Daily Market Newsletter

August 18, 2018Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

Bitcoin/Crypto

View Doc's New Book

September Expiration

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Market Commentary

Something that could move markets as we get to the notoriously light and choppy last two weeks in August….are Trade Talks and the Fed. The Fed releases minutes from its last meeting on Wednesday at 2pm ET this week, and Jerome Powell speaks at the Jackson Hole conference on Friday at 10am ET. Normally, the prepared speeches are released right as the keynote speaker begins, which is then immediately parsed by OCR algorithms and trades executed based on results from keyword searches. All known information will be immediately discounted as of that second, which is to say that a new burst of energy should hit the tape and get things moving.

I will never forget the immediate and lasting reaction from the Bernanke speech in Jackson Hole in August of 2010, where he transparently revealed that they were going to print the economy out of recession. And print they did. You have to remember, in August of 2010 the market had just done ANOTHER 17% correction not one year after the March 2009 bottom, and the conventional wisdom at the time was that markets would re-test the 2009 bottom finally and fill those gaps. Then Bernanke stepped to the mic and everything changed.

For days and weeks, trade desks talked amongst themselves and asked, “did he really say that?” And as we got into the fall of 2010, it was quite clear that one could not fight the fed and the amount of liquidity that they were flooding the market with. Getcha free money now and leverage up! It all seems SO obvious now but was not at all clear at the time.

But what’s clear to me is that we’re on the verge of a big move. Markets are coiled like nobody’s business and we might be hours or days away from the beginning of this move. Probabilities favor the upside; the market keeps peering over the edge of the abyss, emboldening the bears yet again, but then it backs away and the squeeze is on. As I’ve said before, a very 2012-like feel to this market.

I am reviewing/refining my current trading plan and expect to have it finalized shortly; when I do, I’ll post it in the left-hand sidebar on this page.

The scan for the “Cheap Stocks with Weeklys” is available here.

The RSI(2) FE scan is available here.

The current MAIN “high liquidity” watchlist that I’m scanning against in thinkorswim is available here.

The latest crypto video (Cryptocurrency Market Visualized) is available here

Please sign up for our free daily crypto report here.

For an embedded video player version of today’s market video, please click here.

Offensive Actions

Offensive Actions for the next trading day:

- I’ll enter a long call spread on ETFC on Monday; see “Whale” section below.

- I like the lower EM marker for a fade entry this week (due to confluence) .

Defensive Actions

Defensive actions for the next trading day:

- Any vertical, butterfly, or diagonal debit spreads that we set up are risk-managed from day one, and no defense is really required.

- Closing orders have been entered for all new spreads.

Strategy Summary Graphs

Each graph below represents a summary of the current performance of a strategy category. For an explanation of what the graphs mean, watch this video.

Non-Directional Strategies

Semi-Directional Strategies

Directional Strategies

%

%

%

Technical Analysis Section

Market Internals: Volume was average Friday and breadth ended the day relatively strong with +277 advancers minus decliners.

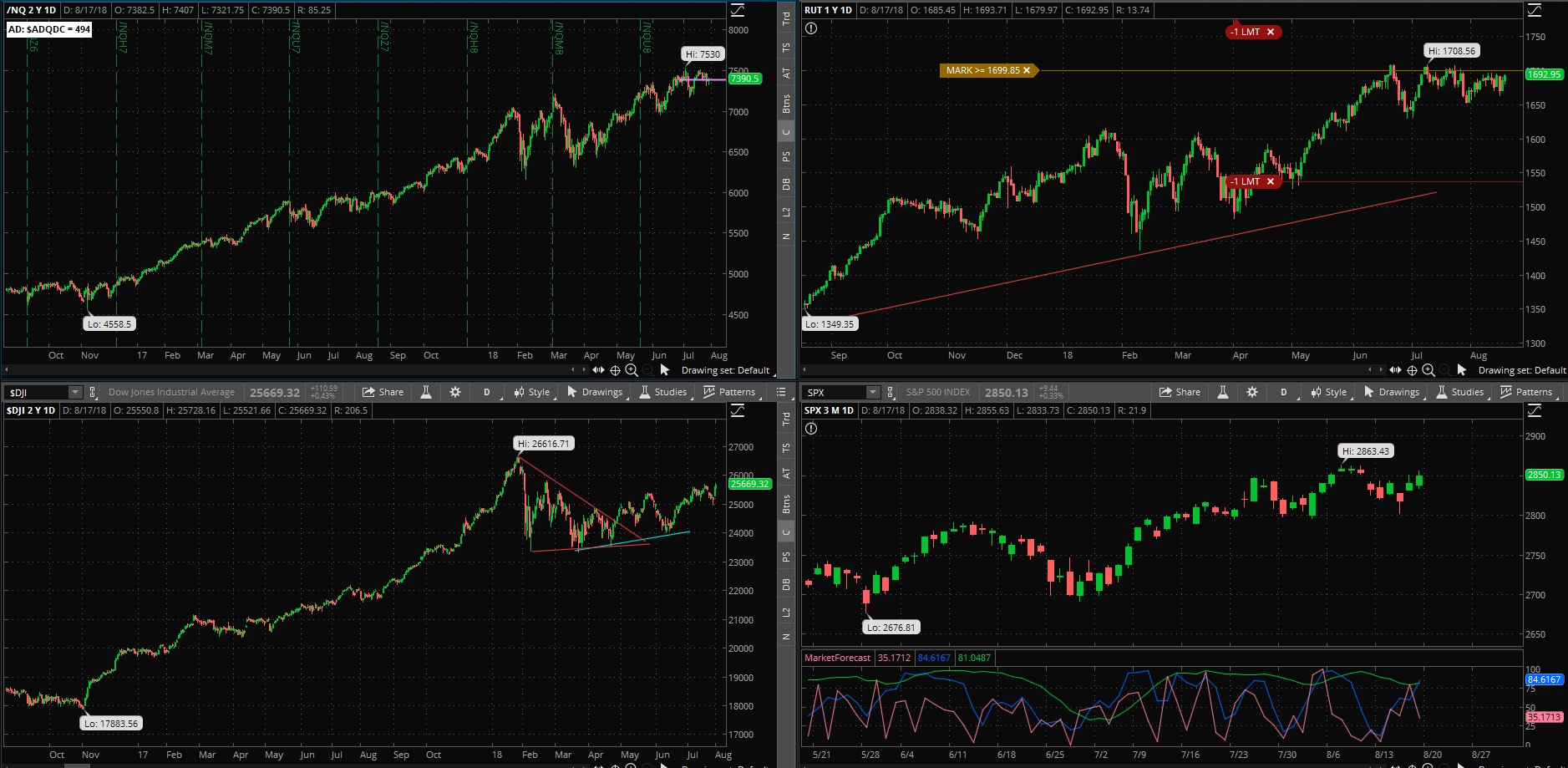

SPX Market Timer : The Intermediate line flattened in the Upper Reversal Zone, still showing a bullish bias. Another Strong bearish cluster is showing again on Friday. This often leads to multiple subsequent clusters before the fade.

DOW Theory: The SPX is in a long term uptrend, an intermediate uptrend, and a short-term uptrend. The RUT is in a long-term uptrend, an intermediate sideways trend, and a short-term sideways trend. The Dow is in an intermediate uptrend and short-term uptrend.

VIX: The VIX fell to 12.64 after peaking at 50.3 seven months ago, inside the bollinger bands. The RVX fell to 14.30 and is inside the bollinger bands.

Fibonacci Retracements: The price has retraced 38.2% of the election rally; so far this has been a garden-variety correction.

Support/Resistance: For the SPX, support is at 2700 … with overhead resistance at 2878. The RUT has support at RUT 1630 with overhead resistance at 1708. All three major index charts that we follow are now showing a Golden Cross with the 50 day moving average crossing above the 200 day average.

Fractal Energies: The major timeframe (Monthly) is almost recharged again, with a reading of 52. The Weekly chart is above exhaustion with an energy reading of 46. The Daily chart is showing a level of 57 which is fully recharged again. We are on the cusp of a major break in price.

Other Technicals: The SPX Stochastics indicator flattened at 70, mid-scale. The RUT Stochastics indicator rose to 64, mid-scale. The SPX MACD histogram rose below the signal line, showing a return of upside momentum. The SPX is back inside the Bollinger Bands with Bollinger Band support at 2799 and resistance at the upper band at 2866 and price is below the upper band. The RUT is back inside the Bollinger Bands with its boundaries at 1659 to 1704 and price is below the upper band. Markets are squeezing like crazy now and will release very soon.

I had the following results for the 17AUG 2018 Options Cycle:

High Probability Iron Condors

- RUT 21SEP 1580/1590*1790/1800 Iron Condor entered for $2.00 credit..I closed this position for a $1.10 debit. This gave us a net profit of $82/contract or about a 10% return on risk in a little less than three weeks.

Low Probability Iron Condors

- SPX 24AUG 2775/2780*2855/2860 Iron Condor was entered for a $2.50 credit and closed for the same debit creating zero return.

Time Spreads

No trades this period.

Cash-Secured Puts/Covered Calls

- 17AUG $16.50 SLV calls expired for $24 credit, or a net $230 profit on 10 contracts.

“Whale” Trades

- XLB 10AUG 58.5/60.5 call vertical entered for $.91 debit and closed for a $1.24 credit. This gave me a net return on this trade of $29 profit/contract or a 31.8% return on capital, or $145 on five contracts.

- XRT 17AUG 49/51 call vertical entered for $1.02 debit and closed for $1.41 credit; this gave us a net profit of $35/contract, or a 34.3% return on capital and $175 profit on five contracts.

Swing Trades

- No swing trades this period.

Hindenburg Positions

- 17AUG SPY 245 puts for a $1.41 debit; this position expired OTM for a net $142 loss.

SPY EM Fade/Target

- SPY 27JUL 283 long put EM Fade entered for a $.38 debit and closed it out about two hours later for a $.78 credit; this gave me a net profit after commissions of $38/contract or a net 100% return on capital, or $190 on five contracts.

Lessons Learned from this cycle:

We’re getting a better read on the current character; it’s quite a departure from 2017 in that the movement is less linear, however it might have more opportunity if we can adapt to it and play along. It feels like the slightly-more volatile/choppy 2014 was to the linear 2013, or a better analogy might be the 2012 recovery year after the perilous 2011 correction.

The last two cycles have marked my return to iron condors again, however this time is “different” in terms of my approach and execution. Gone are the large, “don’t-sleep-at-night” SPX positions that I used to carry, replaced by much smaller, more nimble positions that should provide some “filler” in the months where our directional spreads aren’t as consistent. These condors are meant to be laid on a regular basis like land mines in a harbor, creating a larger, more spread-out position. That sounds great in theory but I’d still rather play to higher probabilities whenever possible. And that means waiting until upside exhaustion.

I now see my mistake on the LP Iron Condor that we placed on the SPX; I waited about three days too long for the post-earnings vol to settle, and that removed my edge. We were up on the LP condor trade several times during its tenure, by as much as 10-15%, however just never to my target. Patterns and price action were (and still are) bullish so we pulled the ripcord.

I feel confident that the market has one big move under its belt and will show its face very soon.

Position Management – NonDirectional Trades

I have the following positions in play:

- RUT 21SEP 1630/1635*1755/1760 Long Iron Condor (8/10) entered for $1.48 debit. Let’s assume an average cost of $.74 per side; we will look for a 200% return on either “side” to assure a 50% overall gross return. This means that I need to place $2.22 credit limit orders on each “side” of the trade. I find that these are easier to fill than placing a four-legged overall order, since the losing side is often zero-bid by that point.

We have switched our stance from “range” to “trend” so we closed the short condor and opened a long condor. We’ll need to see the the RUT either drop to the 1630 level, or rise to 1760 in the next five weeks. Considering the amount of energy showing in the chart and the still-low RVX, I believe that this trade has a good shot of hitting the target.

We will step back from the short condors until we see short-term exhaustion in a trend. If that short-term exhaustion is to the downside first, then we would start a condor by selling the put spreads first.

I have no positions at this time.

We will look for the next upside exhaustion signal to sell into.

I have no remaining positions. Calendar spreads are good for markets in quiet/trending character, so there is a good shot that we can start to play these again.

The calendar spread tracking sheet is available for your download here. Yes, if you follow the math in the sheet, all of the numbers account for commissions in and out of the trade. Please note: If you trade these positions please keep the size small, to the point where you “do not care” about the success or failure of this position.

I am targeting stocks using short puts/covered calls that offer a much lower absolute risk point, where in event of crash we can almost define our total risk by the price of the underlying. While this is not how I intend to manage risk in these positions, I view this as fundamentally more solid than trying to actively manage risk on assets that are going for $$$hundreds which have also gone parabolic. I have the following positions in play:

- VXX Stock – I own 12 shares of this stock and will hold until Armageddon occurs.

- SLV Stock – I have 1000 shares of the SLV that was assigned at the $15 level. I currently have 17AUG $16.50 SLV calls (6/8) for $24 credit; these expired on Thursday and I will look for the next bounce to sell calls into.

No entries at this time; I’d like to see a decent pullback before we go shopping again for new stock candidates.

Position Management – Directional Trades

Thoughts on current swing strategies:

- 8/21 EMA Crossover – No current positions.

- RSI(2) CounterTrend – Looking for the next setup.

- Daily S&P Advancers – if I see the number of daily S&P500 advancers drop into single digits near the close of any trading day, I will go long shares of the SSO.

- Swing – Looking for the next setup. A Larry Connors “PowerZones” long setup was showing on the SPY last Monday; we will continue to track these, and perhaps take the next signal.

The crypto market is continuing to get hammered the last few days and many bear flags have been broken; even BTC is disappointing. This is GOOD because we’re one step closer to the final capitulation. The bear market and strong weekly downtrends look to be having their effect.

Investors should currently be looking to find technical entries to warehouse BTC/ETH/LTC assets for eventual trades on Alt-coins. You should also be looking to devices like “trezor” or other cold-storage devices to keep your assets off of the network, or other secure wallet such as Navcoin. Relying on the security of your broker is no longer good enough; no one can log into your ETrade account and “steal” your stock assets, but the whole nature of Cryptocurrencies and their portability means that someone can grab your assets and transfer them elsewhere. I will continue to discuss the tradingview platform in daily videos as I think that it is currently the best way to chart the “big three.”

Viewing the SPY from the Friday closing price at 285.06, there is a +/-3.532 EM into this coming Friday. This is somewhat smaller than last week’s 4.179 EM, which shows that the market is starting to discount some of the risk events.

The EM targets for this Friday’s close is 288.59 to the upside, and 281.53 to the downside.

With a lot of short-term energy available on the daily chart, I only want to look to fade the lower EM this week. That would involve using ATM call spreads Mon/Tues/Wed, and long front-week ITM options Thur/Fri.

This is a new section for this newsletter; I would like to start to carefully build some bearish positions that would be the virtual opposite of a covered call, yet I will use deep ITM long puts as the short stock substitute, and write short covered puts against those long puts.

I would like to add one additional consideration to the criteria, in that I’d like to see the price print a “lower high” first on the daily chart. Otherwise what is “high” can go “higher” as we’ve seen repeatedly over the years.

I will also publish the criteria for managing the short and long positions with this strategy. This is definitely counter-trend for now but might prove to be valuable down the road.

Right now I’m seeing MRK, PFE, and LLY show up on this scan; not yet ready for entry though. You can see how these stocks are going absolutely parabolic and will eventually have their day of reckoning.

The scan that I discussed in the 8/4/2018 video is available to download for thinkorswim here: http://tos.mx/OvdVnz

I will also be adding a second Larry Connors scan to this section as well; here is the Connors Crash scan: http://tos.mx/BhHuKL

I have the following positions:

- XLF 7SEP 28/29 call vertical (8/6) entered for $.46 debit; I will look for a 50% return from this trade.

This might be a risky time to be long any assets, with price jammed up against the all-time highs on the NQ and SPX and RUT. Let’s add a small one to our portfolio, E*Trade…I will go long the ETFC 14SEP 61/62 call spreads for $.50 or less, moving out to the 61/63 spreads for about $1 if I cannot secure that entry. My goal for the position will be a 50% return. Per the video I’ll want to see the price above $62/share before I enter.

The “Hindenburg Strategy” is meant to capture “value” from successive corrections that lead up to the final “death spiral” with a Bear Market. The basic principle is to buy 3-month out long puts on the SPY, and to finance those puts by the sale of credit spreads. Frankly, selling the “financing” trades has been a huge challenge in this low-vol environment. I will only sell put spreads on decent pullbacks that allow me to secure put spreads 10% OTM

- I entered the 17AUG SPY 245 puts (5/14) for a $1.41 debit. This position expired on Friday.

I will add the next series of long puts after August expiration, especially if we see an upside breakout.