (Monthly) is charged again with a reading of 52. The Weekly chart has an energy reading of 48, starting to pick up on the uptrend. The Daily chart is showing 41, just above exhaustion. Larger timeframe energies are waiting on a very big move, which will start with the smallest timeframes, but the daily chart needs a rest from the recent bounce.

Other Technicals: The SPX Stochastics indicator flattened at 74, below overbought. The RUT Stochastics fell to 56, mid-scale. The SPX MACD histogram fell above the signal line showing a decrease in momentum. The SPX is at the upper Bollinger Bands with support at 2852 and resistance at the upper band at 2999. The RUT is at the upper Bollinger Band with its boundaries at 1502 to 1583.

Position Management – NonDirectional Trades

I have no positions in play at this time.

I will consider the Long Iron Condor strategy when all three timeframes are wound up again.

I had the following positions in play:

- SPX 28JUN 2925/2930*2975/2980 Iron Condor (6/24) entered for $2.50 credit. I closed the position (6/28) right at the opening bell for a $1.40 debit. This gave me a net profit on the position of $102 after commissions, or a 40.8% return on risk.

I rarely take trades like this but we might look for more of these very short-term, risk-limited opportunities in the near future as I believe we’ll see a very choppy summer period.

I have no current positions:

Calendar spreads are good for markets in quiet/trending character. If the market reverts back to quiet/trending, then I’ll look to continue this method; if we see the daily chart go into exhaustion I’ll set up a back week calendar.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I sold the SLV 19JUL $15 calls (6/20) for $.15 credit. My plan is to let these calls expire on the 19th.

- CSCO – I sold the 16AUG $50 puts (6/10) for a $.64 credit. I will look to close this one for $.05 to $.10 debit.

We’ll see if any subsequent pullbacks in the short term allow better entries.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking at the next signal; I would like to see a pullback first closer to the 21ema.

- RSI(2) CounterTrend – None at this time.

- Daily S&P Advancers – Looking for the next signal to go long when we have single-digit advancers on the ADSPD.

- Swing – None at this time..

Crypto “top ten” coins have been positive since early April, and Bitcoin has gone parabolic above $10k again. The Bear appears to be over. In the near term I expect to see large consolidation swings, which might provide “value” entries for these coins on a dip.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 298.46, there is a +/-3.423 EM into this coming Friday; this is somewhat smaller than last week’s 5.265 EM. The EM targets for this Friday’s close are 301.88 to the upside, and 295.04 to the downside.

The price blew through the upper EM last week, well before Friday’s expiration, even though it was a short week. With the strong trend, it’s safer to look to fade the lower EM level this week.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- SBUX 26JUL 85/86 Debit Call Spread (7/1) entered for $.50 debit. I will look for a 50% return on capital but will remove this position on Monday for a profit (life got in the way on Friday for the planned exit).

I will discuss opportunities in DIS, WMT, HD, and COST in today’s video. I will attempt entries on all this Monday morning, assuming that the market is positive and does not gap down in a big way. I might only be able to actually enter two of them due to the skew that we’re seeing .

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time.