Daily Market Newsletter

December 2, 2017Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

Getting Started/FAQ Videos by ReadySetGorilla

What Is Bitcoin and Cryptocurrency?

Buying Your First Cryptocurrency

View Doc's New Book

December Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

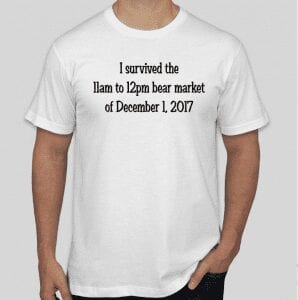

Friday was a wild day in the markets, at least when compared against anything that we’ve seen over the last year. The S&P500 gave us about a 45 point price range, and the Dow clocked in with a 400 point day. This is the increase in volatility that we’ve been waiting for, and it should increase going forward, eventually to the tipping point that gives us a larger range of trading to work with. Yes, actual red candles will show soon.

The US Senate tax bill passed, which must be reconciled with the House version before passage into law. It passed after market hours on Friday, so we might have some reaction in the futures Sunday night, although I wonder how much of that has already been priced into the market already. The Flynn news caused the first “waterfall” decline that I’ve seen in markets in years during the day..

Markets are now at the point of triple exhaustion again, which has never failed to provide at least a pause. Charts are absolutely parabolic but are now extremely sensitive to every little news point, so the aggregate volatility should continue to increase in the near term. I am not expecting to see a crash at this point, there are simply no good alternatives for investing dollars right now.

The market remains at extreme risk of an “exogenous event” which is news coming into the market that has not already been priced in. We could easily see a 3-5% single day event if the wrong news hit the wire. Make sure that your treatment of risk in your account can account for that potential move. We should continue to trade with the uptrend but in this Musical Chairs market, the music can stop very quickly. Any dip regardless of depth should create higher prices to follow.

The scan for the “Cheap Stocks with Weeklys” is available here.

The current MAIN “high liquidity” watchlist that I’m scanning against in thinkorswim is available here.

The latest crypto video (Bitcoin vs. Ethereum?) is available here

If you cannot view today’s video, please click here to view an embedded flash video.

Offensive Actions

Offensive Actions for the next trading day:

- I will add an RSI(2) trade on AMAT Monday; see the “swing trades” section below.

- SPY Expected Move levels have been derived; see the “Weekly EM” section below for actions.

- I will sell more puts against the SLV on Monday; see “stocks” section.

- I will seek to sell 08DEC DUST puts on Monday; see “stocks” section.

- I will add another LP SPX Condor on Monday; see “LP Condor” section below.

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- I have a debit limit order placed for my SPX LP Iron Condor.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was well above average today and breadth was good on the S&P with +262 advancers minus decliners.

SPX Market Timer : The Intermediate line flattened in the Upper Reversal Zone, still showing a bullish bias. This chart has faded lower after showing a strong bearish cluster for the second day in a row.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate uptrend, and a short-term uptrend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX rose to 11.43, back inside the bollinger bands. This is after a twenty-year low on the VIX. The RVX rose to 17.67 and is outside the bollinger bands.

Fibonacci Retracements: If we see an actual pullback then I’ll start to determine fib levels that might act as potential support.

Support/Resistance: For the SPX, support is at 2509 … with no overhead resistance. The RUT has support at RUT 1350 with no overhead resistance. All three major index charts that we follow are now showing a Golden Cross with the 50 day moving average crossing above the 200 day average.

Fractal Energies: The major timeframe (Monthly) is now down into exhaustion again with a reading of 24. The Weekly chart is now in exhaustion with an energy reading of 26, due to the recent trend. The Daily chart is showing a level of 35 which is now in technical exhaustion. We are seeing the movement that we expected, however with an exhausted monthly chart, I don’t think any breakout will be able to reach its potential. The DOW was in triple exhaustion recently which is a rare exhaustion signal, the S&P is now showing the same thing.

Other Technicals: The SPX Stochastics indicator rose to 81, overbought. The RUT Stochastics indicator rose to 88, overbought. The SPX MACD histogram rose above the signal line, showing a return of upside momentum. The SPX is outside the Bollinger Bands for the fourth day in a row with Bollinger Band support at 2555 and resistance at the upper band at 2640 and is above the upper band. The RUT is back inside the Bollinger Bands with its boundaries at 1451 to 1551 and price is below the upper band.

We are seeing the market reaching into a full “runaway” condition, where “fear of missing out” means abandoning any former patience and “wait for the dip” strategy. This usually occurs near the top of the intermediate move.

Position Management – NonDirectional Trades

I have no positions in play; I will wait on the first significant pullback to allow me to secure put spreads below support.I have not put this strategy into play since the 2016 Brexit reaction as the ultra-low risk premium in today’s market has not made this a wise strategy to pursue due to the inherent risk against the backdrop of super-low risk premium.

Offense: I still do not want to set up OTM credit spreads in this low-vol environment until we see real movement to the downside. If and when we get this movement we’ll need to identify levels that we want our credit spreads to be “below.” This is the same type of price action that was so perilous to HP condors back in 2013, so let’s not fight it.

I would need to see a SIGNIFICANT pullback to make me want to initiate this strategy again. Those selling call spreads are screaming in pain once again.

I have the following positions in play:

- SPX 15DEC 2560/2565*2615/2620 Iron Condor (11/21) was added for a $2.50 credit.I will look for a 20% return on this trade however now that the price is above the 2600 level, I might look to just close the position if we see any kind of material dip, which at this point needs to be almost a 50 point dip in the next two weeks.

I’m going to execute a trade on Monday morning that feels reckless but actually the signals support it; I’m going to enter an SPX 29DEC 2600/2605*2680/2685 Iron Condor for a minimum $2.50 credit. I will choose the actual strike prices based on how the Market opens up on Monday….usually choosing the short strikes based on a .30 delta and then adjusting in or out to achieve the desired $.250 midpoint credit that should fill. This is in some ways a “roll” of the 15DEC Condor which I can’t do anything with at this point.

I have no remaining positions. This is normally a perfect time to be selling calendar spreads against the RUT or SPX due to the exhaustion levels, however with my most recent experience with them in September, the effort was barely worth the hassle since we’re selling 6% vol and buying 7.5% vol against it. I might target higher IV underlyings to overcome this, at the risk of seeing greater movement.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I personally believe that while markets are in “runaway” mode, easy gains may be had however there is always a huge amount of risk to “buying at the top.” To combat this risk, I am targeting stocks using short puts/covered calls that offer a much lower absolute risk point, where in event of crash we can almost define our total risk by the price of the underlying. While this is not how I intend to manage risk in these positions, I view this as fundamentally more solid than trying to actively manage risk on assets that are going for $$$hundreds which have also gone parabolic.

I have the following positions in play:

- SDS Stock – I still own 100 shares of this stock from 2011 and will continue to write calls against this position with every correction/pullback.

- VXX Stock – I own 12 shares of this stock and will hold until Armageddon occurs.

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I will wait on the next series of calls until I see a reasonable rally that exhausts the daily fractal. I think that I will use this dip as an opportunity to sell more $15 puts.

- F 15DEC $11 puts were sold for $.12 (10/16). These are available to buy back for a penny now.

- CHK DEC17 $3.5 puts were sold for $.19 credit. These are available to buy back for $.02 now.

- NUGT stock – We are out of NUGT for the time being as it’s in a primary downtrend. We’ll look for a reversal back to the upside to begin selling puts again,

- DUST – I will try once again on Monday to sell $25 08DEC puts for a 1% return or better. I tuned out of this opportunity during Friday’s crash move and missed my chance for a great fill.

- AMD 15DEC $10 puts entered for $.23. (10/30). Hoping to let these expire next week.

- BAC 19JAN $25 puts (11/27) were sold for $.40 credit. These are already showing a 50% profit.

I will sell 19JAN SLV $15 puts on Monday, seeking a minimum of $.16 credit if possible. Please also note the DUST puts that I’d like to fill.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – Looking for the next 8/21 ema entry. The last entry was at the end of August.

- RSI(2) CounterTrend – AMAT is showing an RSI(2) signal; I would like to enter the 15DEC 51.5/52.5 call debit spread on Monday for about $.50 debit, and will look for a 30% net return. If the price gaps up or down I will adjust the strike prices to pay approximately a $.50 debit for a $1-wide spread. MU is also showing the same signal if you want to take both. .

- Daily S&P Advancers – if I see the number of daily S&P500 advancers drop into single digits near the close of any trading day, I will go long shares of the SSO.

Bitcoin and Ethereum are still the ones to accumulate. I would like to let the CME futures addition settle in before adding BTC again. I’m holding my current ETH and LTC.

Please refer to the left sidebar section if you’d like to get caught up on “FAQ” -style intro videos.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere.

I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Here is the most recent video which is “Bitcoin vs. Ethereum”

Viewing the SPY from the current Friday closing price at 264.46, there is a +/- 3.542 EM into this coming Friday. This is a much larger-than-normal EM vs. the normal 2 point SPY EM that we’ve seen lately.

The EM targets for this Friday’s close is 268 to the upside, and 260.92 to the downside.

Last week’s upside EM level got blown away Tuesday after the afternoon bounce; I did not consider fading this target since the price blew through the EM without resistance. I will fade either of these levels this week as long as I see some reaction to the level as it hits it. I will use front-week debit spreads to fade the level through about Wednesday, and I would switch to long options on Thursday/Friday.

I have the following current positions:.

- SPY 8DEC 258/260/262 Ratio Butterfly (11/13) was entered for a $.35 credit. I will look for about a 70% profit to close the position.

Entry criteria are:

- Using calls

- 17 to 50 calendar days

- center strike .25 to .40 delta

- ratio is 1/3/2 quantity, from the bottom, calls are long/short/long

We will exit the spread at a 60-70% level of credit received. The max risk on the trade is defined on the graph if the price goes much higher. There are no early exits, only exiting the week of expiry to avoid assignment. Also avoid dividend periods.

I am currently trialing some trades and will discuss them in the newsletter; after a few cycles, I will start adding these trades to circulation.

TOS scan code: http://tos.mx/ZsIjgu

I have no current positions.

With weekly and daily index charts at exhaustion, this is not a great time to look for explosive breakouts, however I do like the potential for a SBUX long.

No trades for this week at this time.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads.

Frankly, selling the “financing” trades has been a huge challenge in this low-vol environment. I will only sell put spreads on decent pullbacks that allow me to secure put spreads 10% OTM

We currently have the following positions in play with this strategy:

- SPY JAN18 229 long puts (10/11) – i entered this position for a $1.19 debit.