Daily Market Newsletter

February 23, 2019Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

March Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Markets are in a very odd place; not at an extreme in either sense of sentiment yet one look at any index chart and the market appears to be balancing a very heavy weight at the top of a long, skinny pole.

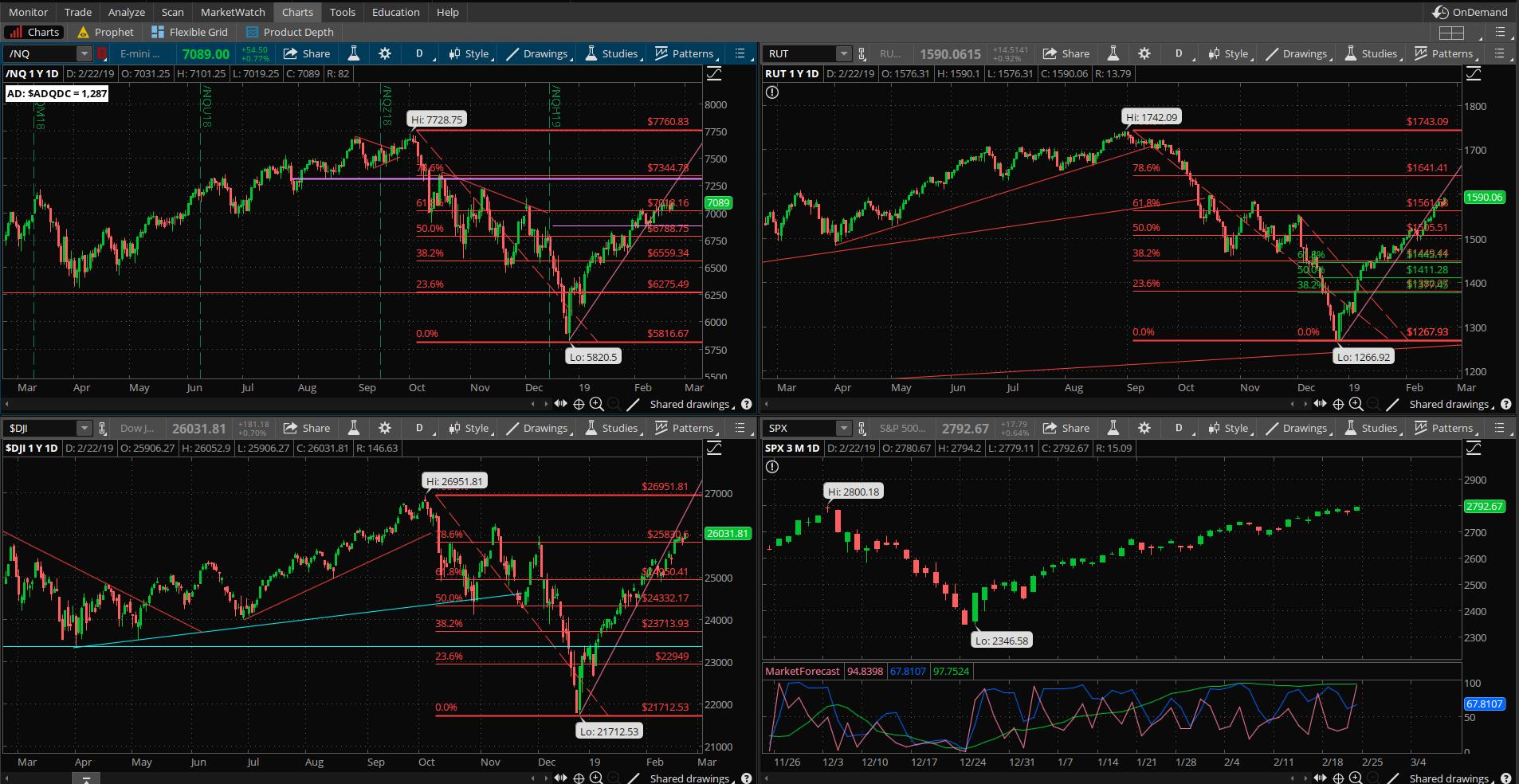

There is no technical “exhaustion” on any timeframe that we use for the major indices (except for the RUT of course), meaning that we’re not factoring in a pause just yet, but everyone’s looking for a pullback.

Back in December, I used the McClellan Oscillator to show that the crash into Christmas Eve was indeed extreme and ranked with the all-time great crashes. And in today’s video, we’ll look at this oscillator to the upside for the all-time rebounds.

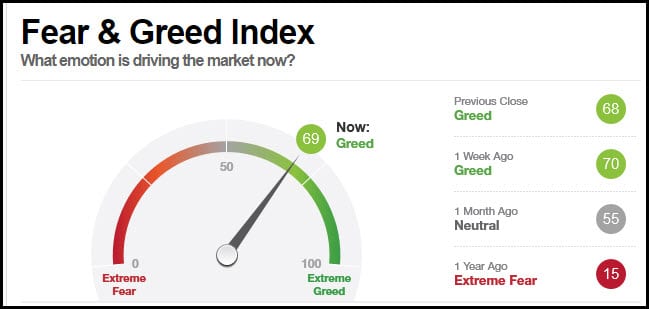

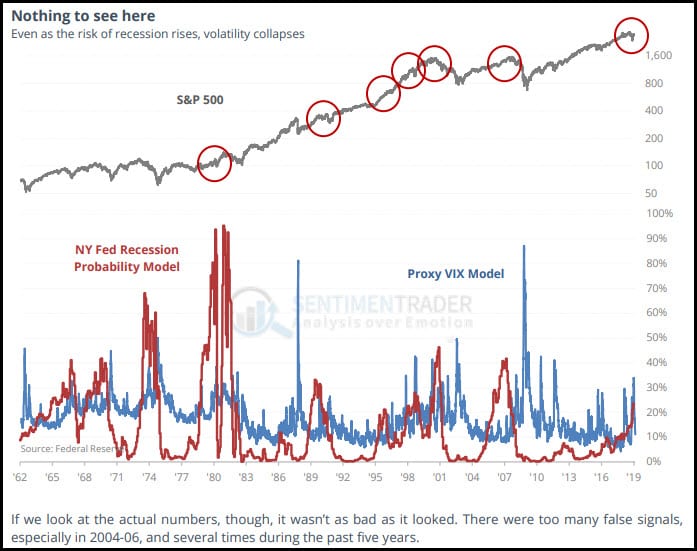

I’ve used a service called Sentimentrader.com (Jason Goepfert) for a number of years and quite honestly there has been little of his statistical back-looking wizardry which has helped explain/time the astounding upside moves over the last six years. This has been because of the Fed policy that forced asset inflation. But Jason’s work helped on the recent downturn, and might help us understand the statistical significance of the recent bounce and where it sits:

Risk of Recession, until recently near zero, has been slowly ticking up lately. Note how every significant spike pre-dated the VIX spike by quite a bit of time, perhaps a year in most cases. This supports the idea that we’re seeing a massive topping formation in the equities markets.

Something else that supports that are the Fed Funds Futures which shows the probability for a Fed Rate Cut increasing by the end of this year.

So how do we trade this bipolar market? First off, we have a current uptrend on all three timeframes. A pullback could show up at any point, but all parent timeframes point up. Secondly, implied vol is not really paying us to sell options at this time; we need to stay long gamma.

Here is the current scorecard – up and down – for the correction from the September 2018 highs:

- S&P was down ~594 points or 20.20%, now up 446 points or 19.00% from the bottom.

- Dow was down 5239 points or 19.44%, now up 4319 points or 19.89% from the bottom.

- /NQ is down 1908 points or 24.69%, now up 1284 points or 22.06% from the bottom.

- RUT is down 475 points or 27.27%, now up 323 points or 25.49% from the bottom.

The majority of the market-moving earnings heavyweights have already reported (FB, AAPL, AMZN, GOOGL). The FOMC meeting and most of the important economic numbers have been printed. The Market’s on its own from this point, perhaps with the help of a little FedSpeak. Anything can happen, but as long as the FOMC is operating with the “implied put” to backstop this market (even though there is LITTLE that they can do!) then I believe that the price is showing us higher in the near term. The Bear will not re-appear as long as the Fed is market-friendly.

Please sign up for our free daily crypto report here.

An embedded flash video is available here.

Offensive Actions

Offensive Actions for the next trading day:

- I will enter a long iron condor on SPY; see details in “HP Condors” section below.

- I will enter a long call debit spread on DE; see “whale” section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

0

Technical Analysis Section

Market Internals: Volume was slightly above-average Friday and breadth ended the day fairly strong with +277 advancers minus decliners, with the high-water mark at +333 mid-day.

SPX Market Timer : The Intermediate line flattened into the Upper Reversal Zone, still showing a bullish bias. No leading signals but this chart is once again very close to a Full Bearish Cluster with all three timeframes overbought.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate uptrend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX fell to 13.51 after peaking at 50.3 a year ago, inside the bollinger bands. The RVX fell to 15.5 and is back inside the bollinger bands.

Fibonacci Retracements: The price has moved through several important Fib levels and is not caring about any confluence levels that these present.

Support/Resistance: For the SPX, support is at 2700 … with overhead resistance at 2800 and 2941. The RUT has support at RUT 1500 with overhead resistance at 1742. The S&P500, Russell 2000, Dow, and Nasdaq 100 have all printed a Death Cross with the 50ma crossing below the 200ma; this can be a leading signal for a true Bearish move. It can also signal “false” and create a massive swing higher. We might be seeing the latter scenario.

Fractal Energies: The major timeframe (Monthly) is charged again, with a reading of 59. The Weekly chart has an energy reading of 44, starting to reflect the uptrend. The Daily chart is showing a level of 41 which is above exhaustion. This chart is just about ready for the next major swing as soon as the daily chart recharges.

Other Technicals: The SPX Stochastics indicator flattened at 87, overbought. The RUT Stochastics indicator flattened at 91, overbought. SPX MACD histogram fell above the signal line, showing a loss of upside momentum and also showing negative divergence; this can be a leading signal for a pause. The SPX is inside the Bollinger Bands with Bollinger Band support at 2637 and resistance at the upper band at 2814 with price is below the upper band. The RUT is inside the Bollinger Bands with its boundaries at 1454 to 1598 and price is below the upper band.

Position Management – NonDirectional Trades

I have the following positions in play:

- SPY 27FEB 225/256*275/276 Long Iron Condor (1/25) entered for $.18 debit on the put spreads and $.20 debit on the call spreads for a total $.38 overall debit. I closed the call spreads (2/12) for a $.51 credit; this gave me a net profit on the call spreads of $27/contract and I still hold the puts.

I like the fact that IV has dropped significantly in recent days; let’s put on a long condor on the SPY for late March. There is a +/- 8.5 point move into the 27MAR SPY cycle, which would map to 287.64 to the upside and 270.64 to the downside. Monday morning I will set up $1-wide debit spreads on the SPY 27MAR options cycle to create $1-wide put and call debit spreads costing approximately $.18. I will leg into each side and will strive to pay the same debit for each.

I have no positions in play.

Waiting for the next condition to sell options again; realized vol is out-pacing implied vol again. The rebound off of the bottom has been violent and traders are chasing after the move.

I have no remaining positions. Calendar spreads are good for markets in quiet/trending character, so we’ll want to wait for that type of price action to show again. I would like to see how the price handles the first pullback before I jump into this style again. It does not work well when realized vol out-races implied vol.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

With all of the four major indices in a death cross, I am suspending additional short put selling until those signals clear, unless a stock is clear of the death cross. I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I currently have the SLV 18APR $15.5 calls (2/11) for a $.17 credit.

I am open to adding a little bit of inventory on stocks that are not in a death cross at this time. Seeing a pullback first would be a good thing.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking for the next signal, which at this point would be the test of the 21ema.

- RSI(2) CounterTrend – Looking for the next setup.

- Daily S&P Advancers – Looking for the next signal to go long when we have single-digit advancers on the ADSPD.

- Swing – I have the following position:

- BAC 26.5/27.5 debit put spread (2/8) entered for $.24 debit per last Thursday’s advisory. I will look for 100% return.

Crypto has gotten a little bump in the last few days; heads are poking up to see if this rally is “real.”

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Viewing the SPY from the Friday closing price at 279.14, there is a +/-3.423 EM into this coming Friday. This is less than last week’s EM of 3.519, as a sense of acceptance hits the tape. The EM targets for this Friday’s close are 282.56 to the upside, and 275.72 to the downside.

Last week’s price stayed neatly within the EM, which has been relatively rare to see lately.

I will start playing directional bear spreads once we see upside exhaustion on more than one timeframe.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have no positions in play:

I like the setup for DE long with debit call spreads, but the only problem is that the options on DE are not exactly great from a liquidity and strike perspective, so I would be forced into placing a $2.5-wide spread which only gives me 15 trading days to grab profits. Let’s do this with a small position and look to secure an entry for about $1.25 debit.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have no positions at this time. I cleared out the most recent set of puts on the drop to the 200ma back in October. I will “reload” again soon, if/when the weekly chart goes into upside exhaustion. The three-month puts are coming down in price closer to what I’d prefer to pay. (3 months out/90% of current value)