Daily Newsletter

February 15, 2020Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

February Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Cash is trash; in a world where there is no shortage of money, then there is only one place to put your capital, and that’s into the “musical chairs” equity market. And if there was any doubt that the Market has been socialized/politicized, here’s more proof. This is such a different world from what we experienced even ten years ago, however most investors with any experience are still trading like it’s 2012 and trouble is just around the next bend. I place myself into this group as well.

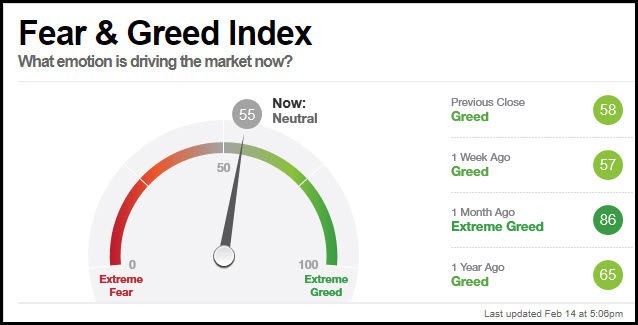

Sentiment is just above neutral and this is “Goldilocks” territory. Our approach should be to grab breakouts to the upside but keeping long gamma positions/short delta to hedge our longs and/or take advantage of rapid distributions that occur to “shake off” the weak hands.

This coming Monday is Presidents’ Day and is a Market holiday. I am anticipating some early volatility and then a quiet afternoon as traders swivel-chair out for the long weekend. There will be no newsletter on Monday.

Earnings are all but over; there will be an occasional mover/shaker as we get to the end of the cycle and start to anticipate the next cycle which starts mid-March. The market’s on its own from here, the next Fed Meeting policy release is March 18th.

The following stocks are reporting earnings over the next few days:

- Tuesday: WMT

- Wednesday: Small Caps and Energy

- Thursday: FSLR, HPE

- Friday: Small Caps

Subscriber Update: I will be “grandfathering” OptionsLinebacker and DocsTradingTools customers over to a new advisory service, targeting the February timeframe. I intend to make this service more “actionable” with more trade alerts, and plan to include guest contributors who are experts in their specific strategies. If there are any elements of the OLD (existing) service that you want to make sure are carried into the new service, please let me know by dropping me at line at doc@docstradingtools.com

Short-Term Outlook: Prices are breaking from a massive consolidation pattern in play since early 2018, or almost another “horizontal bear market” like we had in 2015-2016. At this point we’re wondering how far this swing could go, yet it’s showing incredible resilience.

Please sign up for our free daily crypto report here.

Offensive Actions

Offensive Actions for the next trading day:

- I will sell 03APR puts against BAC; see “Stocks” section below.

- I will buy an INTC debit call spread; see “Whale” section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

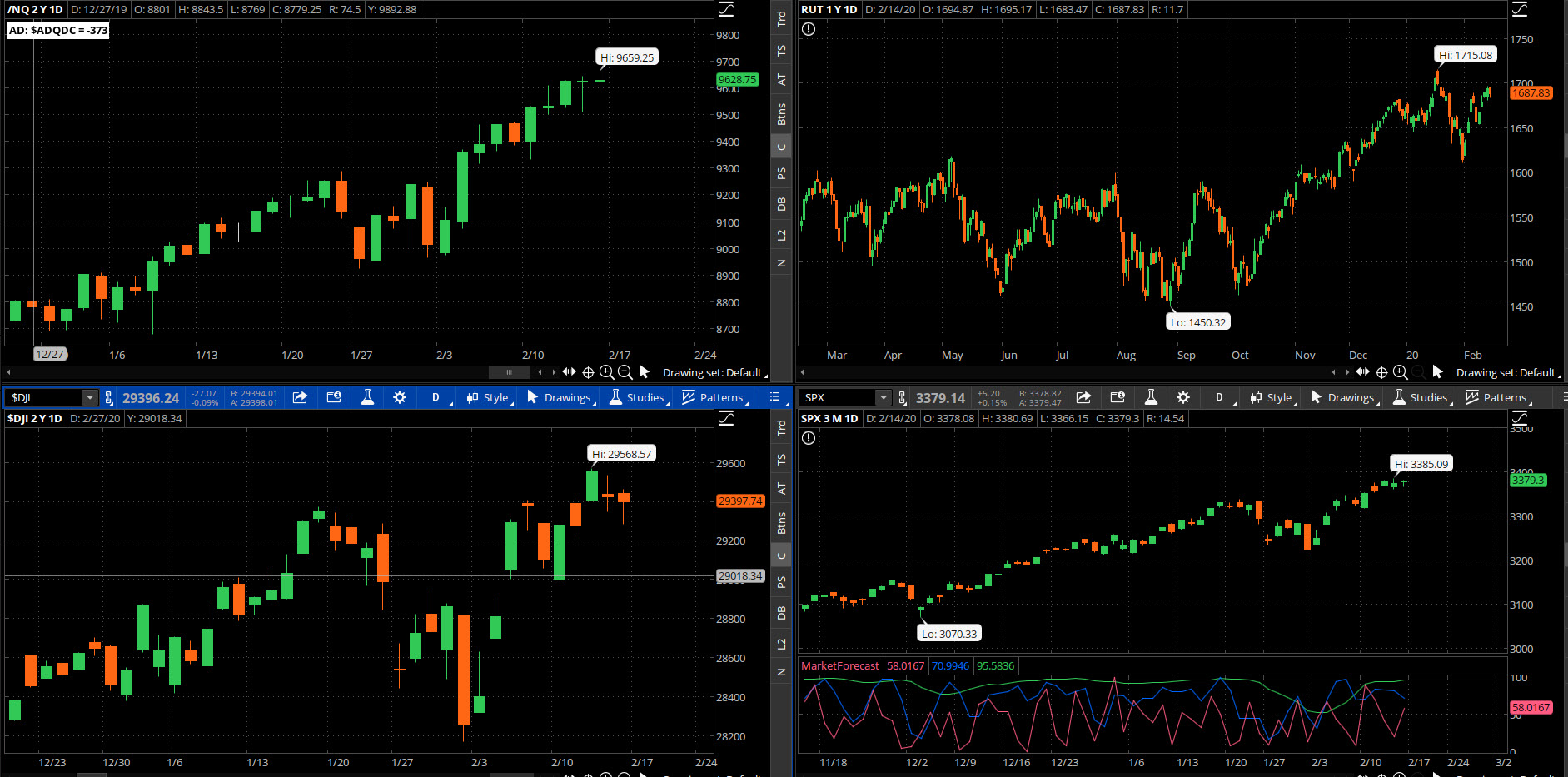

Market Internals: Volume was average Friday, with the advancers minus decliners showing a mixed value of +38.

SPX Market Timer : The Intermediate line has risen into the Upper Reversal Zone and is now “bullish.” After showing a Strong Bearish cluster for the third day in a row, with the two strongest timeframes in the Upper Reversal Zone, this study faded from that signal on Friday and is showing declining momentum. This can be a leading signal for a pause.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate uptrend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX fell to 13.68, inside the Bollinger bands. The RVX fell to 15.72 and is inside the Bollinger bands.

Fibonacci Retracements: The SPX has come down to test the 23.6% fib retracement of the entire October- January swing, and is above the 50% fib retracement of the latest swing higher since December. Back to the former highs again.

Support/Resistance: For the SPX, support is at 3070 with no overhead resistance. The DOW has support at 27325 and no overhead resistance. The RUT has support at 1580 and resistance around 1715.

Fractal Energies: The major timeframe (Monthly) is into exhaustion now at a value of 33, and is starting to reflect energy bleed from the very linear trend from late 2018. The Weekly chart has an energy reading of 38, just above exhaustion and starting to bleed energy again due to the upside strength of the last two weeks. The Daily chart is showing 39, almost into exhaustion again.

Other Technicals: SPX Stochastics rose to 78, below overbought. RUT Stochastics rose to 68, mid-scale. The SPX MACD flattened above the signal line, showing a decrease in positive momentum. The SPX is below the upper bollinger band with the range 3226 to 3403. The RUT is below the upper bollinger band with the range 1623 and 1712.

Position Management – NonDirectional Trades

I have no positions in play at this time.

No additional trades at this time.

We are not in a good mode for the traditional “High Probability” short iron condors since the price movement has been incredibly directional, and the Implied Vol is reflective of this with a very low/complacent value. Not good odds to sell options right now, better odds to buy them and go “long gamma.”

I have the following positions in play:

- SPX 28FEB 3150/3155*3320/3325 LP Iron Condor was entered for $2.55 credit (2/3) and will look for a 25% return on risk.

Based on the bounce that we’re seeing it looks like this move might turn into a “slingshot” in which case I’ll just wave goodbye at it. This swing out of the consolidation has been so incredibly strong that it’s running over every single attempt to catch the chart in a brief consolidation. This is what low interest rates will do, and has made this strategy almost unplayable since 2013.

I have no open positions at this time.

This is the wrong type of price character to play Time Spreads; we’re seeing vol crush and a huge buying panic.The previous fear about Corona has disappeared overnight.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I have the following positions in play:

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. Looking for the next rally to sell calls against.

This is not an ideal setup but I’d be a buyer of BAC at the $32.5 level; on Monday I will sell 03APR puts for at least a $.33 credit.

We’ll look for the next pullback to potentially sell puts against our next candidate.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Awaiting the next signal.

- RSI(2) CounterTrend – I’ll look for the next setup.

- Daily S&P Advancers – Looking for the next signal to go long with single-digit advancers to close the day; stay tuned for this signal to show in the near future.

- Swing – I have no positions in play:

BTC and other top-ten coins have been breaking higher in 2020. The price action looks very good and is moving into linear formation.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

From Friday’s close at SPY 337.60 there is a +/-4.039EM into this coming Friday; this is smaller than the 5.125 EM from last week, but there are only 4 trading days next week. The EM targets for this Friday’s close are 341.64 to the upside, and 333.56 to the downside.

A lot of energy still coursing in these markets. The upper EM was once again blown out last week.

I have the following positions in play:

- SPY 21FEB 319/320 debit put spread (1/22) entered for $.11 debit. I am looking for a $.44 exit from this trade. I might have been too aggressive with my profit target as this trade got up to about a $.35 exit on 1/31.

- SPY 13MAR 328/323 debit put spread (2/12) entered for $.66 debit. I would like to see a 100% return from this trade.

No additional trades at this time.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions in play at this time:

- XLF 6MAR 31/32 debit call spread (2/6) was added for a $.45 debit. I will look for a 50% return.

- FB 13MAR 212.5/215 debit call spread (2/10) was added for a $1.18 debit. I will look for a 50% return.

I’m going to place an INTC 20MAR debit call spread on Monday; I have a feeling that more strike prices will be printed by Monday, so I’ll either place a $1-wide debit spread for about $.50 or a $2.5-wide spread for about a $1.25 debit.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

I have the following open positions at this time:

- SPY 21FEB 279 long puts (11/15) entered for $2.21 debit. I will look to clear half of the position on any test of the 200 sma, and the other half upon a 10% haircut in price. Looks like this one will burn off unused as the price never dropped below the 50ma the entire time.